Crypto Inflows Surge Amid ETF Anticipation

Investors have been enthusiastically channeling their investments into cryptocurrency products over the past four weeks, fueled by high hopes for the potential approval of a spot Bitcoin ETF in the United States. Consequently, the market has witnessed a significant surge in capital inflow.

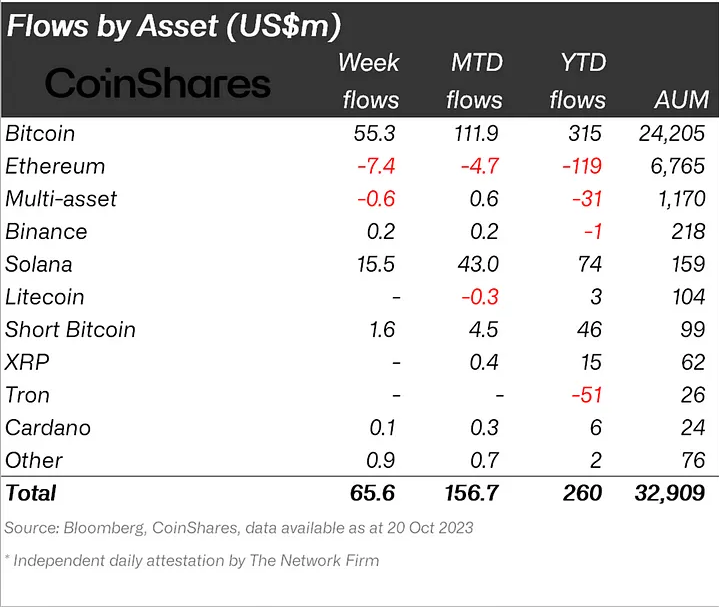

According to the recent report from CoinShares, a renowned asset management firm, the week ending on October 20 saw an impressive injection of $66 million into digital asset investment products. This influx has pushed the total assets under management within the cryptocurrency space to an impressive $33 billion, reflecting the growing interest in this rapidly evolving sector.

Of this week's capital inflow, a substantial portion, $55.3 million, constituting a significant 84% of the total, found its way into Bitcoin-related investment products. This notable contribution has significantly boosted the year-to-date Bitcoin product inflows to a remarkable $315 million, underscoring the continued appeal of Bitcoin as a digital asset investment choice.

It seems that the anticipation of a spot #Bitcoin ETF has prompted further inflows for the 4th consecutive week. Here is our analysis with @Jbutterfill.

— CoinShares (@CoinSharesCo) October 23, 2023

???? Week 43 inflows: US$66m

???? Inflows are relatively low in comparison to June’s @BlackRock announcements, suggesting more… pic.twitter.com/6AkDGQJVOh

However, it's worth noting that CoinShares' Head of Research, James Butterfill, has pointed out that the recent inflows fall short of the levels witnessed earlier this year when BlackRock first announced its intent to create a spot Bitcoin ETF. He highlighted, "While the most recent influx of funds can likely be attributed to the anticipation of a spot Bitcoin ETF launch in the U.S., it falls short in comparison to the initial surge of investments following BlackRock's announcement in June."

Butterfill also emphasized that the four-week inflow run in June was truly remarkable, with a staggering $807 million flowing into the sector. The somewhat lower inflows of recent times suggest that investors are approaching the market with a more cautious mindset, perhaps considering the potential risks and uncertainties in the ever-changing cryptocurrency landscape.

Flows by asset for the week ending Oct. 20 show Bitcoin and Solana as the most popular. Source: CoinShares

Flows by asset for the week ending Oct. 20 show Bitcoin and Solana as the most popular. Source: CoinShares

In the past week, Solana products managed to secure the second-largest share of capital inflows, outperforming all other altcoins and amassing a net gain of $15.5 million. On the other hand, Ether products experienced outflows amounting to $7.4 million, marking it as the only altcoin to endure such losses during the same period.

More recently, interest in a spot Bitcoin ETF surged on October 23, driven by encouraging indications that BlackRock's ETF was one step closer to regulatory approval. Additionally, a U.S. appellate court mandated the Securities and Exchange Commission to review Grayscale's spot Bitcoin ETF filing. These developments triggered a notable Bitcoin rally, resulting in a 14% price surge over the past 24 hours, briefly reaching $34,000 for the first time since May 2022.

This surge in price also led to a significant amount of over $193 million in Bitcoin short liquidations within the last 24 hours, as reported by CoinGlass data, underlining the dynamic and sometimes volatile nature of the cryptocurrency market.

Read more: Coinbase Rumor Clarification

Trending

Press Releases

Deep Dives