Crypto Chronicles: BTC Balancing Act

Bitcoin (BTC) experienced a slight downtick, settling at $37,503, managing to recover $1,000 from the weekly troughs following the Wall Street opening on November 22.

BTC/USD 1-hour chart. Source: TradingView

BTC/USD 1-hour chart. Source: TradingView

Bitcoin adheres to "distinct and unmistakable" key levels

In the ever-fluctuating crypto landscape, Bitcoin demonstrated its resilience by adhering to critical levels, as elucidated by TradingView data monitoring the markets post a sudden downturn the previous day.

In the aftermath of the news surrounding Binance's hefty $4.3 billion settlement with the United States Department of Justice, the dust had yet to completely settle. Bitcoin traders were laser-focused on key price levels, with Daan Crypto Trades astutely observing BTC/USD's faithful adherence to a two-week trading range, even after a dip to $35,600 following the Binance event.

In an insightful commentary shared with X subscribers, Daan Crypto Trades underscored Bitcoin's tenacity, remarking, "A nice tap and bounce of the range low yet again." Emphasizing the significance of specific levels, he pointed out, "It's pretty clear that the most crucial levels are 35.7K and 38K in this particular area."

BTC/USD range chart. Source: Daan Crypto Trades/X

BTC/USD range chart. Source: Daan Crypto Trades/X

Market participants were particularly intrigued by the price corridor spanning $35,000 to $38,000, harboring anticipation for the next phase of the Bitcoin bull run. Notable figures such as trader Credible Crypto foresaw a period of rangebound activity before a potential upward surge. He shared his perspective, stating, "As others have pointed out, the spot premium is back. Definitely a bottom forming here in my opinion... the upside is capped at around 37k and downside capped at 35k as we form a little range here for a couple of days of accumulation before liftoff."

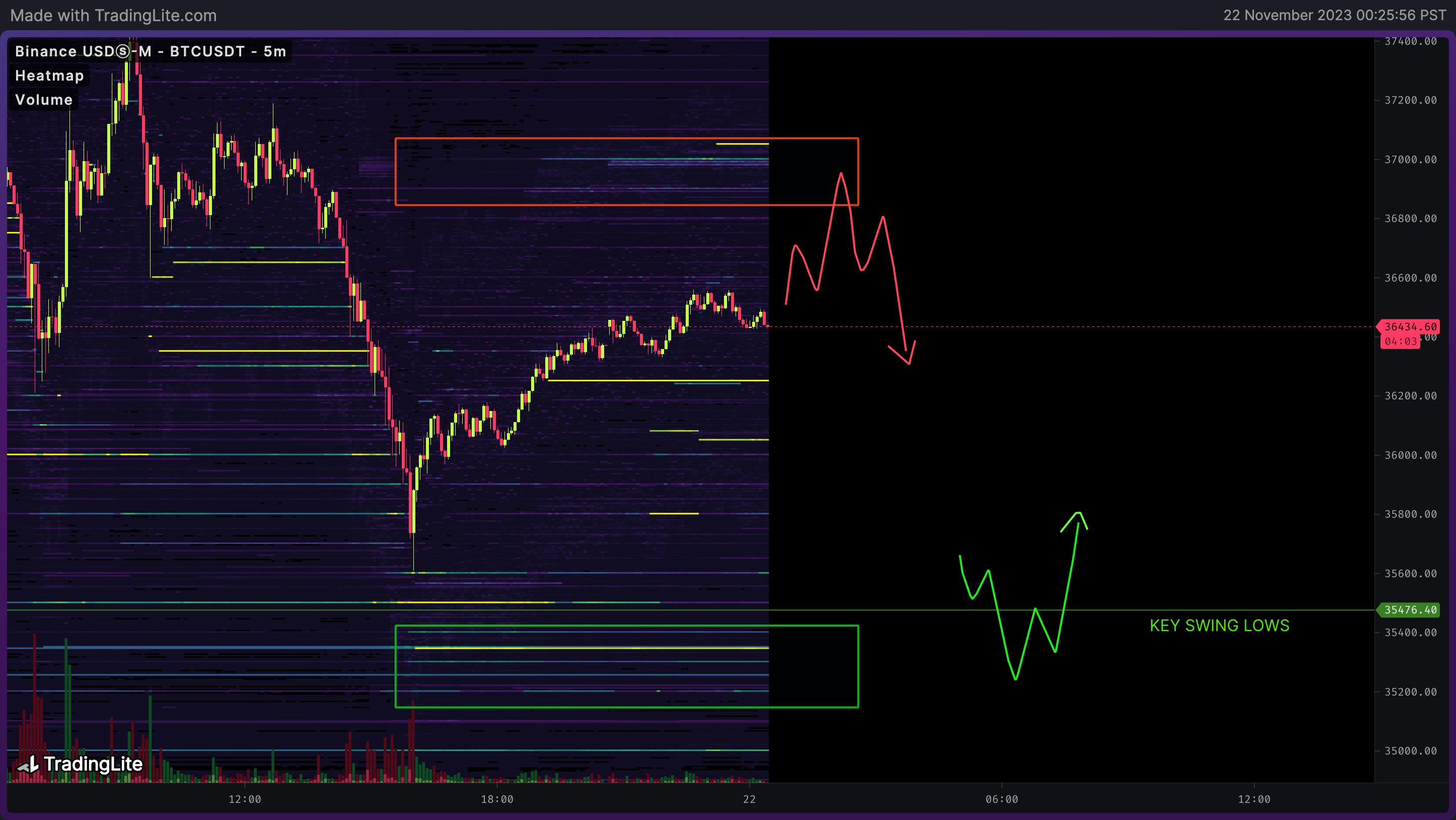

BTC/USD liquidity data. Source: Credible Crypto/X

BTC/USD liquidity data. Source: Credible Crypto/X

Credible Crypto also provided a visual aid with a chart of the Binance order book, spotlighting liquidity pockets that defined probable range highs and lows. Meanwhile, fellow trader Jelle, renowned for his optimistic long-term outlook on Bitcoin, advised caution, underscoring the need for solidifying buyer interest.

