Crypto Market Insights: Navigating the Digital Frontier

Today, Ethereum's native digital currency, Ether (ETH), is on an upward trajectory, experiencing an increase in its value, currently trading at $1,828. This surge in price reflects a broader trend in the cryptocurrency market, as investors are showing optimism regarding the potential approval of a Bitcoin exchange-traded fund (ETF) in the United States.

On October 25th, ETH's price found stability around the $1,800 mark, which is seen as a significant psychological resistance level. This stability follows a remarkable 9% increase in value over the course of the week. Notably, this price surge is accompanied by a surge in daily trading volumes, suggesting a heightened interest in Ether from buyers.

ETH/USD daily price chart. Source: TradingView

ETH/USD daily price chart. Source: TradingView

Let's delve deeper into the factors that have contributed to ETH's recent price surge.

A victory for Grayscale's Ethereum Exchange-Traded Fund (ETF)

A notable development is the application by Grayscale Investments to convert its Ethereum trust into an ETF, which was acknowledged by the U.S. Securities and Exchange Commission (SEC) on October 24th.

SEC has acknowledged Grayscale's spot ether ETF filing...

— Nate Geraci (@NateGeraci) October 23, 2023

This would be conversion of $ETHE into ETF. pic.twitter.com/JMmutgbakZ

This move by the SEC is in response to a direct court order that compels it to review pending ETF applications from Grayscale. While the SEC has not yet confirmed the approval of a spot cryptocurrency ETF, it has previously given the green light to investment vehicles tied to Bitcoin and Ethereum futures. The market, however, anticipates the approval of a spot Bitcoin ETF in early 2024, and this could pave the way for a similar approval for a spot Ethereum ETF.

ETH is probably the best 6 to 12m long among large cap assets now when BlackRock applies for spot ETH ETF 6 to 12m down the road. Ethereum's ESG friendliness and native staking yield will be appealing to institutional investors should BTC spot ETF turn out to be a success.

