Bitcoin's Remarkable 300% Surge Since Early 2019 Draws Attention as Fed Officials Lean Towards Rate Pause

As Federal Reserve officials hint at a pause in the rate hike cycle, reminiscent of a scenario in 2019, Bitcoin investors find themselves in an encouraging position. This echoes a time when Bitcoin's value quadrupled, reaching an impressive $13,880.

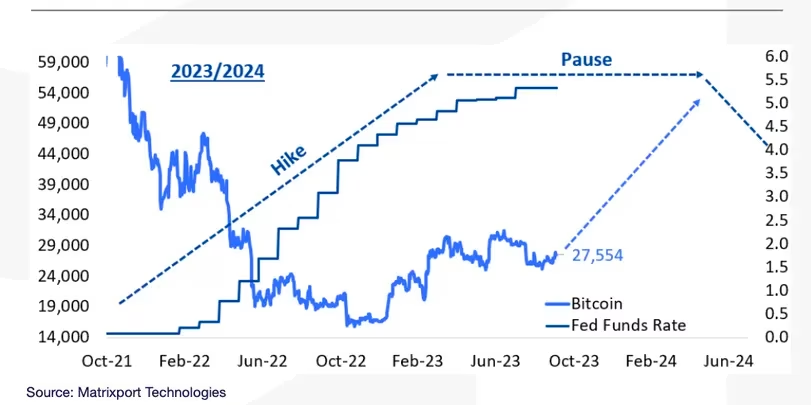

While it's acknowledged that history doesn't always replicate itself, in financial markets, it tends to rhyme with familiar sentiments. The recent dovish stance expressed by U.S. Federal Reserve (Fed) officials has evoked memories of early 2019 when Bitcoin (BTC) saw an unprecedented surge of over 300% against a comparable Fed backdrop.

Since the onset of 2022, the Fed has executed a 525 basis point increase in interest rates to combat inflation, significantly impacting risk assets, including Bitcoin. The liquidity-tightening cycle has been a significant source of concern for investors.

This week, Fed policymakers offered a dovish respite. Notably, Atlanta Fed Bank President Raphael Bostic and Minneapolis Fed President Neel Kashkari hinted that the central bank might not see the necessity for further rate increases. Dallas Fed President Lorie Logan and Fed Governor Christopher Waller argued that the surge in Treasury yields has potentially achieved the Fed's objectives, eliminating the immediate urgency for another rate hike, according to Reuters.

This signals a belief in the market that the central bank's apprehended tightening cycle may have concluded with the 25 basis point increase in July. This may lead to a wait-and-see approach, allowing observation of how the macroeconomic situation unfolds in the coming months. Drawing parallels to the previous rate cycle, which spanned three years, rates peaked at 2.5% in December 2018. Subsequently, the central bank adopted a watchful waiting mode for seven months. Bitcoin's value, at its lowest in December 2018, surged to $13,880 by the close of June 2019.

Another intriguing parallel is that the latest pause in the Fed tightening cycle mirrors a similar scenario prior to the ostensibly bullish Bitcoin blockchain's mining reward halving, as it did four years ago.

Markus Thielen, head of research and strategy, points out that:

"Reflecting back on 2019, the Fed concluded its rate-hiking cycle and entered a seven-month pause. During this period, Bitcoin experienced a dramatic price rally, surging by an impressive 325%."

He emphasizes the likelihood of the Fed concluding its rate-hiking cycle in July 2023.

Assuming all other factors remain constant, past data points towards an upswing in Bitcoin. The leading cryptocurrency was trading at $26,800 at the time of writing, reflecting a 62% year-to-date gain, according to Bitsday data. The historical precedent from 2019 implies that the current hiatus in Federal Reserve interest rate increases and the potential conclusion of the tightening cycle might bode well for Bitcoin. (Matrixport)

The historical precedent from 2019 implies that the current hiatus in Federal Reserve interest rate increases and the potential conclusion of the tightening cycle might bode well for Bitcoin. (Matrixport)

While the 2019 playbook suggests an upside for Bitcoin, an eventual Fed shift towards rate cuts might initially lead to price weakness. Traders are advised to closely monitor the rationale behind potential Fed rate cuts, particularly those implemented to counter economic weakness and low inflation, which might carry bearish implications.

Read more: Crypto ETF Fever: SEC Anticipation

Trending

Press Releases

Deep Dives