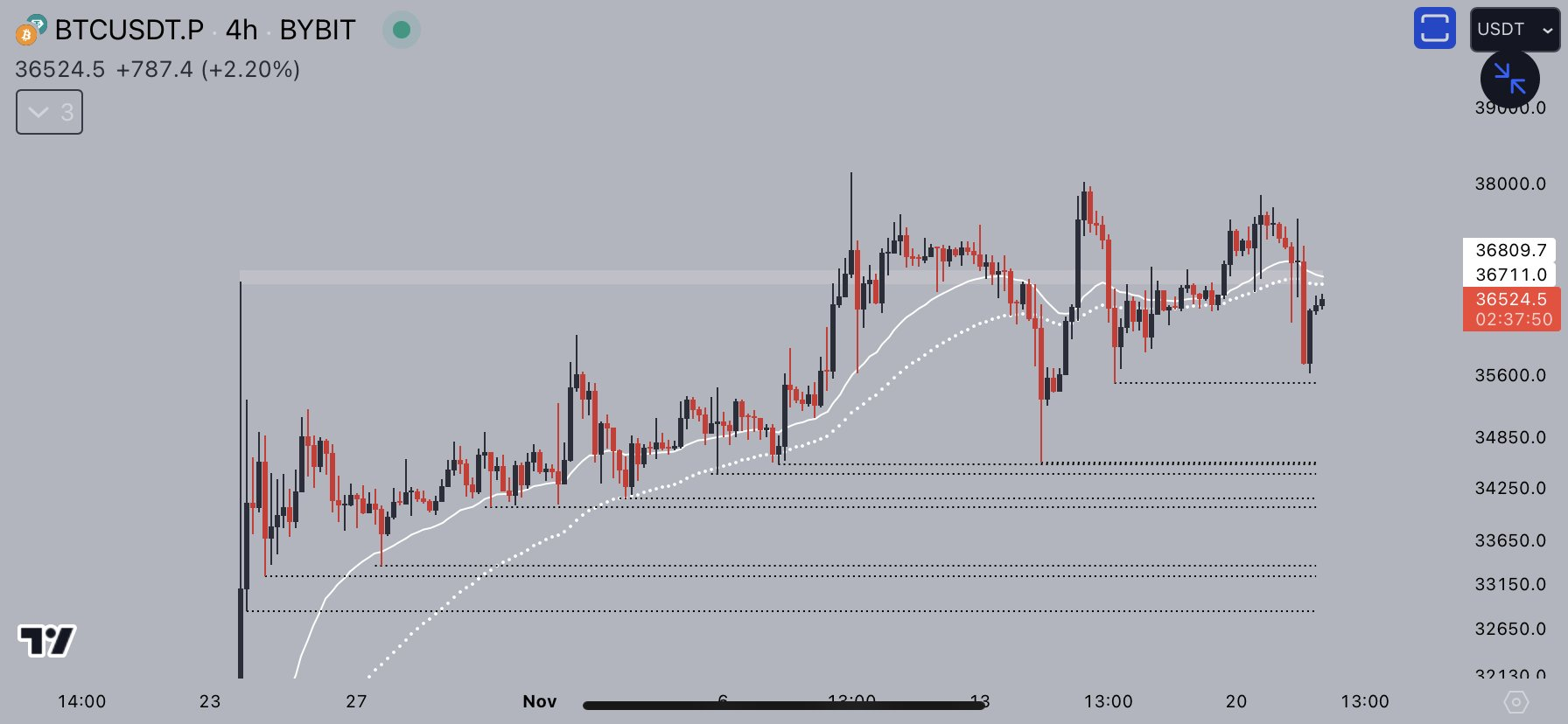

The 4-hour chart of BTC price signals

Commenting on the 4-hour chart post-Binance, Jelle noted, "While we never took out a single low, Bitcoin has work to do... For the first time in this consolidation, we failed to make a higher low - and now we're also back below the key level. Bulls need to step in here."

BTC/USD 4-hour chart. Source: Jelle/X

BTC/USD 4-hour chart. Source: Jelle/X

Despite lingering concerns, Jelle identified a potential breakout from a "cup and handle" pattern on higher timeframes, setting a BTC price target of $48,000.

#Bitcoin's cup & handle pattern broke out and pushed straight through the $30k resistance level!

— Jelle (@CryptoJelleNL) November 22, 2023

Targets from here are $48,000 and new ATHs ???? https://t.co/VcSfEzGySa pic.twitter.com/XHzeMtuh1z

Material Indicators, in its latest coverage of order book changes, highlighted ongoing whale selling. However, the overall increase in liquidity was seen as a positive indicator, as noted in X commentary.

Waking up to some interesting activity in the #Bitcoin order book.#FireCharts 2.0 (beta) shows both bids and asks moving up which is a sign of short term bullishness following yesterday's dip. No real surprise there, but what you can clearly see is different in this chart than… pic.twitter.com/xgJj8AytZe

— Material Indicators (@MI_Algos) November 22, 2023

Read more: Crypto Summit: SEC Talks & ETF Prospects

Trending

Press Releases

Deep Dives