- Home

- Cryptocurrency

- Coinbase Users Lead the Charge in Solana's Impressive Rally

Coinbase Users Lead the Charge in Solana's Impressive Rally

Over the past two weeks, Solana (SOL) has experienced a remarkable surge of over 50%, with users on the Nasdaq-listed digital assets exchange Coinbase playing a significant role in driving up the cryptocurrency's value.

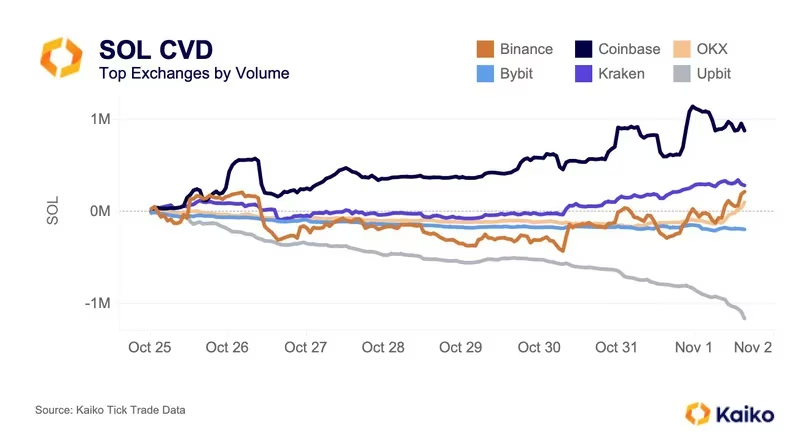

Solana's Cumulative Volume Delta (CVD) has witnessed a surge on the Coinbase exchange, as reported by Kaiko. This indicates a notable influx of capital into Solana on the platform.

Solana's Cumulative Volume Delta (CVD) has witnessed a surge on the Coinbase exchange, as reported by Kaiko. This indicates a notable influx of capital into Solana on the platform.

According to data tracked by Paris-based Kaiko, since October 25, the cumulative volume delta (CVD) for SOL on Coinbase has surged by nearly $1 million, indicating a substantial influx of capital. On exchanges like Binance and Kraken, the CVD turned positive earlier this week. In contrast, on the South Korean exchange Upbit, it has consistently remained negative and on a downward trajectory for two weeks.

hard to say without speculating too much, its average order size is smaller than Kraken but its median (and st. dev) order size is larger than on any other exchange so... maybe some institutional demand?

— Riyad Carey (@riyad_carey) November 1, 2023

The CVD metric serves as a gauge for the net difference between buying and selling volumes over a specific period. It offers an ongoing assessment of the overall bullish or bearish pressures in the market. Positive values indicate an excess of buying activity, while negative values suggest the opposite.

Kaiko analyst Riyad Carey pointed out that the median order size on Coinbase has been notably larger compared to other exchanges. This may signal the interest of institutional investors in SOL through the Nasdaq-listed platform.

Coinbase's prominent position in the SOL market comes on the heels of a report by VanEck, a multi-billion dollar institutional asset manager. The report outlines an optimistic scenario that could potentially drive the cryptocurrency's price as high as $3,200 by 2030. This bullish projection hinges on the possibility of Solana becoming the first blockchain to accommodate applications with over 100 million users.

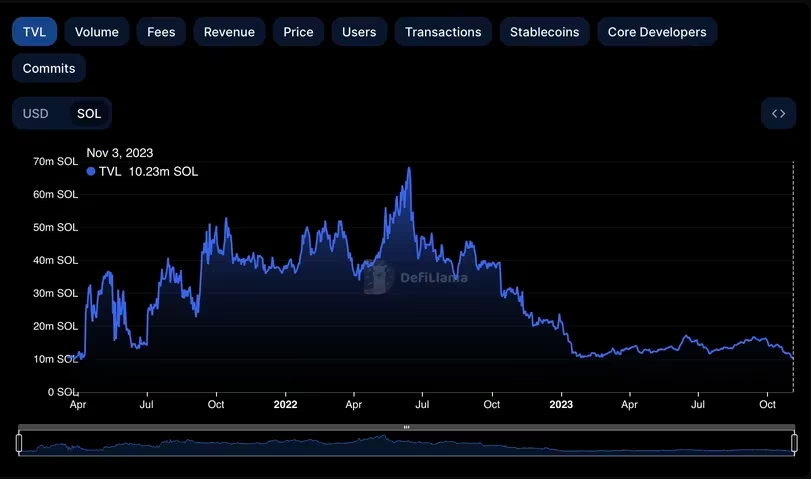

However, despite SOL's recent surge in price, on-chain activity has not experienced a corresponding upswing. In the span of two weeks, the total value of assets locked in Solana-based decentralized finance (DeFi) protocols has decreased from 12.03 million SOL to 10.23 million SOL. This represents the lowest figure since April 2021, as reported by DefiLlama. While total value locked (TVL) is not a perfect measure, it is widely used to gauge the utilization of smart contracts in the ecosystem.

The Total Value Locked (TVL) has reached its lowest point since April 2021, according to data from DefiLlama.

The Total Value Locked (TVL) has reached its lowest point since April 2021, according to data from DefiLlama.

Solana-based decentralized exchanges have experienced an uptick in trading volume, and there has been an increase in active addresses on the network. However, according to on-chain analyst Patrick Scott, these metrics still do not fully justify the recent surge in prices.

This was intended to be more informational, but in general I'd say stats are increasing steadily. nothing out of this world to justify the price increase, but there are other reasons to be bullish.

— Patrick Scott | Dynamo DeFi (@Dynamo_Patrick) November 1, 2023

Read More: Floki's TokenFi Platform Leverages Trillion Dollar RWA Narrative

Trending

Press Releases

Deep Dives