- Home

- Cryptocurrency

- Crypto Turmoil and Triumph: Binance Fallout and Market Shifts

Crypto Turmoil and Triumph: Binance Fallout and Market Shifts

Binance experienced a tumultuous conclusion to November, with its CEO and co-founder, Changpeng Zhao, reluctantly stepping down from his position. This decision came as a result of his admission of guilt for neglecting to enforce adequate Anti-Money Laundering (AML) regulations within the company. Concurrently, Binance, without explicitly admitting culpability, agreed to settle with US authorities, agreeing to pay fines exceeding a substantial $4 billion across various charges.

The aftermath of these events extended beyond immediate price impacts on the industry and the BNB token, casting a shadow on investor confidence in the exchange. As anticipated, amidst these unfolding developments, certain platforms emerged as beneficiaries.

Identifying the Winners:

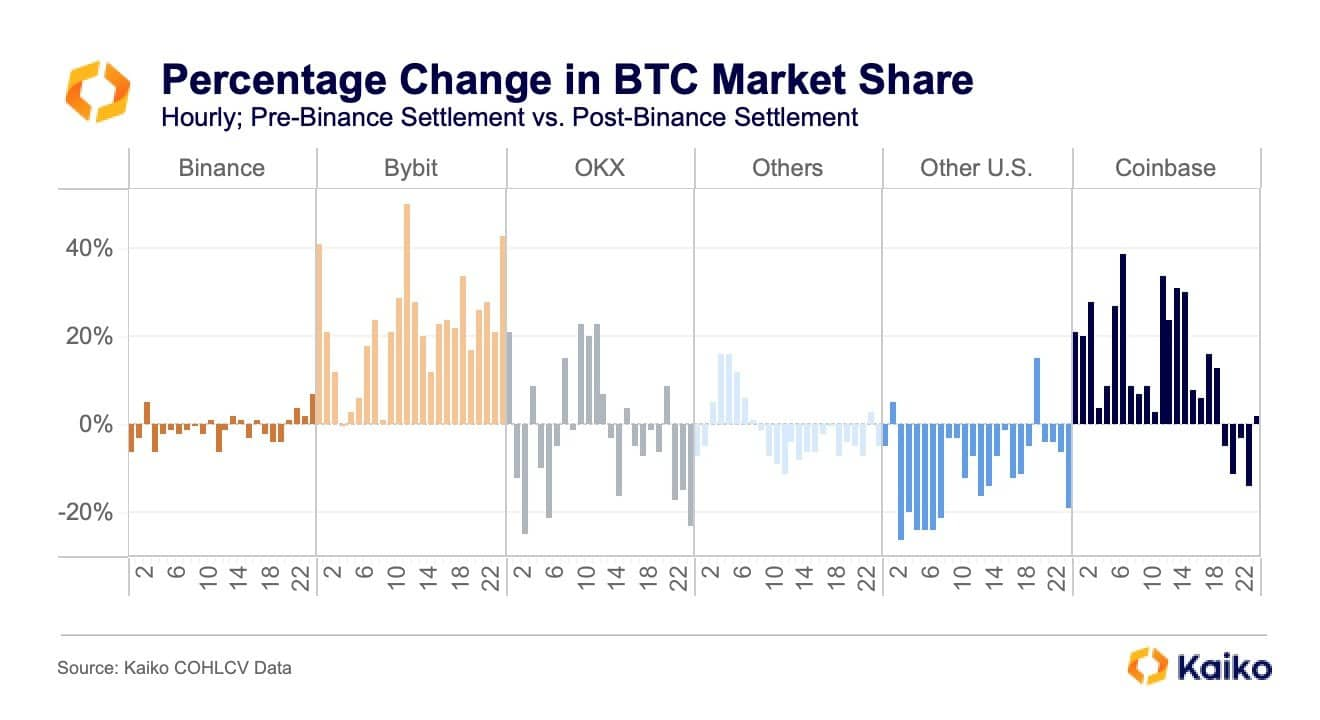

Initial post-settlement reports hinted at a significant migration of assets from Binance to its US counterpart, Coinbase Pro. Subsequent research by Kaiko not only confirmed this trend but also revealed a remarkable 34% surge in Coinbase's market share. Surprisingly, an even more significant beneficiary emerged in Bybit, experiencing an astonishing 50% increase in market share within a mere few days.

Kaiko's recent analysis painted Bybit as the standout winner, consistently gaining market share every hour and witnessing growth exceeding 20% in 16 out of 24 hours.

Crypto Exchange’s Balances After Binance’s Settlement. Source: Kaiko

Crypto Exchange’s Balances After Binance’s Settlement. Source: Kaiko

However, it's worth noting that despite Coinbase's ascent, Binance maintained its leadership in liquidity for both Bitcoin (BTC) and altcoins. This assertion was seconded by CryptoQuant, which observed a 20% reduction in Binance's reserves post-settlement, with BTC holdings decreasing from 634,000 in May to approximately 500,000.

Binance's enduring dominance in key indicators for BTC and certain altcoins, including Dogecoin, remained steadfast, as highlighted by Kaiko.

"The resilience of Binance is underscored by the performance of DOGE. Over the past few weeks, its spreads have consistently stayed below 1.5 basis points, while Bybit's baseline spread, although comparable, frequently exceeds 2 basis points. Coinbase's spreads in both scenarios surpass those of its competitors and have yet to show signs of narrowing the gap."

Coinbase COIN Performance:

Shifting our focus to Coinbase, the performance of its COIN stock exhibited an upward trajectory, reaching a peak unseen in over a year. On closer examination, a noteworthy surge was evident, commencing in the wake of the Binance settlement.

Before speculations surrounding Binance's potential deal surfaced, COIN traded at just under $100. Following reports of Changpeng Zhao's anticipated resignation, the shares embarked on an upward trend, peaking at nearly $135 by December 1. This signifies a remarkable 35% increase in the value of the largest US-based crypto exchange's shares within the two weeks coinciding with the Binance settlement.

Read more about: Financial Flux: A Tale of Valuation Ventures

Trending

Press Releases

Deep Dives