BTC's Supply Dynamics: Long-Term Holders and Speculators

Bitcoin (BTC) prices are experiencing a significant drop, currently at $29,764, and this drop is making the cryptocurrency scarcer than ever. Whether you're a BTC price speculator or a newcomer to the market, the scarcity is something to take note of in the current financial landscape.

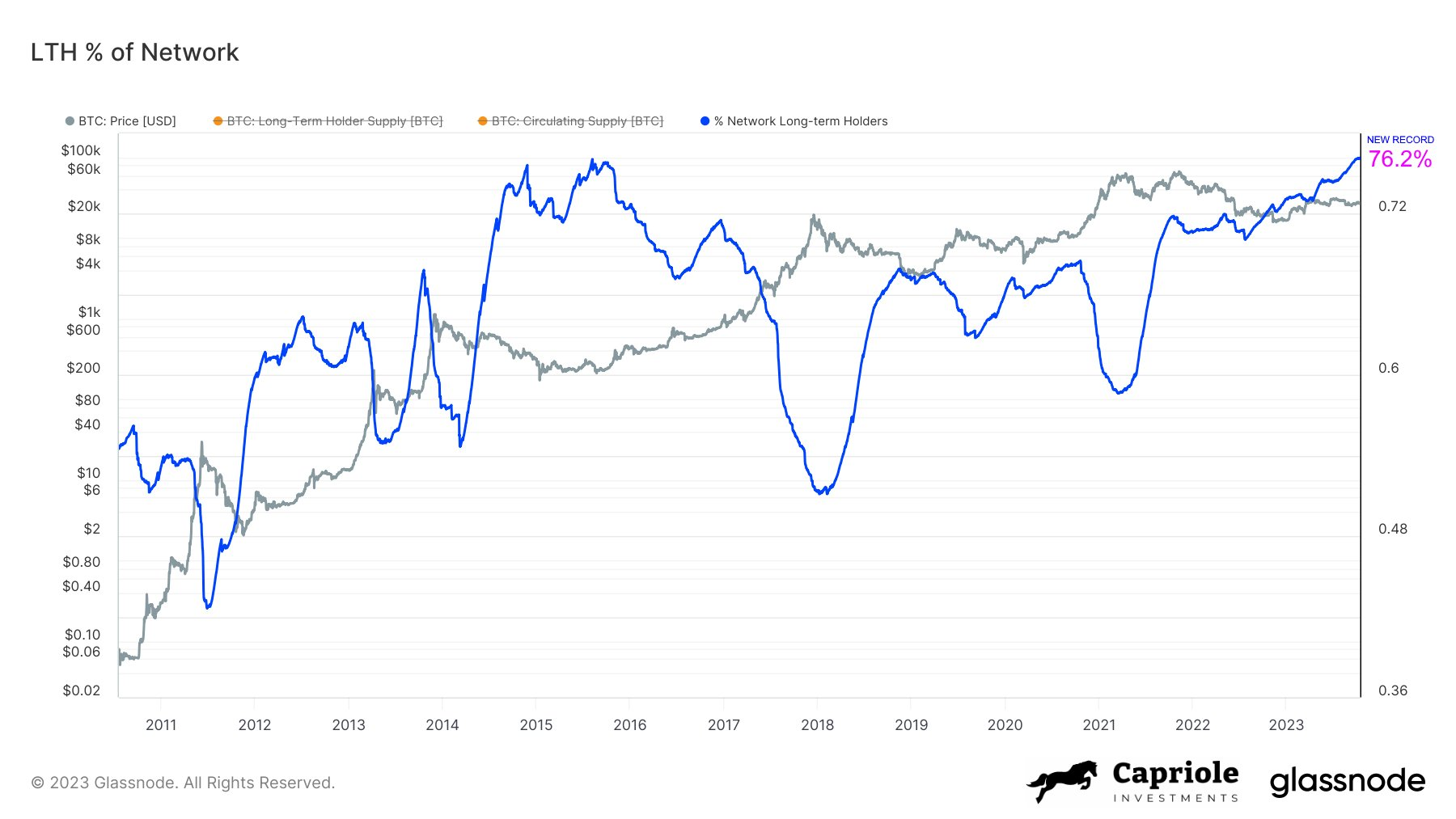

The most recent data from on-chain analytics company Glassnode reveals a new high in the proportion of the available BTC supply that's now securely stored away for the long term.

The presence of long-term Bitcoin holders has reached unprecedented levels

More than 76% of Bitcoin's supply is now under the control of long-term holders (LTHs), marking an all-time high in their dominance. This phenomenon is shedding light on the evolving dynamics of the cryptocurrency market.

Despite the continuous increase in supply with each block, the percentage of BTC held by those with a long-term investment approach is higher than ever before. Charles Edwards, the founder of Capriole Investments, a quantitative Bitcoin and digital asset fund, commented on this milestone, stating, "A record-breaking 76.2% of the Bitcoin network is currently held by long-term holders as of October 18. This surpasses the previous record set in 2015. With less liquid supply, the competition for available coins intensifies, which naturally drives up prices."

Bitcoin long-term holder (LTH) % BTC supply share chart. Source: Charles Edwards/X

Bitcoin long-term holder (LTH) % BTC supply share chart. Source: Charles Edwards/X

Edwards also noted the ripple effect of this record among long-term holders, emphasizing that the availability of coins for other market participants is dwindling. As these long-term holders continue to accumulate, it becomes increasingly challenging for those seeking to enter the market, adding an extra layer of complexity to the BTC ecosystem.

Accompanying data from Glassnode illustrates the substantial increase in BTC holdings by long-term investors since mid-2021, demonstrating their commitment to "hodling" throughout even the most bearish market periods. Only sporadically has their control over the supply decreased, showing their resilience and conviction in the future potential of Bitcoin.

In private conversations, Edwards further clarified that while demand for Bitcoin has its fluctuations, the overall trend is unmistakable. "By 'demand,' I'm not suggesting it's the same as in 2015. What I mean is that with current demand and a diminishing supply, price pressure must inevitably push upwards, driven by supply and demand economics. However, it's important to acknowledge that demand for Bitcoin has significantly increased since 2015, which should exert even greater upward pressure on prices during this market cycle. We've never seen Bitcoin's supply this restricted heading into a halving event."

Bitcoin speculators are keeping a cautious distance

On the other end of the spectrum, short-term holders (STHs) or speculators have also piqued the interest of market observers. The realized price of STH-owned coins has consistently provided support throughout this year, and recent data confirms that this trend persists. The STH realized price, representing the price at which STH-owned coins were last moved, currently stands just below $27,000. BTC/USD breaking above this level is seen as a significant bullish signal, according to analysts, offering a glimmer of hope for those who prefer shorter-term positions.

TradingView data indicates that Bitcoin has maintained support at the $28,000 level after reaching two-month highs, reflecting the resilience of the cryptocurrency in the face of market fluctuations.

BTC/USD 1-day chart. Source: TradingView

BTC/USD 1-day chart. Source: TradingView

In August, the historically low BTC exposure among STH entities had already raised concerns among market observers, highlighting the ongoing shifts and dynamics in the cryptocurrency market.

Read more: Grayscale's Innovative Bitcoin ETF Endeavor

Trending

Press Releases

Deep Dives