Crypto Landscape Unveiled: Bitcoin's Journey

Bitcoin, the celebrated cryptocurrency, represented by its ticker BTC, experienced a decline, marking a significant dip and plunging to fresh October lows at $26,846, following the commencement of Wall Street activities on October 11. An analyst, deeply immersed in market dynamics, observed this occurrence as the "culmination," symbolizing the final act in the ongoing cryptocurrency bear market.

BTC/USD 12-hour chart. Source: TradingView

BTC/USD 12-hour chart. Source: TradingView

Traders emphasize the significance of the $26,800 threshold in the context of Bitcoin

Within the intricate web of cryptocurrency trading, Bitcoin traders echoed the importance of a specific price level, precisely the $26,800 mark, as a critical pivot point. Analyzing data from TradingView, it became evident that BTC's price displayed a further weakening, breaching the support level of $27,000, causing palpable unease among the bullish market participants.

As we navigate the ever-changing landscape of the cryptocurrency realm, at this very moment, the primary cryptocurrency, Bitcoin, appeared to be heading steadily toward the $26,600 mark, as the momentum of the downward trend continued to gain traction.

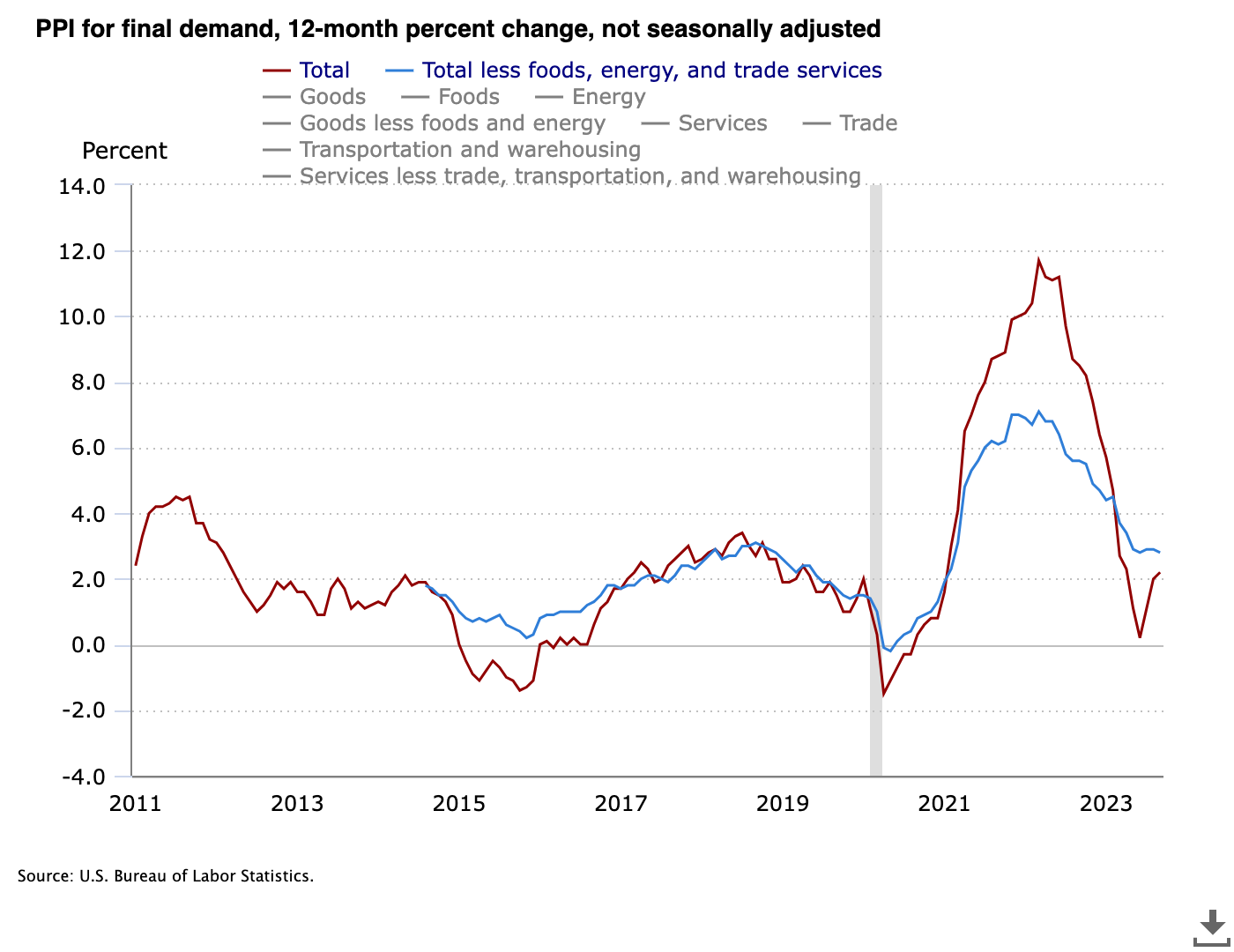

This significant market movement followed the release of crucial United States inflation data, encapsulated within the Producer Price Index (PPI). The data surpassed initial expectations, coming in at 2.2% compared to the anticipated 1.6% year-on-year (YoY). This unexpected development fueled concerns about persistent inflationary pressures within the United States, leading to a strengthened dollar and a consequent decline in risk assets.

Producer Price Index (PPI) chart. Source: U.S. Bureau of Labor Statistics

Producer Price Index (PPI) chart. Source: U.S. Bureau of Labor Statistics

Commenting on this scenario, Michaël van de Poppe, the astute founder and CEO of MN Trading, shared insights, saying, "Given the unexpected rise in PPI, it's likely that the DXY will bounce upwards, causing corrections in Bitcoin's value southward. We are closely monitoring the lower thresholds here for potential entry points."

Adding to the complexity of the situation, Bitcoin had already experienced a decline of $1,000 since the occurrence of a "death cross" on the daily chart at the beginning of the week. This recent decline propelled Bitcoin to its lowest levels since September 29, effectively negating its prior gains in October and altering the month's anticipated trajectory from a typical "Uptober."

Van de Poppe continued to share his insights, stating, "This marks the ultimate phase of the crypto bear market, a moment of great significance and anticipation."

