Crypto Crescendo: The Symphony of Institutional Adoption

Bitcoin, symbolized by BTC, currently hovers at $37,125, its ticker subtly marking a descent. The unfolding narrative, however, paints a fascinating picture, akin to the ebb and flow of a financial tide, as whispers of a potential United States exchange-traded fund (ETF) approval conjure a veritable "torrent" of interest from institutional players.

Tapiero anticipates a substantial surge in capital inflows poised to impact Bitcoin imminently

In this intricate dance of market dynamics, Dan Tapiero, the visionary founder and CEO of 10T Holdings, emerges as a maestro leading the bulls in a symphony of institutional adoption. His anticipation of a substantial capital deluge into Bitcoin seems like the prelude to a transformative movement, a shift from mere hope to tangible reality. As BTC/USD scales 18-month peaks, the institutional landscape echoes this crescendo. A noteworthy shift is observed in the open interest on CME Group's Bitcoin futures markets, traditionally the domain of institutions for BTC derivatives, now surpassing that of Binance for the first time this week.

Tapiero, ever the conductor, heralds this moment with a declaration on November 10th: "Now begins the renewed drumbeat of 'institutional adoption' of Bitcoin." The beat is synchronized with CME BTC futures open interest outpacing Binance, hinting at an imminent torrent of capital cascading from the conventional financial realm.

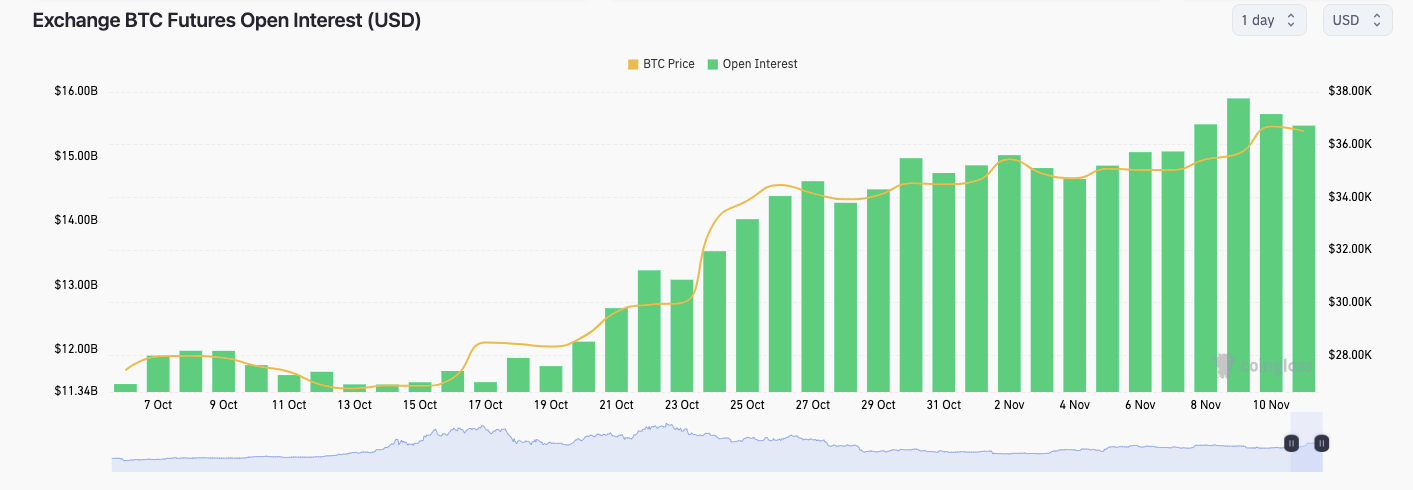

As of November 9th, the aggregate Bitcoin futures open interest surged to a crescendo at $17 billion, marking a seven-month zenith. Present data from CoinGlass tunes this down slightly to $15.5 billion.

Bitcoin exchange futures open interest (screenshot). Source: CoinGlass

Bitcoin exchange futures open interest (screenshot). Source: CoinGlass

The optimistic overture is harmonized by the widespread anticipation of the green light for a U.S. Bitcoin spot price ETF. While slated for early 2024, some whispers suggest it could grace the stage sooner, even this month.

In this financial ballet, trading firm QCP Capital steps in with its market update on November 10th, introducing a subplot that adds intrigue. They spotlight the potential for a spot ETF for Ether (ETH), presently languishing at $2,082, as a catalyst that could elevate the entire crypto market to new heights.

The daily Relative Strength Index (RSI) of Bitcoin suggests a need for prudence

Yet, amidst this orchestrated bullish symphony, QCP injects a note of caution. A series of lower highs on Bitcoin's daily relative strength index (RSI) signals a potential cooling-off from the soaring highs. The macro picture, now adorned with the rosy hues of short-term rate pause expectations, encourages confidence. Dips are expected to be swiftly embraced, driven by FOMO traders eager to hop onto the financial locomotive. However, the cautionary refrain persists, as crucial resistance levels loom large, and BTC is composing a triple bear divergence with the RSI—a historical signal of momentum stalling.

BTC/USD 1-day chart with RSI. Source: TradingView

BTC/USD 1-day chart with RSI. Source: TradingView

As the curtain falls on this financial performance, BTC/USD gracefully pirouettes near $36,500, as per the latest TradingView sonata. Meanwhile, ETH/USD takes a bow with a graceful 4% ascent, elegantly surpassing the $2,000 mark. The financial stage is set, and the players are poised for the next act in this captivating crypto saga.

Read more: Crypto Clarity: Bitwise Unveiled

Trending

Press Releases

Deep Dives