Crypto SEC Delay Impact

The cryptocurrency market is experiencing a downturn today, primarily due to the interference of the U.S. Securities and Exchange Commission (SEC) in this week's rally.

SEC Postpones Approval of Spot Bitcoin ETFs

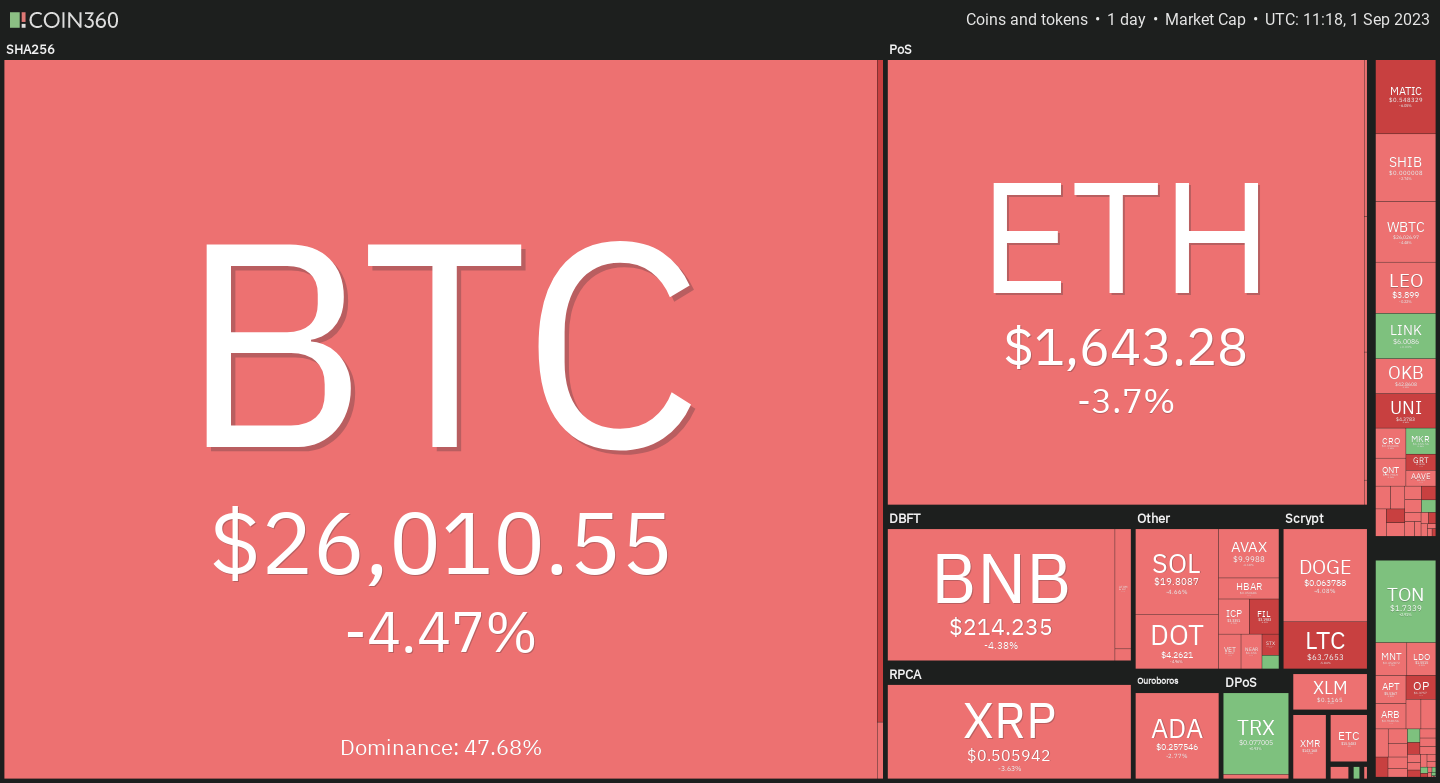

In the past 24 hours, the total worth of all cryptocurrencies has decreased by 3.7% to reach $1.02 trillion on September 1.

Bitcoin (BTC), which constitutes nearly half of the cryptocurrency market, has seen a 4.5% drop in its value over the last day. This decline initiated when the SEC decided to delay its verdict on six spot Bitcoin ETF applications, including one from BlackRock. The SEC's decision has cast a shadow on the market, and the situation worsened as Bitwise, one of the Bitcoin ETF applicants, withdrew its application in response to the delay.

The cryptocurrency industry has been eagerly anticipating the SEC's approval of a Bitcoin ETF in the United States, believing it would attract institutional investors and consequently inject more capital into the crypto sector.

Recent cryptocurrency market activity over the last 24 hours, as reported by Coin360.com

Recent cryptocurrency market activity over the last 24 hours, as reported by Coin360.com

On August 29, the cryptocurrency market and BTC's price experienced a surge of over 5% following a federal court's order for the SEC to reconsider Grayscale Investments' application to launch a Bitcoin ETF.

However, these gains have now been wiped out.