He added a glimpse into potential future scenarios, stating, "We may already witness a reversal in October, potentially transitioning into an upward trend in November (with a retest of the $26,800 region), or the reversal might manifest towards the end of December, setting the stage for a pre-halving & ETF rally. Positive times lie ahead for Bitcoin, painting a picture of hope and optimism in the crypto landscape."

In the aftermath of this substantial market movement, the highly regarded trader Skew underlined the importance of $26,800 as a pivotal point within the existing trading range.

Sharing insights with X subscribers about the four-hour chart, Skew said, "I'll wait for the closing, but it appears to be a rejection so far, and this is also the last area for the bulls to act upon, in my opinion, at around $26.8K, adding an element of suspense and anticipation."

Simultaneously, another knowledgeable trader, Daan Crypto Trades, pointed out multi-month highs in open interest, a significant indicator of market sentiment. High levels of open interest were noted to have triggered bouts of volatility, defining the initial week of this eventful month.

#Bitcoin At it's highest Open Interest level since the August dump.

— Daan Crypto Trades (@DaanCrypto) October 11, 2023

Usually this is met by some kind of squeeze from this point. pic.twitter.com/IZuhVbt6lt

The Binance order book indicates a lack of substantial bids

Adding to the narrative, before the release of the PPI data, the monitoring tool Material Indicators illustrated a concerning lack of substantial support bids on the BTC/USD order book on the largest global exchange, Binance, primarily clustered around the $26,650 region.

BTC/USD order book data for Binance. Source: Material Indicators/X

BTC/USD order book data for Binance. Source: Material Indicators/X

"Today's YoY Core PPI report displays a continuous upward trend since July," highlighted Keith Alan, one of the co-founders, showcasing a deep dive into market indicators and trends in his subsequent analysis.

Alan concluded by introducing a layer of speculation and foresight, stating, "Interest rates might persist at current levels, without relief for risk assets, for a longer duration than previously anticipated, a notion that introduces a sense of uncertainty and contemplation into the prevailing market conditions."

This intricate narrative further unfolds, revealing the multifaceted dynamics of the cryptocurrency market, leaving room for interpretation and analysis, as the cryptocurrency world continues to evolve, offering both challenges and opportunities for market participants.

You might also like: Streamlined STP: Binance's Fee-Saving Solution

Trending

Press Releases

Deep Dives