Crypto Resurgence: CME's Triumph and the ETF Odyssey

In the ever-evolving saga of digital currency dynamics, Binance's erstwhile dominance in the Bitcoin ticker realm has gracefully taken a backseat, currently resting at a relatively modest $37,182 in futures open interest. The torchbearer of this shift is none other than the esteemed Chicago Mercantile Exchange (CME), orchestrating a noteworthy resurgence for Bitcoin beyond the elusive $37,000 threshold, marking a triumphant return after a prolonged hiatus of over 18 months.

As the analyst community engages in fervent discourse over this seismic shift, CME ascends to the throne in Bitcoin futures open interest, gracefully eclipsing the global cryptocurrency exchange's former reign. Open interest, a metric akin to a financial barometer, navigates the intricate landscape of futures and options markets, encapsulating the cumulative contracts held by traders. The delicate ballet between longs and shorts shapes the dynamic tapestry of open interest, a phenomenon not lost on keen observers.

Wow, the real flippening that no one is talking about:

— Will (@WClementeIII) November 9, 2023

CME just flipped Binance for the largest share of Bitcoin futures open interest.

Bittersweet -- there will soon be more suits than hoodies here.

(h/t @VidiellaLaura) pic.twitter.com/SIPRLMlFcy

Enter James Seyffart, the astute research analyst specializing in exchange-traded funds (ETFs) at Bloomberg Intelligence. His inquisitive mind delves into the ongoing narrative sparked by Will Clemente's (formerly Twitter) initial post, raising thought-provoking questions about whether CME's burgeoning Bitcoin futures open interest will serve as a soothing balm for the historical concerns of the United States Securities and Exchange Commission (SEC). This regulatory behemoth has long grappled with concerns about the integrity of Bitcoin markets and the looming specter of potential manipulation.

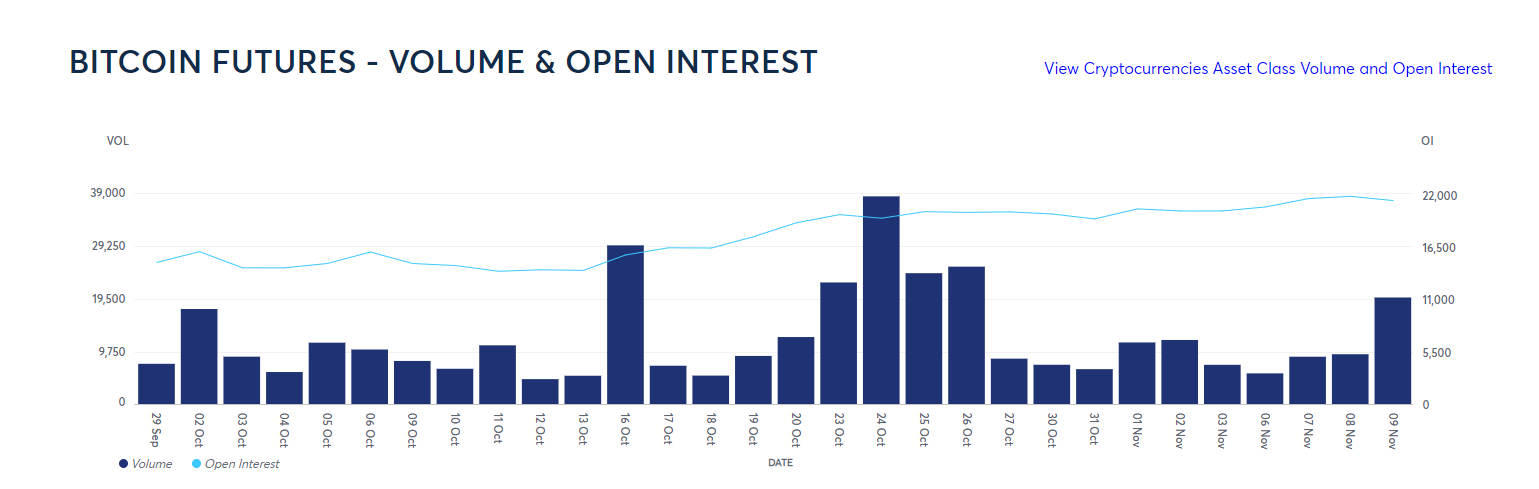

Bitcoin futures volume and open interest on CME over the past month. Source: CME

Bitcoin futures volume and open interest on CME over the past month. Source: CME

These SEC concerns, akin to a persistent ripple in the regulatory pond, have been a formidable obstacle, causing the regulatory body to wield its cautious pen and withhold approval for several spot Bitcoin ETF applications in recent years. Notable players such as BlackRock and Fidelity found themselves in the regulatory crosshairs, facing setbacks as the SEC deemed their filings "inadequate," pointing fingers at omissions related to the markets underpinning the value of the proposed Bitcoin ETFs.

Okay this is interesting... Does this constitute 'market of significant size' now? haha https://t.co/eQb7QXvO3H

— James Seyffart (@JSeyff) November 9, 2023

Fast forward to the enigmatic month of July 2023, where the Chicago Board Options Exchange (CBOE) steps back into the spotlight, armed with insights gained from SEC feedback, rekindling the flame of optimism for Bitcoin spot ETFs. Fidelity, ever the optimist, aims to launch its Bitcoin ETF on CBOE, while BlackRock, the towering figure in asset management, continues to make headlines with its Nasdaq-bound Bitcoin ETF proposal.

CBOE's revised filing, resembling a knight fortifying its armor, emphasizes its commitment to erecting barriers against fraud and market manipulation in the proposed Wise Origin Bitcoin Trust. Adding an element of anticipation to this unfolding drama is the foreseen surveillance-sharing agreement with Coinbase, a central figure in the U.S.-based spot trading platform for Bitcoin. This agreement, akin to a strategic alliance in the financial battleground, is poised to fortify CBOE's oversight.

Describing this agreement with Coinbase, CBOE's filing envisions it carrying the "hallmarks of a surveillance-sharing agreement," akin to unlocking the floodgates to supplementary access to Bitcoin trading data on Coinbase. Notably, Kaiko Research data, akin to a compass pointing to market trends, reveals that Coinbase represented approximately 50% of the U.S. dollar-to-Bitcoin daily trading volume in May 2023. This statistical nugget assumes significance in the intricate dance of market dynamics, especially in light of the SEC's reservations about the depth of BTC markets supporting ETF products.

In this intricate ballet of financial narratives, the surveillance-sharing agreement takes center stage, promising to furnish exchanges and regulators with the tools needed to identify potential market manipulation and uphold the integrity of stock or share values. As the curtain rises on the next act in this unfolding drama, the financial world watches with bated breath, anticipating the twists and turns in this captivating storyline.

You might also like: Crypto Crescendo: The Symphony of Institutional Adoption

Trending

Press Releases

Deep Dives