Crypto Conundrum: Navigating Regulatory Waves

The cryptocurrency market finds itself in a turbulent state today, with Bitcoin (BTC) experiencing a dip to $36,612, Ether (ETH) to $2,022, and a corresponding downward trend in altcoin prices. This downturn is exacerbated by a looming specter of regulatory actions, notably the United States Department of Justice (DOJ) preparing to make a significant announcement on November 21. Reports from The Wall Street Journal suggest an impending enforcement action against Binance, coupled with a substantial $4.3 billion fine.

In the midst of this market unease, investors and fund managers are grappling with the complexities of potential regulatory fallout, casting a shadow on the otherwise dynamic cryptocurrency landscape.

Cryptocurrency market performance, 1-day chart. Source: Coin360

Cryptocurrency market performance, 1-day chart. Source: Coin360

The regulatory crackdown on crypto led by the United States comes to a culmination

The strained relationship between the cryptocurrency industry and regulators, marked by misconceptions and mistrust regarding the practical applications of digital assets, has deepened. The United States Securities and Exchange Commission (SEC) has taken a proactive stance, filing civil lawsuits on June 5 and 6, 2023, against two major centralized exchanges, Binance and Coinbase. Allegations include the classification of 61 cryptocurrencies, valued at $100 billion, as securities.

Recent reports from The Wall Street Journal and Bloomberg add fuel to the regulatory fire, indicating that the DOJ's announcement on November 21 will shed light on enforcement actions against Binance. While the initial DOJ communication hinted at robust measures against the crypto sector, details remain elusive.

Speculation is rife about Binance agreeing to a $4.3 billion fine, and Changpeng "CZ" Zhao purportedly considering a guilty plea for violating U.S. Anti-Money Laundering regulations, with plans to step down as CEO.

The prevailing sentiment across risk assets, including Bitcoin and altcoins, is intricately tied to investor sentiment. The persistent threat of unfriendly cryptocurrency regulations or the worst-case scenario of an outright ban continues to cast a monthly shadow on crypto prices.

Adding another layer of complexity, on November 20, the SEC filed a complaint in a San Francisco federal court, targeting Kraken for allegedly operating a platform facilitating unlawful crypto trading.

Enthusiasm surrounding spot ETFs for ETH and BTC may be diminishing

Initially, optimism regarding the potential approval of a spot Bitcoin exchange-traded fund (ETF) in November fueled market euphoria, propelling Bitcoin to an 18-month high above $38,000. However, this enthusiasm has waned, with BTC prices declining on November 21 following the SEC's delay announcement on November 17.

