- Home

- Latest News

- Crypto Insights: ETH and BTC Analysis

Crypto Insights: ETH and BTC Analysis

In the realm of recent market dynamics, the performance of nine freshly introduced Ethereum (ETH) futures exchange-traded funds (ETFs) has been less than stellar, experiencing a notable dip of approximately $1,633. Given this, analysts at K33 Research are gently nudging investors to reevaluate their strategies, hinting at a potential pivot back towards Bitcoin (BTC), currently reflecting a downturn of roughly $27,623.

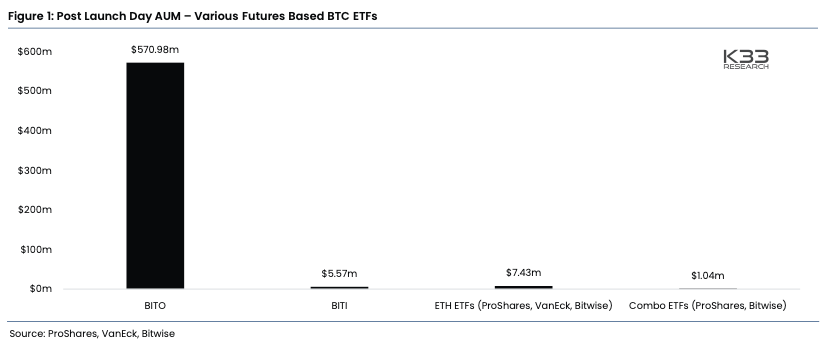

In their all-encompassing market report dated October 3, analysts Anders Helseth and Vetle Lunde thoughtfully underscored the importance of pausing and pondering investments in ETH, perhaps considering a return to the embrace of BTC. They carefully pointed out that the initial trading volume of Ether futures ETFs constituted a mere 0.2% of the trading volume observed with the ProShares Bitcoin Strategy ETF (BITO) on its inaugural trading day in the illustrious month of October 2021.

This discrepancy in initial trading volumes between Ether futures ETFs and their Bitcoin counterparts raised eyebrows, especially given the overall bullish market conditions. However, the first-day trading figures for Ether futures ETFs fell significantly short of the grand expectations that were initially set.

Day one trading of ETH futures ETFs accounted for just 0.2% of what BTC futures ETFs amassed in 2021. Source: K33 Research

Day one trading of ETH futures ETFs accounted for just 0.2% of what BTC futures ETFs amassed in 2021. Source: K33 Research

The somewhat lukewarm reception and tepid institutional interest in Ether ETFs compelled Lunde to gently backtrack on his earlier advice of mulling over an augmentation of ETH allocation, a strategy once seen as a way to ride the ETF hype wave.

In the report section aptly titled "Anticipating More Volatility," Lunde delved into a nuanced analysis, expressing that the majority of the crypto market is currently in a state of tranquility, lacking those sudden surges or dips, and might, therefore, meander in its sideways trajectory for the foreseeable future.

In Lunde's judicious evaluation, this particular market terrain seems to favor Bitcoin, especially with the potential ETF approval lurking on the horizon for early next year and the highly awaited halving event neatly slated for mid-April.

He gracefully remarked,

The present gravitational force in the crypto sphere overwhelmingly beckons towards BTC, promising events on the horizon that seem to endorse a strategy of assertive accumulation.

In parallel musings, Ben Laidler, the sagacious global markets strategist at eToro, voiced a similar perspective on the fate of crypto assets, treading with a gentle cautionary tone.

In his eloquently conveyed email, Laidler alluded to ongoing macroeconomic trends as potential triggers for downward adjustments in the price trajectory of major crypto assets like Bitcoin.

"Recent shifts in the Federal Reserve's policies and the gyrations of oil prices have consistently held sway over the crypto market in recent years," wrote Laidler. "At this juncture in the late stages of the rate hike cycle, the market eagerly seeks positive news for further propulsion. Yet, with the rekindling of oil prices, there might be a tempering effect on market sentiment, a gentle ebb in the overall fervor."

Read more: SBF Trial: Balancing Acts of Crypto

Trending

Press Releases

Deep Dives