Crypto Storm: Binance's Ripple Effect

Bitcoin (BTC), currently priced at $37,642, is navigating a turbulent landscape marked by a cascade of liquidations that has caused a downturn in crypto markets.

BTC/USD 1-hour chart. Source: TradingView

BTC/USD 1-hour chart. Source: TradingView

Amidst this financial maelstrom, the regulatory enforcement action initiated by the United States Department of Justice has cast a looming shadow over Binance, the world's largest exchange, with the specter of a substantial fine. Changpeng Zhao (CZ), the informal moniker of Binance's CEO, may soon find himself compelled to relinquish his post and, potentially, face the grim prospect of incarceration.

This unfolding narrative, a watershed moment for a crypto industry stalwart, has sent ripples of concern through the markets. BTC/USD witnessed a dip to $35,600, plumbing depths not seen since Nov. 16, before staging a rebound, courtesy of the closure of short positions.

$BTC

— Skew Δ (@52kskew) November 22, 2023

Longs rinsed in this sell off

price bounced from shorts closing & taking profit (OI down & delta up + price up)

PC charts soon since im awake now https://t.co/xqPVoFphRp pic.twitter.com/0czcBwdWMf

Altcoins, however, have fared less favorably, with many large-cap tokens languishing 3-5% lower at the time of this writing.

In the midst of this market tumult, participants are bracing for potential volatility, scrutinizing a myriad of BTC price targets.

