Bitcoin's Resilient Rally: A Deep Dive into Supply Dynamics and Market Sentiment

Data from Glassnode, a trusted source in the world of cryptocurrencies, provides intriguing insights into the current state of Bitcoin (BTC). As the Bitcoin ticker dances around the $35,230 mark, it appears to be following an accumulation pattern, making the crypto enthusiasts and market analysts pay close attention. This pattern is accompanied by a noteworthy milestone - the available supply of Bitcoin has hit an all-time low, indicating a significant squeeze in its overall availability.

The report from Glassnode highlights the growing prominence of illiquid Bitcoin holdings and the increasing number of long-term holders, painting a picture of a market that is maturing and evolving.

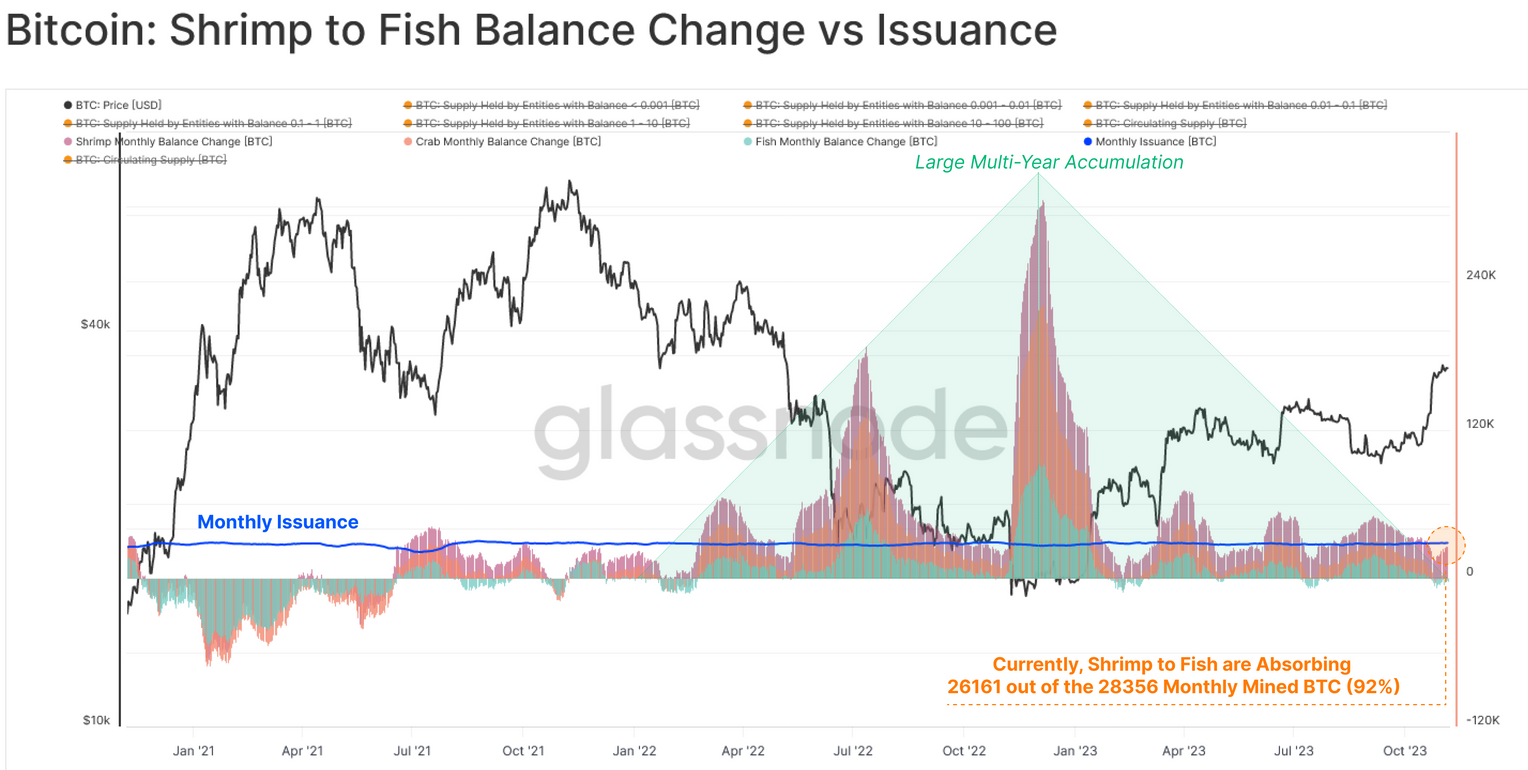

In this climate of tightening supply, we see a fascinating trend emerging: smaller, long-term holding entities are actively in the game, actively acquiring the available BTC. This collective appetite for Bitcoin accumulation, spanning across a majority of investor cohorts, coupled with the unwavering conviction of long-term holders, has led to the absorption of an astonishing "92% of the newly mined supply," as per Glassnode's meticulous analysis.