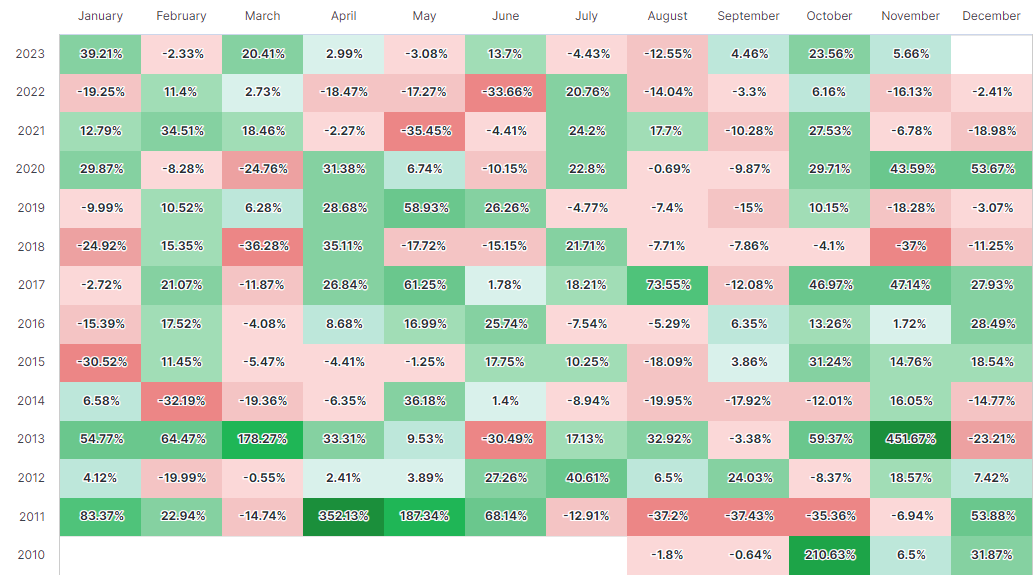

Bitcoin historical returns by month. Source: Newhedge

Bitcoin historical returns by month. Source: Newhedge

While BlackRock remains optimistic about the approval of a cryptocurrency spot ETF, the SEC's potential delay until 2024 introduces a note of uncertainty. The SEC's postponement on November 15 of a decision on Grayscale's Ether futures ETF, coupled with speculation about Grayscale's 19b-4 form as a potential "trojan horse," further adds intrigue.

On November 17, the SEC's decision to delay applications for the Hashdex and Global X ETFs, along with the pending decision on Franklin Templeton's Bitcoin ETF application by November 21 (potentially deferred to 2024), injects additional uncertainty into the market.

The crypto market experiences a decline triggered by liquidations in futures

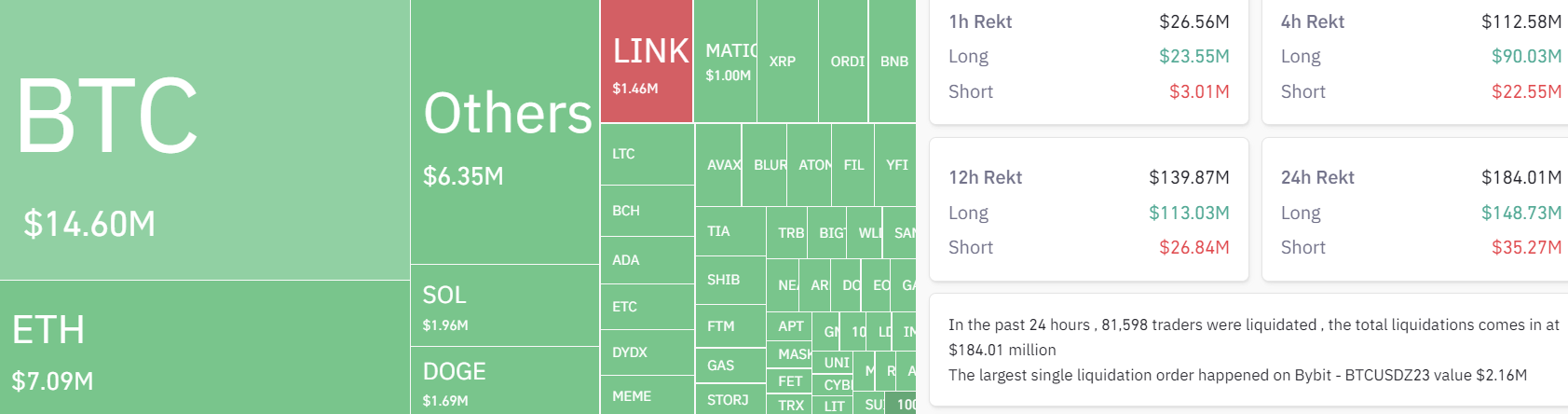

Against this backdrop, traders are seemingly taking a cautious approach, securing profits at the current multi-month high prices due to the anticipated prolonged waiting period. The recent decline in major cryptocurrencies has triggered substantial liquidations in the derivatives market, with over $148.7 million liquidated in the past 24 hours.

Crypto market liquidations. Source: Coinglass

Crypto market liquidations. Source: Coinglass

As the cryptocurrency market navigates through these multifaceted challenges, the ebb and flow of various economic and regulatory factors will undoubtedly play a pivotal role in shaping its trajectory in the foreseeable future.

Read more about: CryptoShift: Teng Takes the Helm at Binance

Trending

Press Releases

Deep Dives