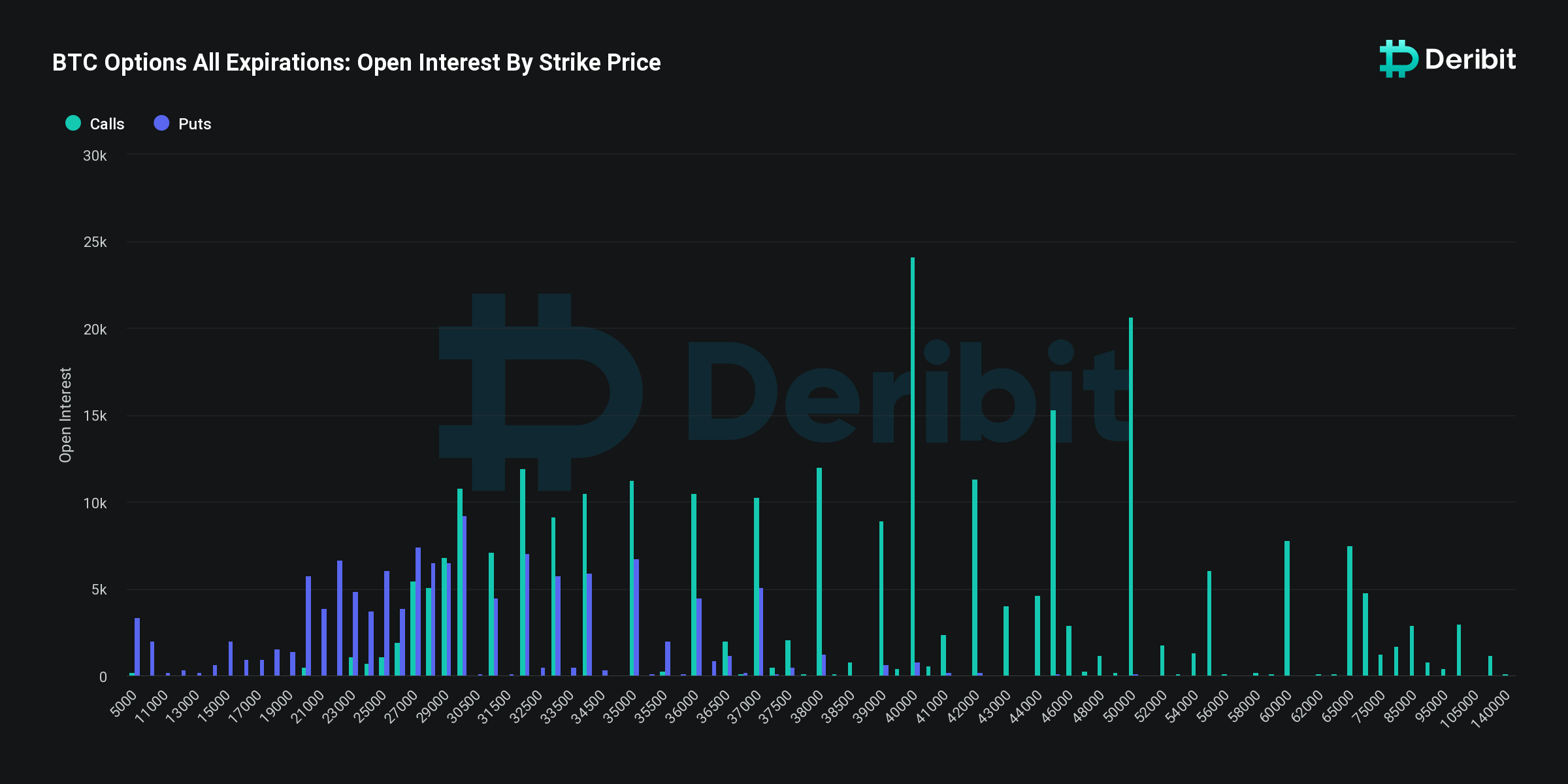

The critical threshold for Bitcoin, known as the "maximum pain" price, currently stands at $32,000

James Van Straten, a research and data analyst at CryptoSlate, notes that the Binance bombshell has shattered what would have been an otherwise "quiet" week in crypto trading. He predicts a continued deluge of volatility catalysts, exacerbated by a colossal $3.8 billion, 104,000 BTC options open interest expiry event scheduled immediately after the U.S. Thanksgiving holiday.

Van Straten highlights the options market's put/call ratio, indicating predominantly bullish sentiment. Nevertheless, amidst this sea of optimism, the ominous "max pain price" emerges at $32,000, a figure that currently lingers below Bitcoin's prevailing market value. This discrepancy implies potential pressure on the Bitcoin price as the expiration date approaches.

Bitcoin options open interest by strike price chart. Source: Deribit

Bitcoin options open interest by strike price chart. Source: Deribit

Even in the eventuality of the $32,000 scenario materializing, Van Straten asserts that the overarching bull market thesis would remain impervious.

Placing confidence in the resilience of the "Notorious B.I.D." is the current strategy

