Crypto Dominance: UK & Beyond

In a recent revelation, a groundbreaking study has shed light on the United Kingdom's burgeoning role within the global cryptocurrency landscape, highlighting its position as the paramount cryptocurrency powerhouse in Central, Northern, and Western Europe (CNWE) in terms of sheer transaction volume. This intriguing insight stems from the latest research conducted by none other than the esteemed blockchain analytics firm Chainalysis. Remarkably, this revelation coincided with the release of two new segments of the highly-anticipated 2023 Geography of Cryptocurrency report on October 18. As a part of this unveiling, the freshly minted CNWE study made its debut, alongside the eagerly awaited second edition of the Eastern Europe report.

This CNWE-focused report unveils an astonishing narrative wherein this region not only takes the stage as the second-largest cryptocurrency market on the global spectrum but also makes a substantial stride forward, second only to the towering presence of North America. With an impressive contribution of 17.6% to the worldwide transaction volume during the period spanning from July 2022 to June 2023, CNWE emerged as a formidable player, amassing an astounding estimated value of $1 trillion in on-chain transactions during this timeframe.

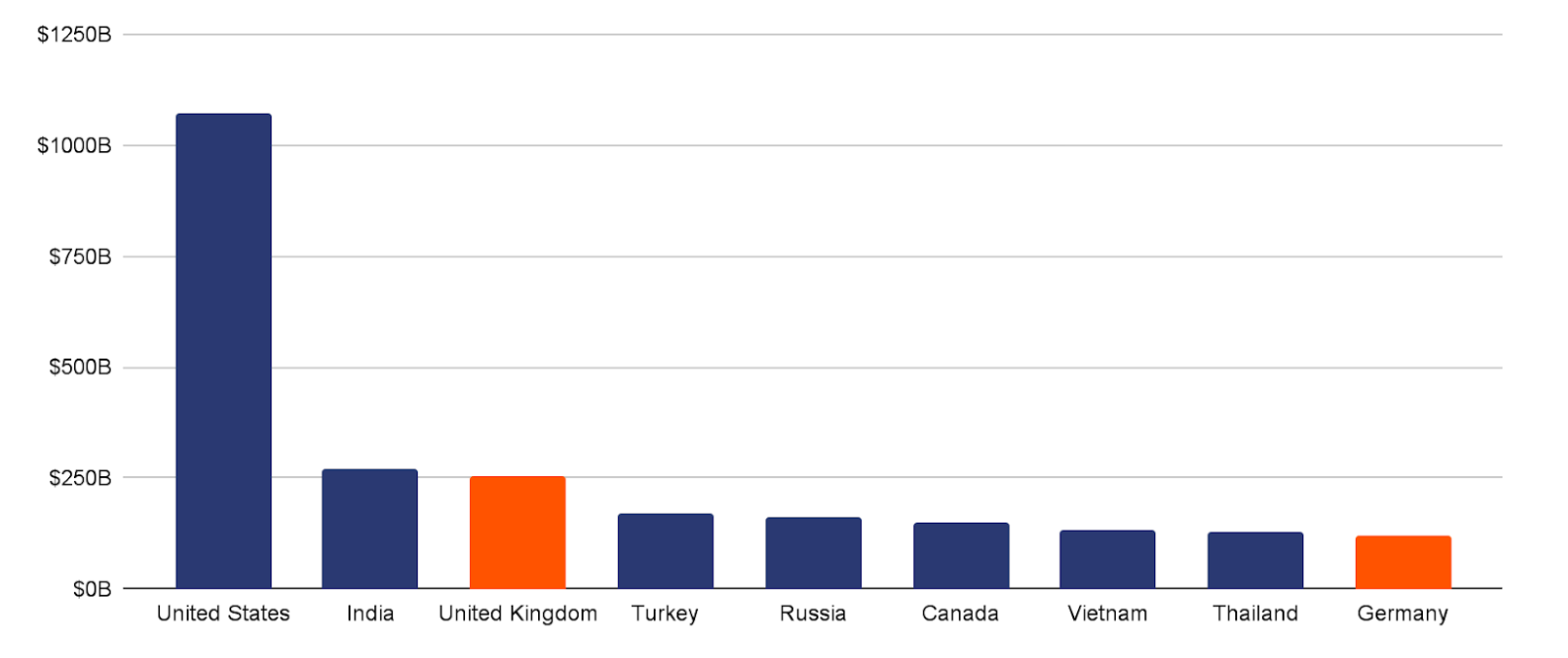

Diving deeper into the details, the United Kingdom, within the CNWE realm, emerges as the undisputed champion of cryptocurrency markets, ranking third worldwide in terms of transaction volumes. This stellar achievement places the UK in an elite league, with the United States and India being the sole competitors to surpass its remarkable standing. The data from Chainalysis underpins the significance of the UK's role in the cryptocurrency space, with approximately $252.1 billion in cryptocurrency transactions recorded in the past year.

But the UK isn't the sole star in the CNWE galaxy; it shares this prestigious platform with other noteworthy cryptocurrency economies, including Germany and Spain, which each clocked in at around $120 billion and $110 billion in cryptocurrency transactions during the same period, respectively. These countries, in turn, are followed by several other prominent cryptocurrency markets, such as France, the Netherlands, Italy, Switzerland, Sweden, and various others.

Top countries by cryptocurrency value received between July 2022 and June 2023. Source: Chainalysis

Top countries by cryptocurrency value received between July 2022 and June 2023. Source: Chainalysis

Amid this backdrop of remarkable growth in the UK's cryptocurrency landscape, some astute cryptocurrency analysts have hinted at a growing appetite for cryptocurrencies within the nation. As an exemplar of this sentiment, the cryptocurrency tax platform Recap, in February, declared London as the world's foremost cryptocurrency-friendly city for businesses, surpassing renowned cities like Dubai and New York.

The surge in cryptocurrency adoption in the UK aligns harmoniously with the country's proactive approach to cryptocurrency regulations. The UK government has been steadily advancing towards the adoption of the Financial Services and Markets Bill, which introduces a comprehensive definition of crypto assets within the existing financial services legislation and meticulously lays the groundwork for regulating stablecoins like Tether (USDT), which presently holds a valuation of $1.00.

In October 2023, the UK's Financial Conduct Authority ushered in the Financial Promotions Regime, marking a significant milestone by setting standards for cryptocurrency firms to promote their businesses while simultaneously safeguarding the interests of investors. Furthermore, the UK embraced the "Travel Rule" for cryptocurrency in September 2023, requiring crypto asset businesses within the UK to meticulously collect, verify, and share specific information pertaining to designated cryptocurrency transfers.

Beyond the confines of the CNWE report, Chainalysis also unveiled a comprehensive report dedicated to Eastern Europe, an emerging cryptocurrency hub that proudly secures the title of the fourth-largest cryptocurrency market, according to the discerning experts at the firm. Within the span from July 2022 to June 2023, Eastern Europe bore witness to a remarkable $445 billion in cryptocurrency transactions, contributing a noteworthy 8.9% to the global transaction activity during the analyzed period.

While the information disclosed by Chainalysis is undoubtedly groundbreaking, it's imperative to note that the methodology underpinning this comprehensive study and the specifics concerning the types of cryptocurrency transactions considered in the analysis remain, as of now, shrouded in mystery, as the company has yet to respond to requests for clarification on these aspects. We will diligently keep an eye out for further developments and updates on this matter as new information emerges.

You might also like: Crypto ETF Optimism Grows Amid Regulatory Dialogue

Trending

Press Releases

Deep Dives