Bitcoin's Rocky Road: Price Insights

Bitcoin (BTC) is currently navigating through a labyrinthine landscape, hinting at a potential reevaluation of a pivotal long-term support level, as suggested by ongoing data trends. This unfolding narrative follows a subtle dip in BTC's price at the tail end of August. As of now, BTC appears to be maintaining a relatively stable position, hovering around the $25,457 mark.

1-hour BTC/USD chart data sourced from TradingView.

1-hour BTC/USD chart data sourced from TradingView.

The direction appears to be leading BTC's price towards $23,000

Nonetheless, there are subtle indicators that insinuate a potential descent, possibly towards the $23,000 range. Notably, the sentiment surrounding BTC/USD has undergone a transformation, with the cryptocurrency recently slipping beneath the $26,000 threshold as of September 1, a revelation based on data sourced from TradingView.

Initially, market participants were imbued with confidence, riding the wave of bullish sentiment as Bitcoin clung tenaciously to a significant long-term trendline while steadfastly guarding the $27,000 level. However, this buoyant mood faced a stern challenge in the form of a decision from the United States Securities and Exchange Commission (SEC) to defer several Bitcoin spot price exchange-traded fund (ETF) applications. The regulatory development precipitated a swift and sharp $1,000 decline in Bitcoin's price, an oscillation that occurred within the span of just two hourly trading candles.

Presently, a sense of trepidation has settled in, raising questions about whether the current price levels can indeed provide robust support for the cryptocurrency market. A prominent trader by the name of Ali, renowned for disseminating insights to subscribers on X (formerly Twitter), has highlighted on-chain data that suggests Bitcoin's potential vulnerability below the $25,400 threshold. Should Bitcoin breach this critical level, there looms the possibility of a swift correction down to $23,340.

Annotated chart depicting UTXO realized price distribution (URPD) data sourced from Ali/X

Annotated chart depicting UTXO realized price distribution (URPD) data sourced from Ali/X

This outlook is vividly depicted in Ali's chart, which employs the UTXO realized price distribution (URPD) metric from Glassnode, an on-chain analytics firm. The URPD metric serves as a navigational instrument, guiding traders toward potential price support and resistance levels.

The $23,000 target has already captured the collective attention of various traders and analysts, further fortifying the plausible scenario of a descent to this level.

Bitcoin is gradually approaching a critical support zone

In addition to Ali's analysis, Material Indicators, a diligent on-chain monitoring resource, has unveiled a similarly somber outlook for BTC/USD across daily (D), weekly (W), and monthly (M) timeframes. Drawing insights from one of its proprietary trading tools, Trend Precognition, Material Indicators underscores the pivotal significance of Bitcoin holding steady at the $24,750 level as a prerequisite for any potential resurgence of bullish sentiment. A breach of the $25,350 level would render the W signal invalid. Conversely, if support continues to hold above the lower limit (LL) at $24,750, it could potentially serve as a sturdy launching platform for a prospective rally and a retest of resistance levels. The insights gleaned from the Trend Precognition algorithms at the monthly candle open will provide invaluable guidance, shedding light on whether the ongoing downtrend will persist or if there exists potential for a shift in monthly momentum towards the upside.

1-month BTC/USD chart featuring signals from Trend Precognition, sourced from Material Indicators/X

1-month BTC/USD chart featuring signals from Trend Precognition, sourced from Material Indicators/X

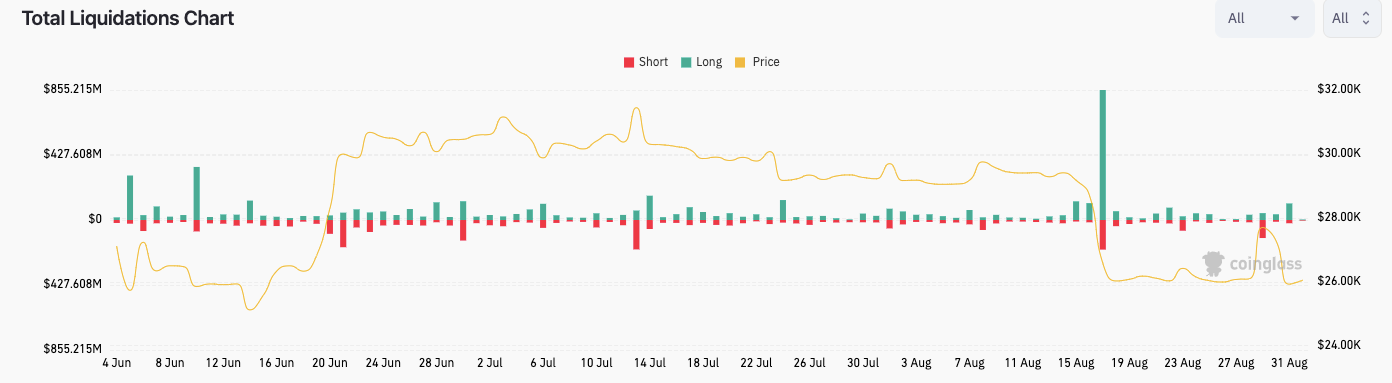

Furthermore, data gleaned from CoinGlass reveals that August 31 marked a significant event - the highest volume of BTC long liquidations since Bitcoin's 10% price dip earlier in the month. The cumulative total of these liquidations amounted to $41 million. However, it is pertinent to note that the broader cross-crypto liquidation figure remains markedly lower at $108 million, in contrast to the daily totals observed just a fortnight ago.

Chart depicting cryptocurrency liquidations, sourced from a screenshot provided by CoinGlass

Chart depicting cryptocurrency liquidations, sourced from a screenshot provided by CoinGlass

Trending

Press Releases

Deep Dives