Entity Bitcoin balance changes versus issuance. Source: Glassnode

Entity Bitcoin balance changes versus issuance. Source: Glassnode

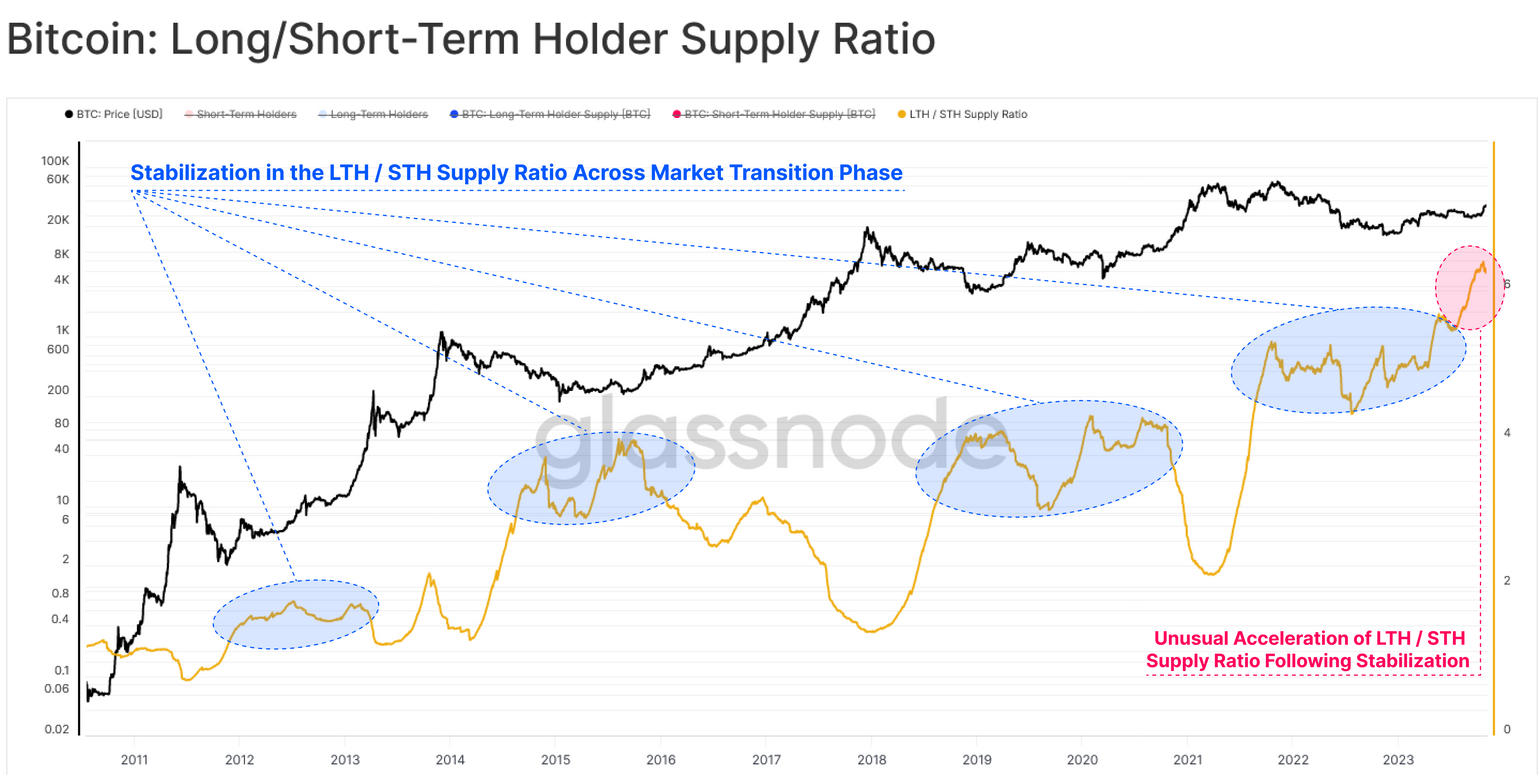

Now, if we zoom in on the smaller entities in the crypto space, often affectionately referred to as 'Shrimps,' we observe them playing a crucial role. As these smaller players accumulate freshly minted Bitcoins, long-term holders have achieved unprecedented levels of dominance over short-term holders, a situation not seen since the bygone days of July 2023. Adding to this captivating narrative, the supply held by short-term holders has dwindled to an all-time nadir.

