Crypto ETF Surge: Navigating the Waters of Bitcoin Buzz

The fervent speculation surrounding the imminent approval of a Bitcoin (BTC) exchange-traded fund (ETF) in the United States has set off a notable surge in demand for the leading cryptocurrency, consequently resulting in a significant uptick in transaction fees.

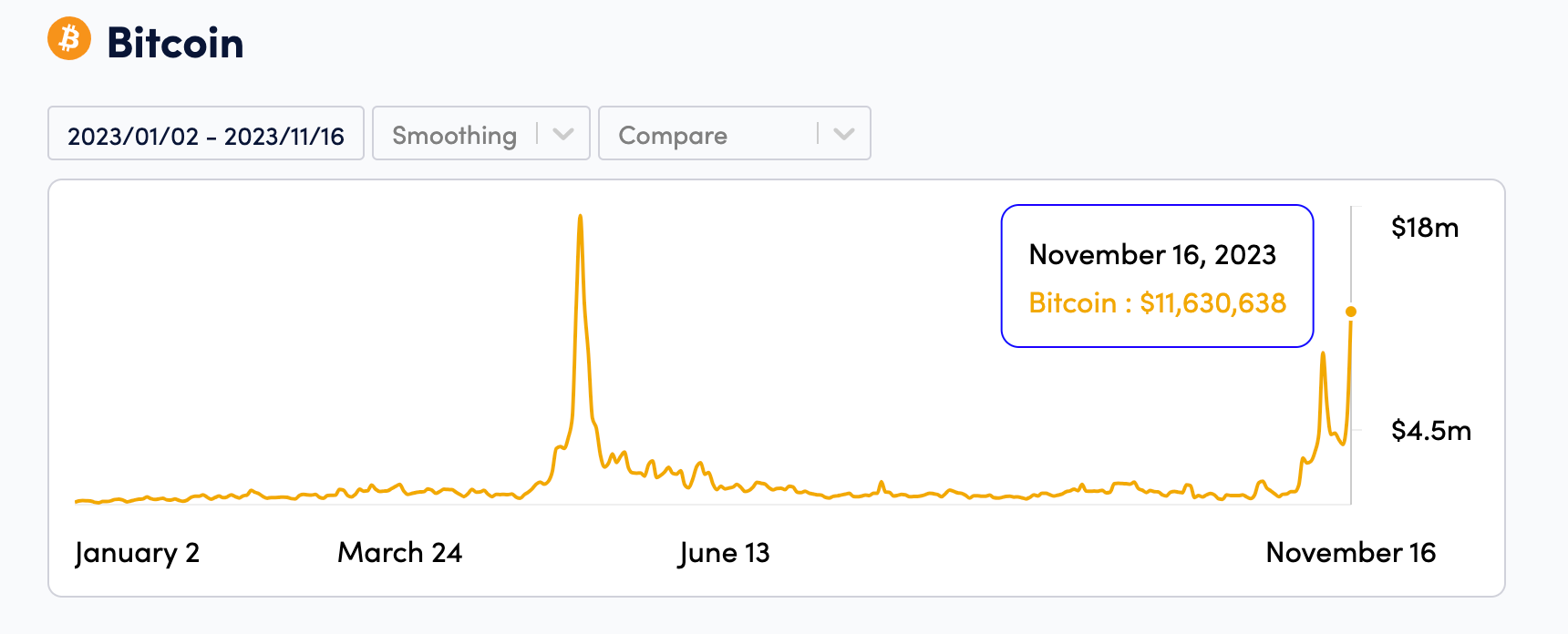

Remarkably, on November 16, the Bitcoin blockchain recorded a staggering $11.6 million in fees, as reported by CryptoFees. Presently, YCharts data indicates an average transaction fee of $18.69, showcasing a 113% increase from the previous day and a substantial 746% surge compared to a year ago.

Bitcoin transaction fees between January 2023 and November 2023. Source: CryptoFees

Bitcoin transaction fees between January 2023 and November 2023. Source: CryptoFees

Amidst the thorough analysis, Bitcoin maintains its resilient stance near 18-month highs, defying its previous bear market boundaries. As of the current writing, the cryptocurrency is valued at $36,407, reflecting a modest 0.58% gain in the past 24 hours.

The intriguing ascent in Bitcoin's valuation traces back to BlackRock, a prominent Wall Street investment manager, filing for a spot BTC ETF with the Securities and Exchange Commission in June. Following BlackRock's pioneering move, a cascade of other influential asset managers in the United States jumped on the bandwagon, presenting analogous proposals. Notable names include Fidelity, ARK Invest, and WisdomTree, among others.

#Bitcoin has officially flippened ETH in daily fees for the first time in 3 years. pic.twitter.com/2G3t6j64TP

— ₿ Isaiah⚡️ (@BitcoinIsaiah) November 17, 2023

While the SEC is actively engrossed in dialogues with these financial entities to address necessary proposal adjustments, the final verdict remains pending, with the deadline now gracefully extended to January 2024. On November 16, WisdomTree initiated the revision process, followed by ARK, 21Shares, Valkyrie, Bitwise, and VanEck, each making amendments to their Form S-1 filings with the regulator.

Bloomberg's seasoned senior ETF analyst, Eric Balchunas, speculates that these meticulous revisions may serve as a strategic response to concerns raised by the SEC, interpreting it optimistically as a positive indicator of substantial progress. "It means ARK got the SEC’s comments and has dealt with them all, and now put [the] ball back in [the] SEC’s court,” Balchunas opined. “[In my opinion] good sign, solid progress.”

The intrinsic nature of a spot Bitcoin ETF lies in its capacity to mirror the price dynamics of Bitcoin, with the "spot" attribute dictating the fund's acquisition of Bitcoin as the underlying asset. This innovative approach empowers investors to seamlessly navigate the intricate Bitcoin market through their conventional brokerage accounts, obviating the need to directly procure it from a cryptocurrency exchange.

The potential approval of a spot Bitcoin ETF looms large on the horizon, promising to beckon capital from institutional investors and potentially catapulting the price of Bitcoin to unprecedented heights in the forthcoming months. According to sagacious Bloomberg analysts, the likelihood of unanimous approval for all proposals within the same batch in January stands impressively at 90%.

Read more about: Blockchain Odyssey: Navigating the ETF Seas with Mike Belshe

Trending

Press Releases

Deep Dives