Bullish Resurgence: Bitcoin's $40K Triumph

In spite of indications pointing towards an imminent bearish trend, Bitcoin has recorded a noteworthy surge, successfully regaining the pivotal psychological resistance at $40,000. While the market reflects a robust bullish sentiment, there are indicators hinting at the potential for a temporary correction.

Analyzing Bitcoin's Price Movement: Daily Chart

Bitcoin has sustained a robust upward trend since the commencement of 2023, consistently surpassing previous swing highs. Following this significant uptrend, the price has effectively reclaimed the critical resistance at $40,000, affirming substantial demand in the market.

Historically, the $40,000 resistance has posed a considerable challenge for Bitcoin, and its breach signals a notable presence of buyers. However, the current price has entered a crucial resistance zone, denoted by the significant $45,000 region and the upper boundary of a multi-month ascending channel. Consequently, the market is likely to undergo a phase of consolidation correction before determining its next directional move.

Source: TradingView

Source: TradingView

BTC on The 4-Hour Chart

A detailed examination of the 4-hour chart reveals a period of lateral consolidation, ultimately resulting in an unexpected surge in the price. This has empowered Bitcoin to reclaim the significant resistance region of $40,000.

After a minor pullback to the broken level, the price continued its upward trajectory, targeting the $45,000 resistance region. This range acts as a pivotal barrier for Bitcoin buyers, and a successful breach of this level could lead to another impulsive surge towards the $48,000 resistance zone.

Nevertheless, considering the prevailing supply around the $45,000 price range and the prolonged bearish divergence between the price and the RSI indicator, the market appears to necessitate a temporary consolidation phase before determining its next move. In such a scenario, potential support levels for Bitcoin would lie within the 0.5 and 0.618 levels of the Fibonacci retracement, applied to the recent impulsive uptrend.

This cautious approach acknowledges the market's requirement to establish a solid foundation before potentially continuing its upward trajectory.

Source: TradingView

Source: TradingView

Insights from On-chain Analysis

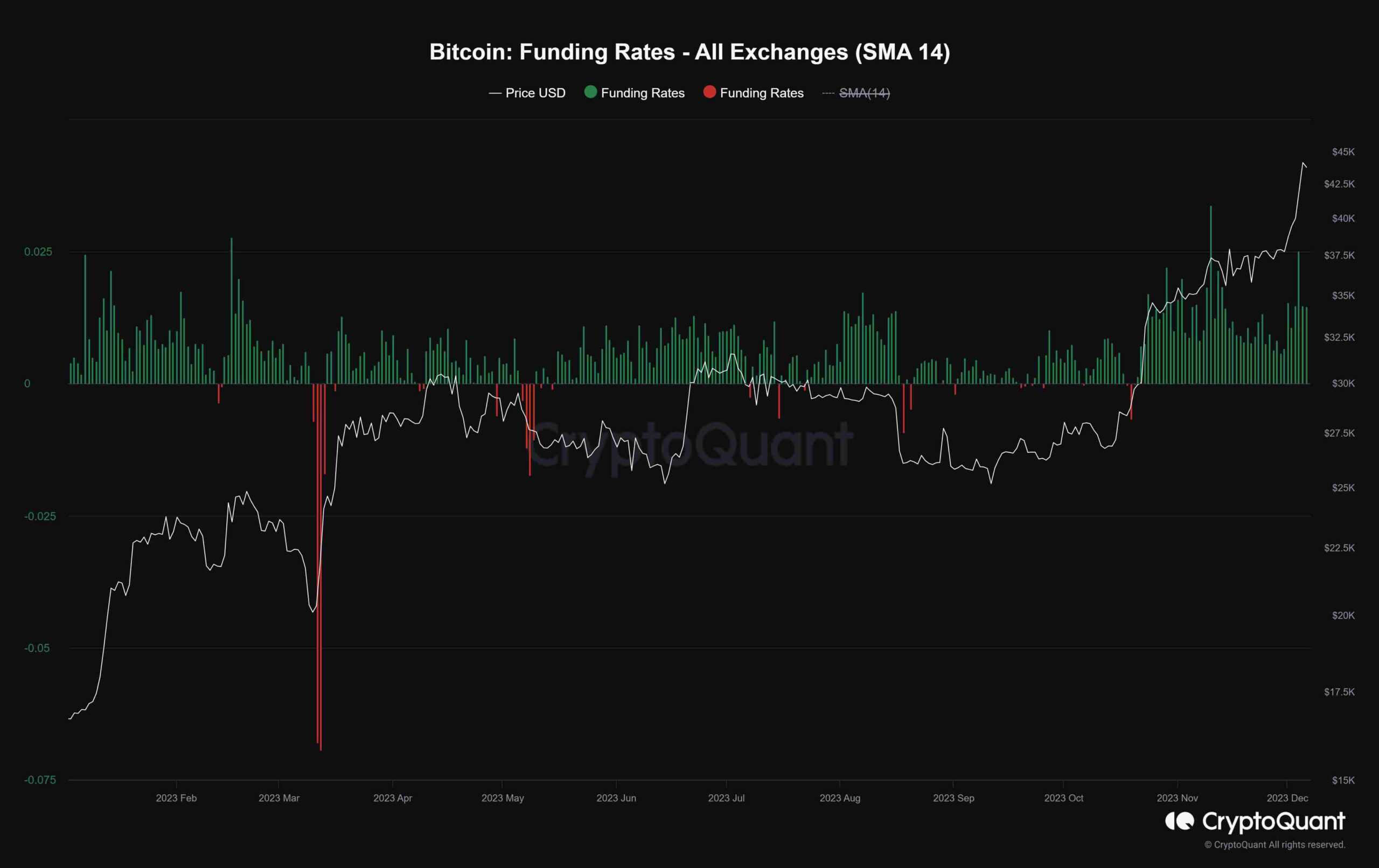

Bitcoin has witnessed a substantial surge in price, surpassing the $40,000 threshold. However, delving into the sentiment of the futures market can offer valuable insights into the health of the ongoing uptrend and the likely direction of Bitcoin's price in the near term.

The chart under consideration illustrates the funding rates metric, a reflection of traders' sentiment in the perpetual futures market. Positive funding rates indicate the dominance of long-position traders, willing to pay funding to short traders. Conversely, negative funding rates signal the prevalence of short-position traders willing to pay long traders.

Importantly, this metric has consistently displayed positive values concurrently with the price surge above the $40,000 mark, indicating a significant bullish sentiment in the futures market. While a positive sentiment is generally seen as favorable, it does raise concerns about the potential for a long-squeeze event if this pattern persists. A long-squeeze event occurs when a rapid downward price movement forces traders with long positions to exit their trades, causing a temporary cascading effect.

Monitoring the funding rates closely will be crucial to assess the sustainability of the bullish sentiment and to identify any potential risks, such as a long-squeeze event.

Source: CryptoQuant

Source: CryptoQuant

Read more: Ethereum's Price Dance: Hurdles and Surges

Trending

Press Releases

Deep Dives