Crypto Quagmire: Navigating Tides of Uncertainty

In the ever-evolving landscape of the cryptocurrency market, the prevailing sentiment has taken a downturn, prompting both investors and financial experts to ponder the potential ramifications should the United States Securities and Exchange Commission opt for a postponement in approving the current spot Bitcoin (BTC) exchange-traded fund (ETF) applications on the fateful day of November 17.

Cryptocurrency market performance, 1-day chart: Coin360

Cryptocurrency market performance, 1-day chart: Coin360

The excitement surrounding spot ETH and BTC ETFs may be diminishing

The once vibrant enthusiasm surrounding the endorsement of spot Ethereum (ETH) and BTC ETFs appears to be losing its luster, contributing to a modest decline in BTC price by nearly 2% during the week of November 17, following the earlier surge that propelled Bitcoin to an impressive 18-month high above $38,000.

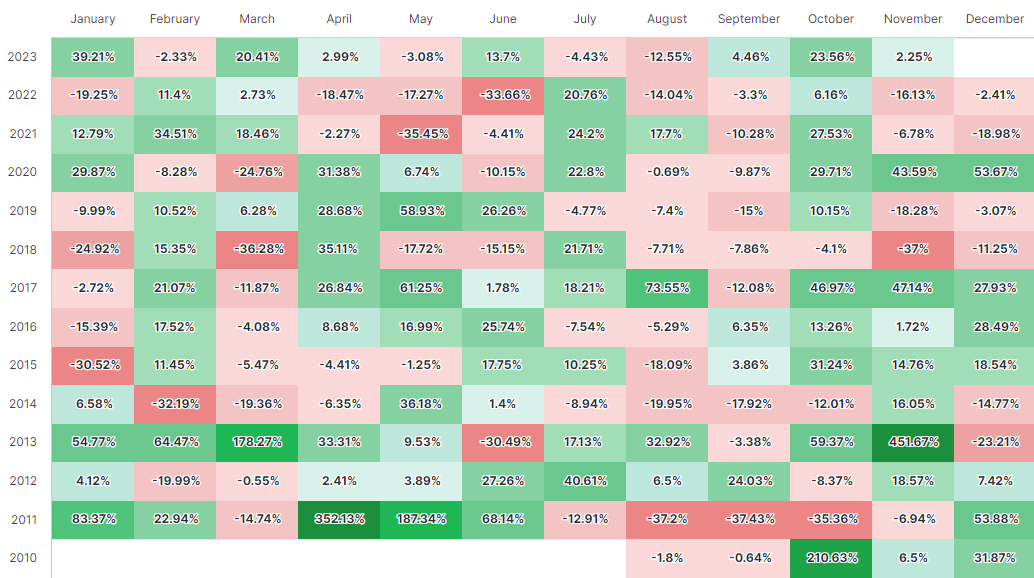

Bitcoin historical returns by month. Source: Newhedge

Bitcoin historical returns by month. Source: Newhedge

Despite the collective optimism for favorable spot ETF developments this week, the outlook seems rather bleak, particularly with the SEC having already deferred Hashdex's application for a spot Bitcoin ETF conversion on the ominous date of November 15. While BlackRock remains steadfast in its belief that the SEC lacks valid grounds to reject a cryptocurrency spot ETF, the prevailing indicators suggest a likely delay. The SEC's decision to procrastinate on Grayscale's Ether futures ETF verdict on November 15 adds another layer of uncertainty, with some astute analysts viewing Grayscale's 19b-4 form submission as a potential regulatory "Trojan horse."

XRP and other alternative coins experience a decline following a spurious ETF filing

The recent market sell-off, involving XRP and a myriad of altcoins, conveniently aligns with the looming expectations of the SEC's scrutiny over several pending spot Bitcoin ETF applications. Significantly, the SEC must render decisions on applications from Hashdex and Global X ETFs by the pivotal date of November 17, and Franklin Templeton's Bitcoin ETF application by November 21, with a potential extension to 2024 dangling as the sword of Damocles should no decision materialize. Crypto analyst James Edwards from the illustrious Australian fintech firm Finder foresees another delay, citing a peculiar incident involving a spurious BlackRock XRP trust filing. This filing not only disrupted XRP markets but also triggered a Department of Justice investigation request. Edwards posits that this event may serve as a stumbling block to the much-anticipated launch of a spot Bitcoin ETF in the U.S., amplifying the SEC's allegations of price manipulation within the crypto industry.

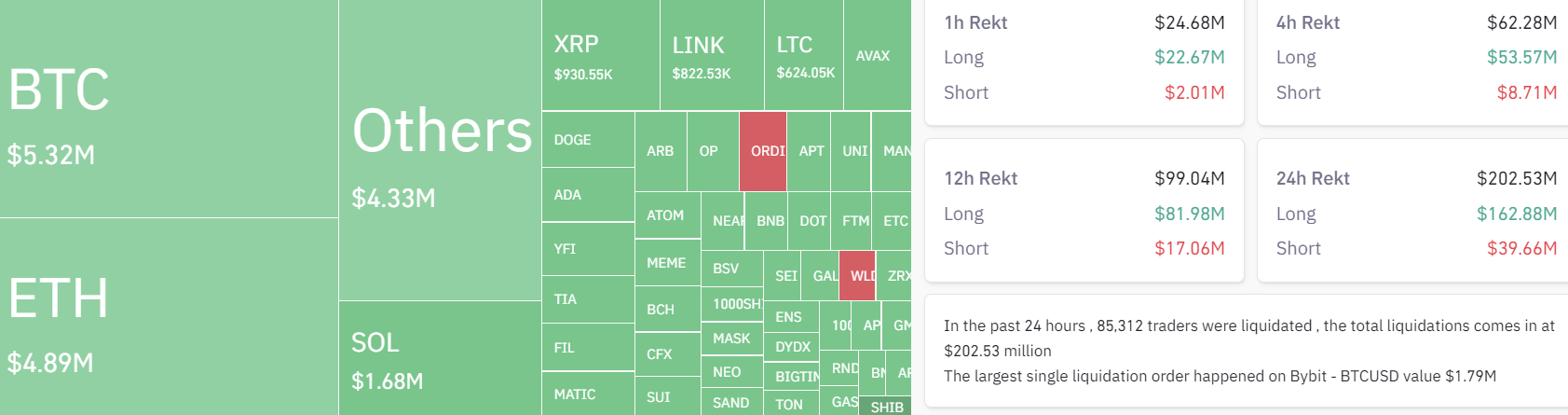

The crypto market experiences a downturn due to liquidations in futures contracts

Amidst this sea of uncertainty, traders are understandably adopting a prudent approach, securing profits at the current zenith of multi-month high prices in the crypto market, foreseeing a potentially protracted waiting period. The recent downturn in major cryptocurrencies has triggered a cascading effect of liquidations in the derivatives market. A staggering $161.4 million in long positions have been liquidated in the past 24 hours alone, with a substantial $54 million obliterated in the preceding four hours. The evident adverse impact on crypto market prices resulting from the liquidation of long derivative positions without the cushion of buying pressure from trading volume is undeniable.

Crypto market liquidations. Source: Coinglass

Crypto market liquidations. Source: Coinglass

Looking ahead, the cryptocurrency market, akin to a ship navigating through tumultuous waters, is poised to confront a series of persistent challenges. The ebb and flow of its trajectory will inevitably be shaped by a complex interplay of economic and regulatory factors, painting an uncertain yet intriguing canvas for its future course.

You might also like: Crypto ETF Surge: Navigating the Waters of Bitcoin Buzz

Trending

Press Releases

Deep Dives