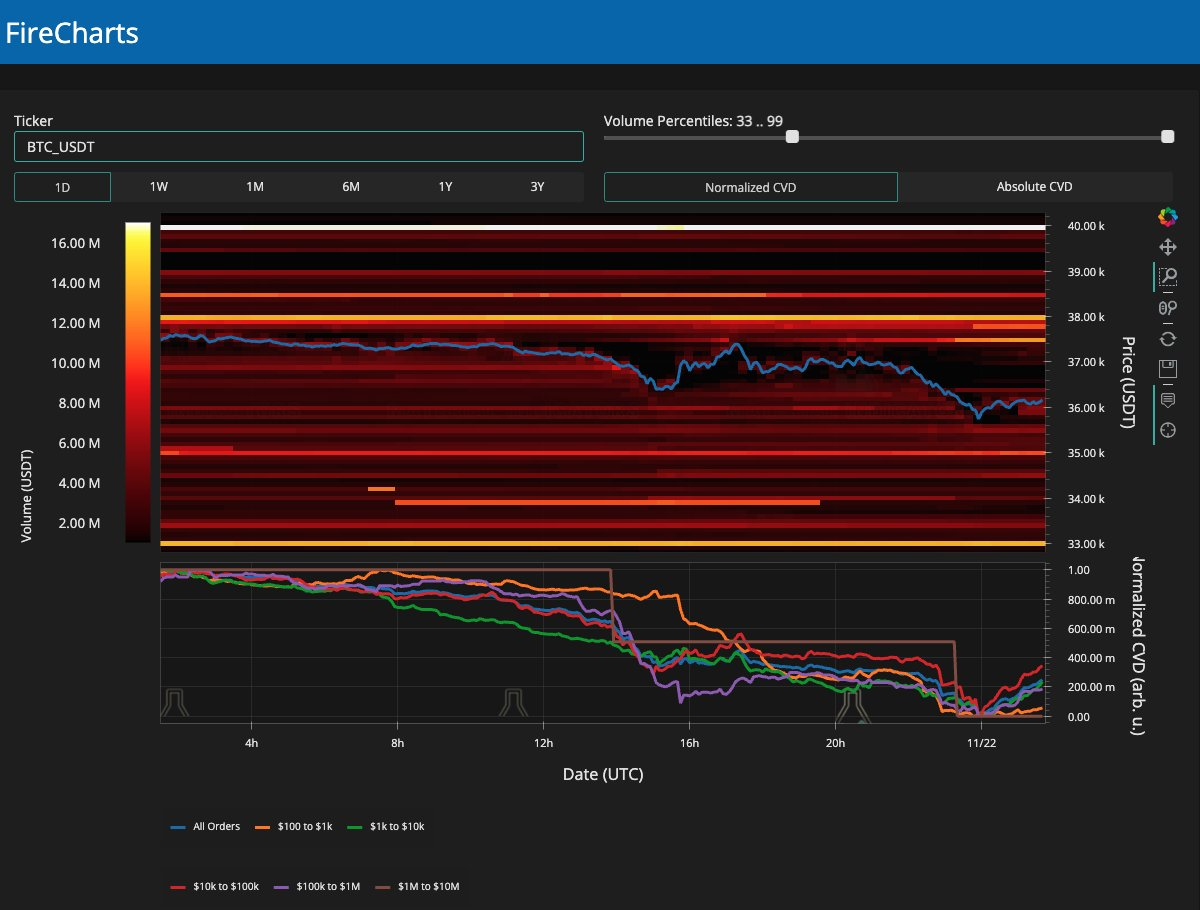

Material Indicators, a discerning on-chain monitoring resource, foresees a potential descent toward the $30,000 mark by dissecting the order book's composition. This analytical perspective posits that Bitcoin, having rapidly ascended to nearly $38,000, should retest bid liquidity areas. The order book's intricate dance sees sellers adjusting asks in anticipation of $38,000, but the analysis underscores the pivotal importance of the bulls reclaiming the 21-Day MA.

BTC/USD 1-day chart with 21SMA. Source: TradingView

BTC/USD 1-day chart with 21SMA. Source: TradingView

Despite the plethora of bearish forecasts preceding the Binance bombshell, including a delineated $30,900 floor within a broader BTC price channel, the market's overnight response has exhibited a degree of modesty.

BTC/USDT liquidity data. Source: Material Indicators/X

BTC/USDT liquidity data. Source: Material Indicators/X

Withdrawals from Binance remain at a restrained level

The discerning eye of CryptoQuant contributor Gaah notes a conspicuous absence of sustained stablecoin withdrawals from Binance, suggesting a nuanced and multifaceted response to the ongoing situation. It's worth recalling that earlier in the year, concerns over liquidity and regulatory scrutiny had triggered a mass exodus of funds from the exchange.

Despite the stepping down of CZ, Binance's CEO, in the last few hours there have been no significant outflows of BTC or Stablecoin from @binance

— G a a h (@gaah_im) November 21, 2023

➡️You can follow this data on @cryptoquant_com ????https://t.co/GadYLsQIJF pic.twitter.com/c8IBKXGY44

Read more about: Crypto Chronicles: BTC Balancing Act

Trending

Press Releases

Deep Dives