- Home

- Latest News

- Blockchain Brilliance: Navigating the Digital Frontier

Blockchain Brilliance: Navigating the Digital Frontier

Bitcoin (BTC) is currently showing a downward trend, with its price at $34,351, but there's optimism that it could reach $45,000 in November, following a classic BTC price cycle, according to the well-known analyst CryptoCon.

In a recent discussion on October 25th, the creator of the Bitcoin price model shifted focus to an analysis based on Fibonacci retracement levels. CryptoCon expressed the view that a potential rise to $45,000 next month is "within the realm of possibility" for Bitcoin.

An analyst suggests that Bitcoin hitting $45,000 next month is within the realm of possibility

Despite Bitcoin achieving 17-month highs this week, many market participants are anticipating a pullback. However, CryptoCon is of the opinion that there is still significant room for upward movement by comparing the current behavior of the BTC price to past cycles. He pointed out that the BTC/USD pair could reach the top of the Fibonacci model, with four of its targets already achieved, including the fourth target, which is approximately 3.3% above this week's peak at $36,368. In the middle of these targets, there are distinct "phases," and November has now become a critical milestone for the next phase's completion.

CryptoCon elaborated, stating, "The transition to the mid-top of the cycle generally takes about 2 months after the conclusion of phase 2. Since the first month is about to end in phase 4, the mid-top could potentially be reached as early as November." In simpler terms, this suggests the possibility of Bitcoin surpassing $45,000 by the next month.

Bitcoin Mid-Cycle Fibonacci Phases chart. Source: CryptoCon/X

Bitcoin Mid-Cycle Fibonacci Phases chart. Source: CryptoCon/X

Furthermore, CryptoCon highlighted two significant resistance levels that Bitcoin bulls need to overcome to realize the $45,000 target, both of which are situated around the $36,400 mark.

BTC/USD chart with Fibonacci resistance levels. Source: CryptoCon/X

BTC/USD chart with Fibonacci resistance levels. Source: CryptoCon/X

The behavior of the BTC price cycle is strikingly dissimilar

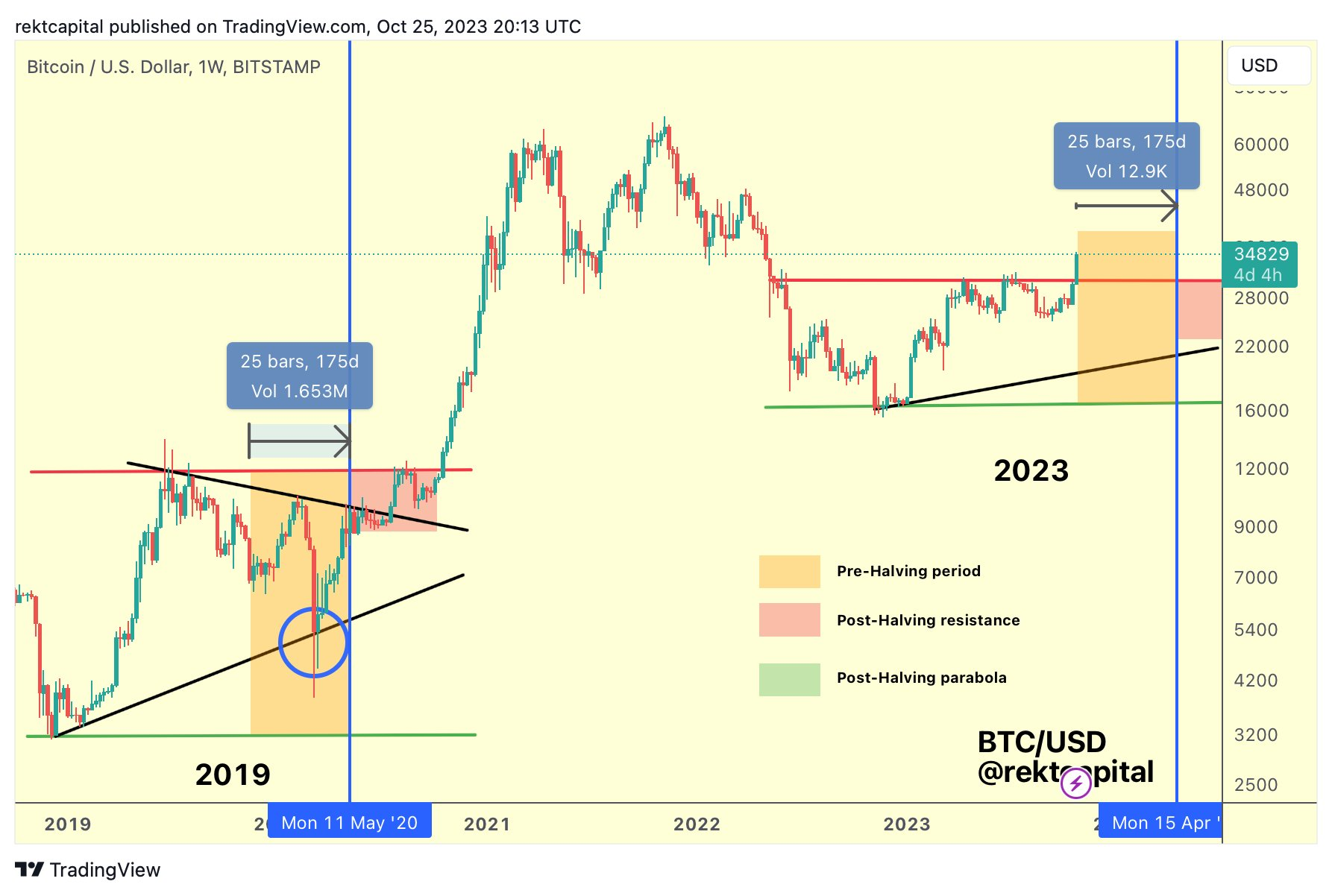

Meanwhile, another trader and analyst, Rekt Capital, provided a contrasting perspective. He argued that the behavior of BTC price cycles in 2023 is "completely different" from previous patterns. According to Rekt Capital, at this stage in the four-year pattern, BTC/USD should be testing support, rather than encountering resistance. He drew a comparison between the current situation and that of March 2020 when Bitcoin reached cycle lows slightly above $3,000, a time when a market-wide crash occurred due to the onset of the COVID-19 pandemic.

Bitcoin price cycle comparison. Source: Rekt Capital/X

Bitcoin price cycle comparison. Source: Rekt Capital/X

Rekt Capital concluded that Bitcoin's current behavior is distinct from what was observed in 2019 at the same point in the cycle. In various recent discussions, Rekt Capital also noted that any substantial pullback could present a significant buying opportunity within the cycle.

#BTC

— Rekt Capital (@rektcapital) October 25, 2023

Any deeper retrace that occurs over the next 175 days before the Halving will represent an outsized opportunity for the next few years$BTC #Crypto #Bitcoin pic.twitter.com/KH7bsC7edq

You might also like: CryptoSynergy: Mastercard and MoonPay's Web3 Revolution

Trending

Press Releases

Deep Dives