— Arthur (@Arthur_0x) October 24, 2023

Large-scale Ethereum transactions reach the highest point in three months

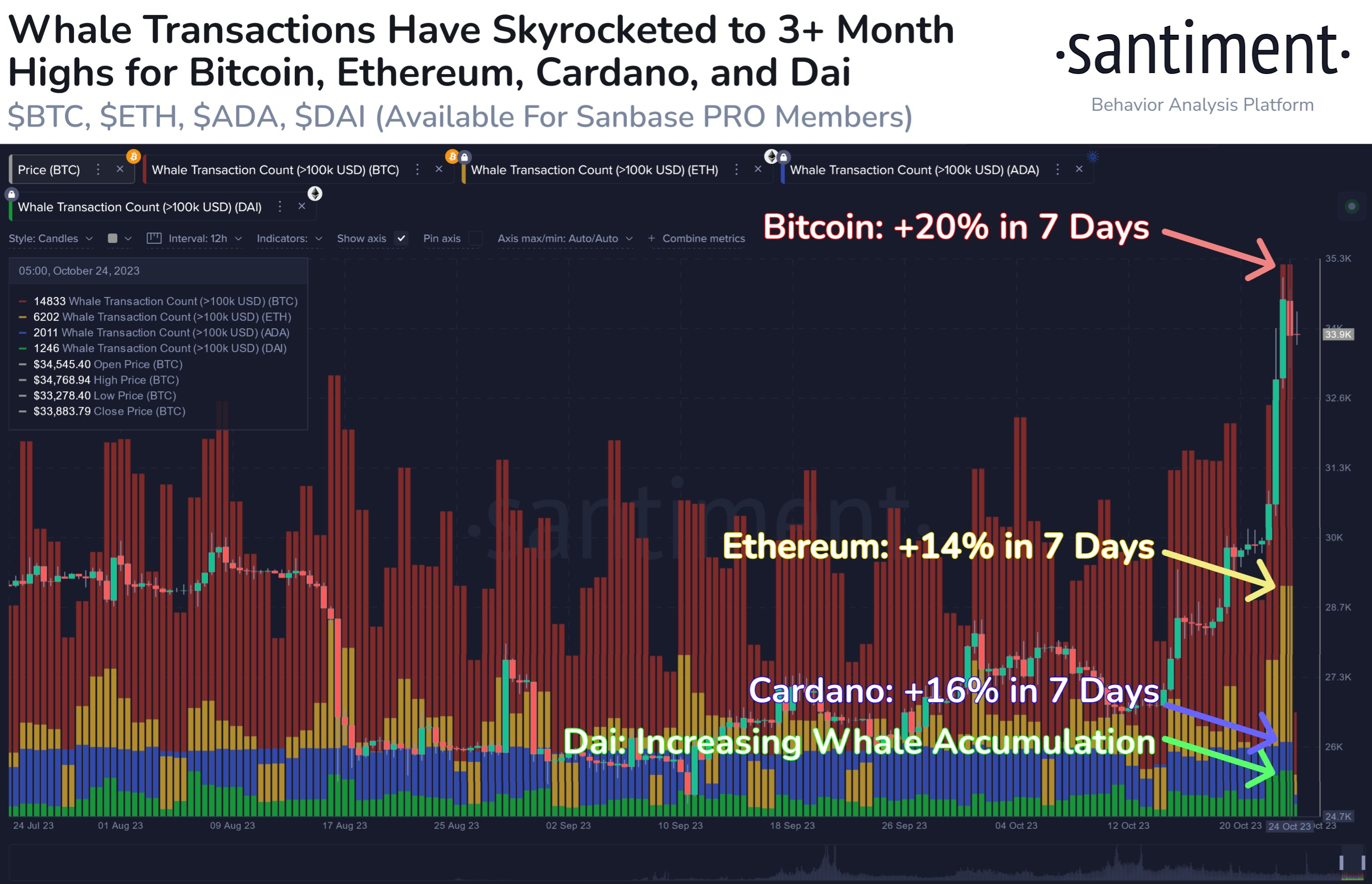

In parallel with this burgeoning ETF enthusiasm, there has been a notable uptick in large transactions by Ethereum whales, those holding substantial amounts of Ether. Data from Santiment reveals that transactions exceeding $100,000 have increased by 15% in a week, reaching their highest level since June.

Ethereum whale transaction count exceeding $100K in value. Source: Santiment

Ethereum whale transaction count exceeding $100K in value. Source: Santiment

This trend is not limited to Ethereum alone, as Bitcoin, Cardano, and DAI have also witnessed similar growth in whale transactions. The accumulation of Ether by whales aligns with the overall surge in Ether's price, indicating a vote of confidence from these significant players. Additionally, the withdrawal of ETH by whales from exchanges suggests their intent to hold the cryptocurrency for the long term rather than trading it for other assets.

1 hour ago, Fresh Whale withdrew 8.31K $ETH ($15.09M) from #coinbase at $1816.

— The Data Nerd (@OnchainDataNerd) October 24, 2023

There have been 3 Fresh Wallets jointly accumulated a total of 47.76K $ETH ($82.97M) in the last 24H.

Bullish ???? pic.twitter.com/sIzlMci76V

The price of ETH surges to $1,800 due to the closure of short positions

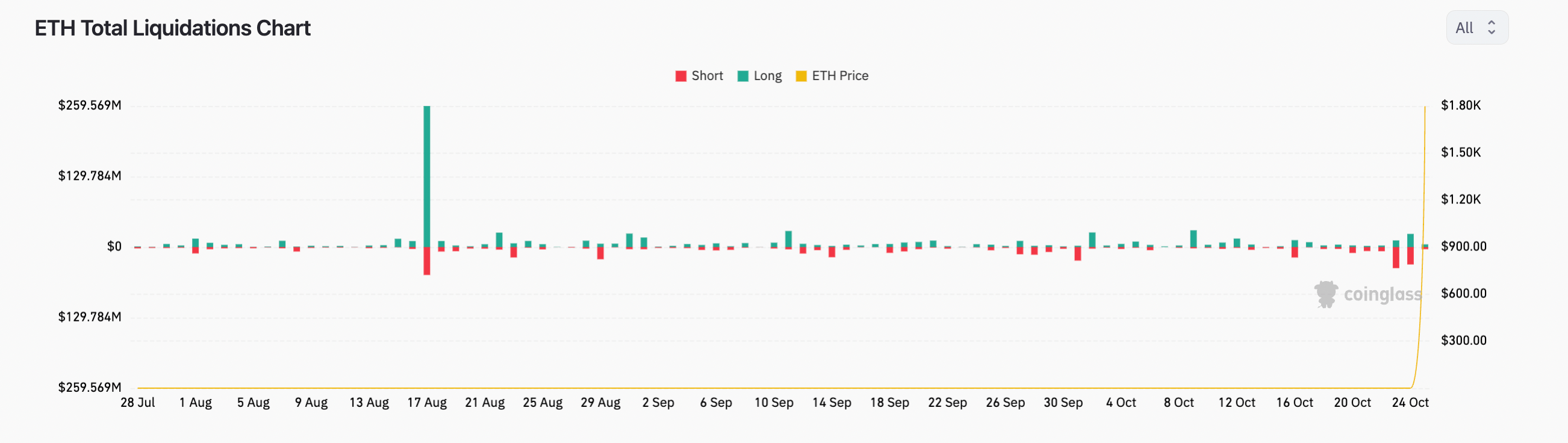

The recent price increase in Ethereum has coincided with the liquidation of short positions in Ether futures contracts, totaling over $70 million. In contrast, long positions worth approximately $41 million were liquidated during the same period. Short sellers were compelled to close their positions by purchasing futures contracts at any price, ultimately pushing the price of ETH above $1,850 on October 24th.

ETH total liquidation every 24 hours. Source: Coinglass

ETH total liquidation every 24 hours. Source: Coinglass

Overall, Ethereum bulls have reason to be optimistic, with the potential for new investment opportunities through traditional stock market brokers looming on the horizon.

Read more: CryptoMetamorphosis: Unveiling the POL Token and Polygon's Evolution

Trending

Press Releases

Deep Dives