Long-term versus short-term Bitcoin holder ratio. Source: Glassnode

Long-term versus short-term Bitcoin holder ratio. Source: Glassnode

What's the net effect of all this market activity? It leads to a notable scarcity of BTC available for purchase, likely contributing to Bitcoin's remarkable ability to maintain its price above the $34,000 mark while offering robust support well above the $30,000 range.

Market strategist Joel Kruger, who keeps a keen eye on the crypto world as part of LMAX Group, has an interesting perspective on a potential Bitcoin price breakout to $40,000. He explains that the current week doesn't seem to offer any standout catalysts for Bitcoin's price movement. Instead, it appears to be driven by a steady demand from medium- and longer-term players who are strategically building their exposure. This is intriguing, especially when we consider that Bitcoin has shown relative stability compared to traditional currencies and riskier assets, which have experienced significant rallies due to expectations of a more accommodating shift in Federal Reserve policy, following a series of softer economic data. From a technical standpoint, he suggests that a breach above $36,000 would be the trigger that catches the attention of the market and sparks the next wave of bullish momentum.

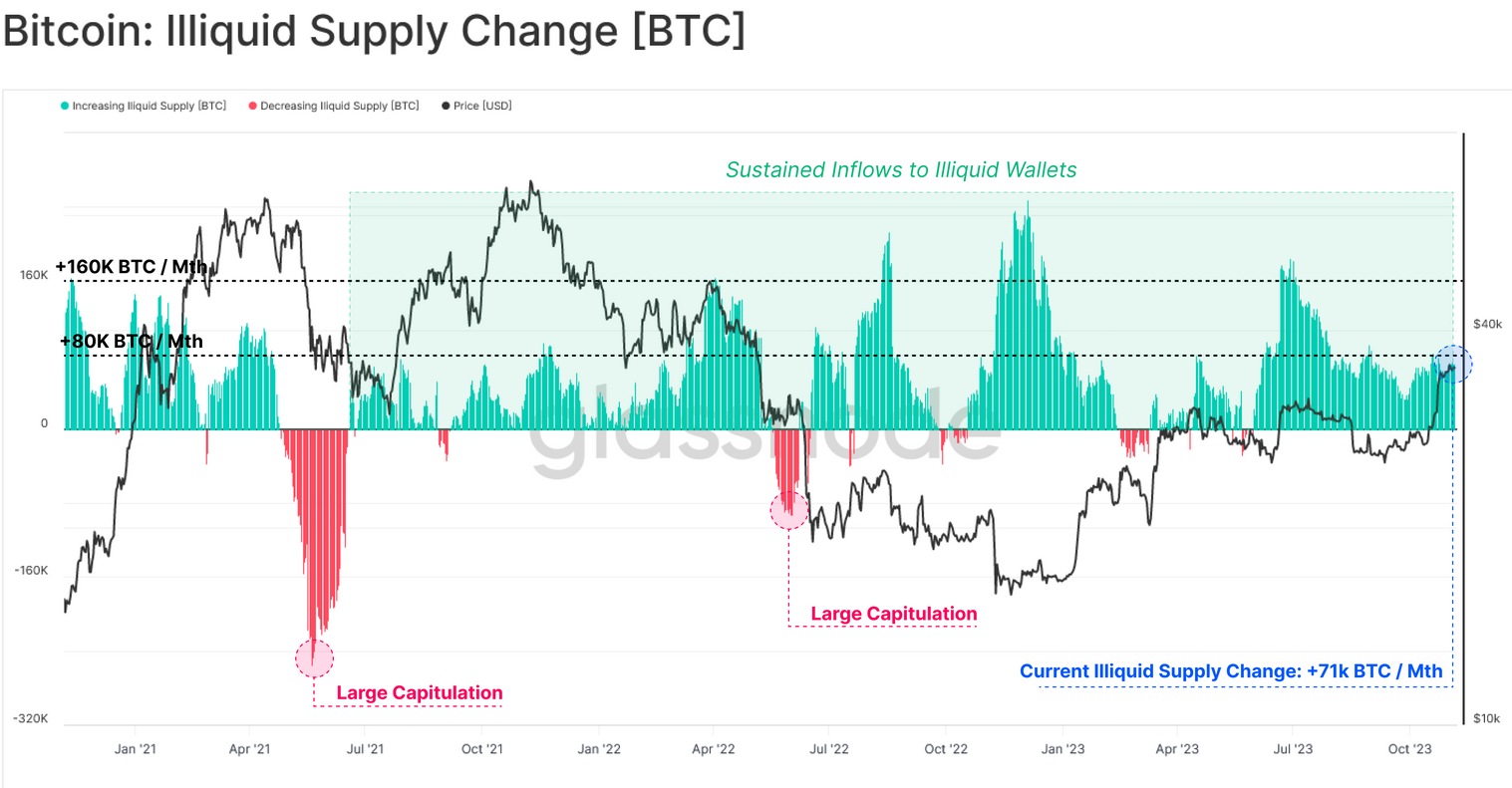

And let's not forget, illiquid coins, given Bitcoin's limited supply, are often seen as a bullish indicator. The flow of illiquid Bitcoin continues to grow at a monthly rate of 71,000 BTC, maintaining the cryptocurrency's allure.

Bitcoin illiquid supply change. Source: Glassnode

Bitcoin illiquid supply change. Source: Glassnode

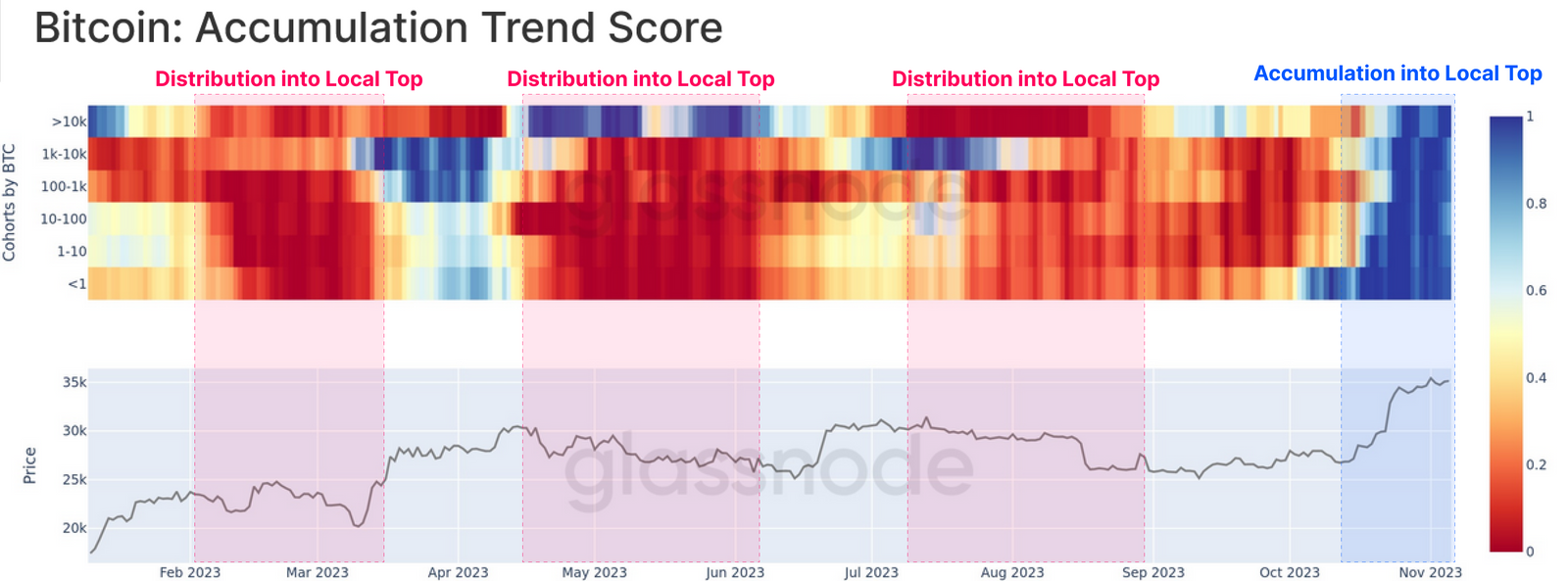

This growing confidence in Bitcoin's future, driven by the tightening supply, isn't confined solely to the smaller entities. Across the board, various investor cohorts have been actively increasing their Bitcoin holdings this year, underscoring the broader trust in the potential of this digital asset.

Bitcoin accumulation across all cohorts. Source: Glassnode

Bitcoin accumulation across all cohorts. Source: Glassnode

Read more about: CryptoLend Pro: Empowering Institutional Asset Management

Trending

Press Releases

Deep Dives