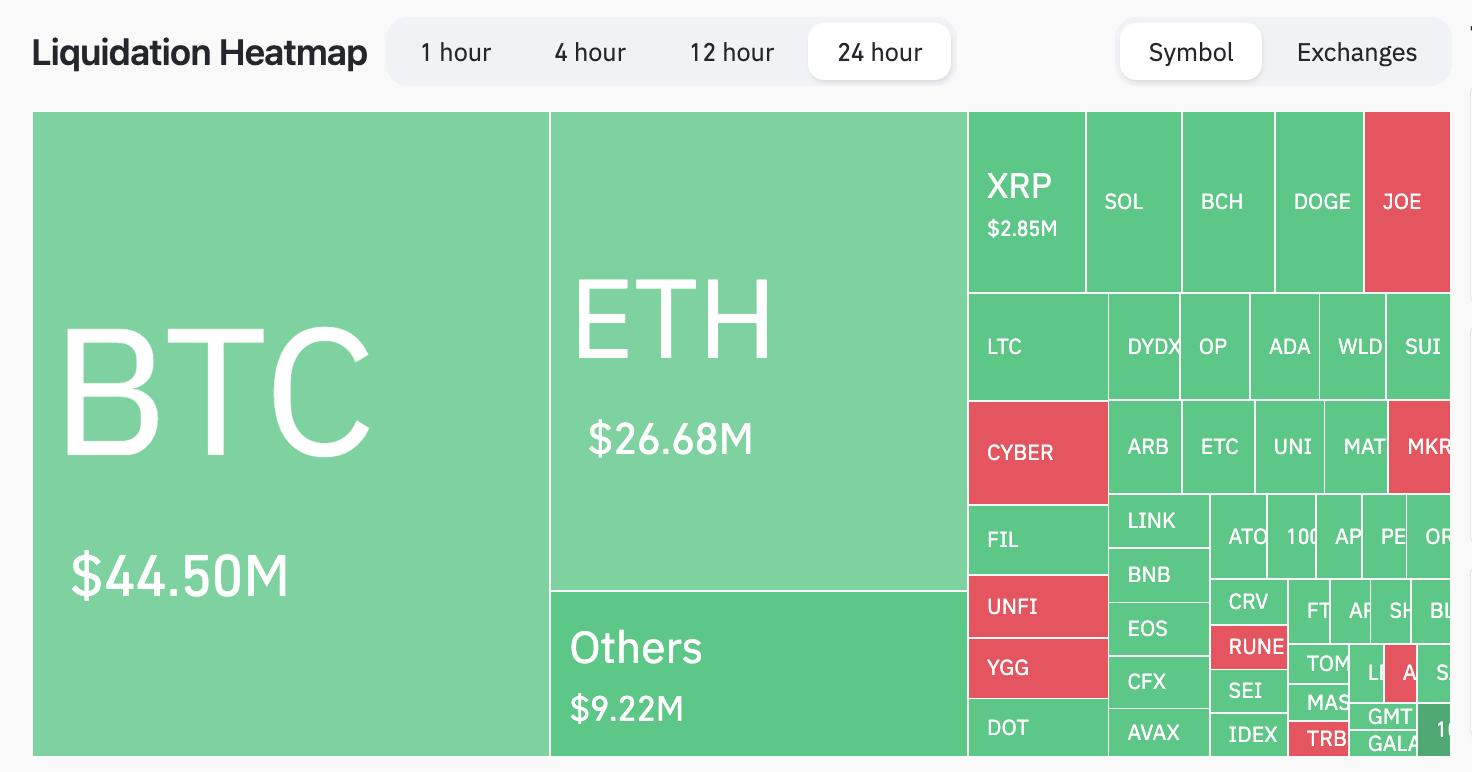

Long Liquidations Outweigh Short Positions

Bitcoin's losses in the past 24 hours are further exacerbated by substantial long liquidations during the same period. Remarkably, the crypto derivatives market has liquidated $106.32 million worth of long positions, while short liquidations only amounted to approximately $16 million.

Visualization depicting crypto asset liquidations, sourced from Coinglass Long liquidations involve exchanges selling off traders' initial margins to protect themselves from potential losses on borrowed funds. In simpler terms, they are selling Bitcoin to cover the borrowed amount, adding selling pressure to the market.

Visualization depicting crypto asset liquidations, sourced from Coinglass Long liquidations involve exchanges selling off traders' initial margins to protect themselves from potential losses on borrowed funds. In simpler terms, they are selling Bitcoin to cover the borrowed amount, adding selling pressure to the market.

The Strength of the U.S. Dollar and its Impact on Crypto since July

Another significant factor contributing to the crypto market's decline is the resurgence of the U.S. dollar. The crypto market has consistently shown a negative correlation with the U.S. dollar throughout 2023. Notably, the U.S. Dollar Index (DXY), which gauges the greenback's strength against major foreign currencies, has risen by 0.75% since August 31. Furthermore, its daily correlation coefficient with the crypto market stands at approximately -0.78.

TradingView chart displaying the daily performance of DXY and its correlation with the cryptocurrency market capitalization.

TradingView chart displaying the daily performance of DXY and its correlation with the cryptocurrency market capitalization.

This uptrend in the DXY has been ongoing since early July when Bitcoin reached its yearly high of around $31,000.

Crypto Market Outlook for September 2023

From a technical perspective, the cryptocurrency market is currently hovering near its long-standing ascending trendline support, with hopes of a rebound towards $1.058 trillion in September. This recovery target aligns with the market's support line from May-June 2023 and the descending trendline resistance.

TradingView chart showcasing the daily performance of the cryptocurrency market

TradingView chart showcasing the daily performance of the cryptocurrency market

Conversely, if there is a decisive breach below the ascending trendline support, it could lead to a significant drop in the cryptocurrency market's valuation, potentially falling into the range of $950-975 billion, as indicated by the red bar in the chart above.

Trending

Press Releases

Deep Dives