Bitcoin's Price Outlook: Navigating Uncertainty

Bitcoin's price is currently embroiled in a rather vexing predicament, as it navigates a narrow and frustratingly tight trading range confined between the not-so-distant shores of $25,500 and $26,500. This seemingly endless oscillation has cast a shadow of uncertainty upon traders, who now find themselves pondering the enigmatic path that Bitcoin may choose to tread in the days to come.

Enter Charles Edwards, the visionary founder of Capriole Investments, whose perspective on Bitcoin's current price of $25,852 is akin to a gleaming beacon amidst the murky waters of ambiguity. Edwards, with unwavering confidence, perceives this moment as a unique opportunity for those with a penchant for long-term investments, one that carries with it the allure of minimal risk. This belief of his, you see, is firmly rooted in the fundamental tenets of Bitcoin's production cost and its underlying energy value.

Capriole Investments' energy value theory, like a seasoned captain charting a course through treacherous seas, charts a course to a fair value price of $47,200 for Bitcoin. And, as if to fortify his stance, Edwards reaffirms his bullish outlook by asserting that Bitcoin's production cost serves as a bedrock, providing a floor price estimation of approximately $23,000, all backed by an impeccable 100% hit ratio.

The intriguing allure of this trade lies in its tantalizing risk-reward ratio, an impressive 1:5 proposition that beckons traders with the prospect of even loftier price targets. Yet, as Edwards wisely points out, this projection hinges on the assumption that the rally price would somehow come to a graceful halt at its designated fair value—a feat that, in reality, has proven elusive.

My favorite Bitcoin chart right now. The relative distance between Bitcoin's price, the historical price floor (Bitcoin Electrical Cost) and fair value (Bitcoin Energy Value). That’s a 5:1 risk-reward assuming no-hype and that price would stop at fair value, which it never has. pic.twitter.com/J2yuGcNX9q

— Charles Edwards (@caprioleio) September 7, 2023

Positive Energy Valuation Theory

Now, let's delve into the world of the Bullish Energy Value Theory, a concept conceived by Edwards back in December 2019. According to this theory, the fair value of Bitcoin can be ascertained by quantifying the quantum of energy expended in its production—a concept as profound as the depths of the ocean.

In the year 2023, the energy consumption associated with Bitcoin mining has been surging, akin to the rising tides, as mining companies bolster their capabilities, eagerly claiming a larger share of the hash rate through the strategic deployment of new ASICs, all in anticipation of the impending halving event slated for April 2024.

Bitcoin's price graph accompanied by the energy value indicator, sourced from TradingView

Bitcoin's price graph accompanied by the energy value indicator, sourced from TradingView

In Edwards' eyes, the Bitcoin energy value emerges as a shimmering reflection of its intrinsic fair value, mirroring the underlying currents of the cryptocurrency ecosystem.

It's worth noting that Bitcoin's energy value has displayed a rather robust correlation with its spot price, an observation that lends credence to the theory's validity, albeit with some minor caveats. One such caveat is the theory's susceptibility to inaccuracies, primarily due to the fluctuating efficiency of Bitcoin mining operations over time.

Furthermore, the theory, akin to a solitary lighthouse amidst the vast expanse of the open sea, does not account for the myriad external factors that could potentially influence Bitcoin's price, including the ever-shifting tides of market demand and supply, as well as the intricate strategies employed by miners leading up to the forthcoming halving event.

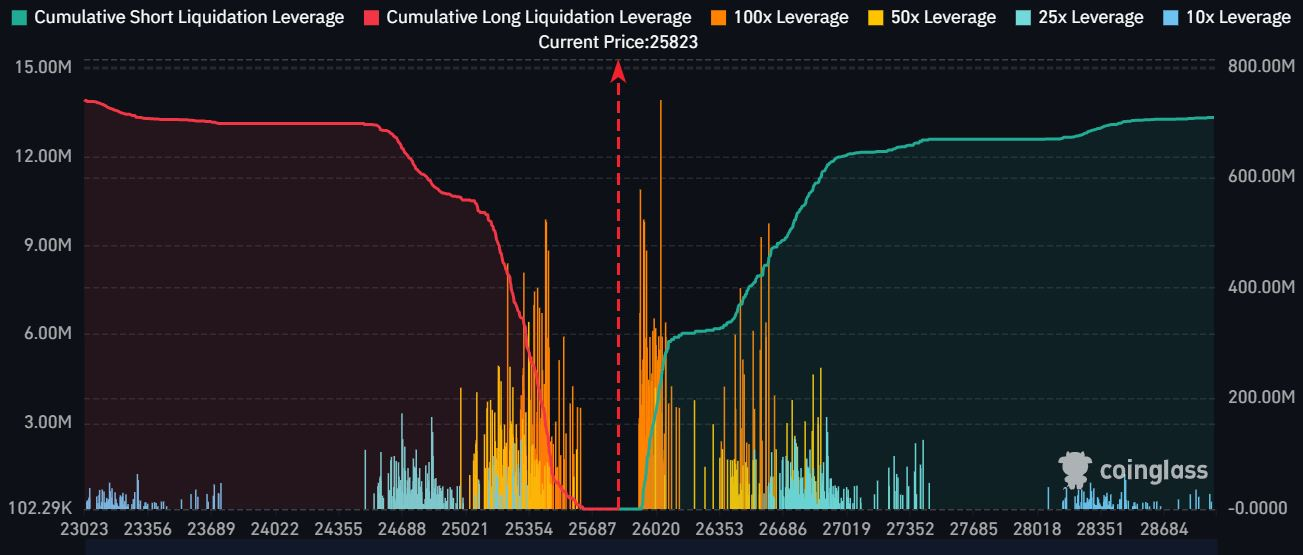

As we gaze into the crystal ball of Bitcoin's future, a few storm clouds gather on the horizon. Examination of Bitcoin's spot liquidity data on Binance suggests that buyers have cast their hopeful eyes upon the $24,600 level as a potential refuge in troubled waters. Yet, as the bullish winds appear to falter, a growing congregation of traders seeks solace in the shelter of yearly lows, praying fervently for their stability.

A perusal of the liquidation levels derived from futures orders on CoinGlass reveals that buyers brace themselves for a potential descent to $24,600, with smaller liquidations extending their reach toward the elusive $23,000 mark. Intriguingly, the price bracket spanning from $25,000 to $25,500 hosts a remarkable multitude of leveraged orders, resembling alluring treasure troves in the eyes of intrepid traders.

Heatmap depicting Bitcoin futures liquidation data, sourced from CoinGlass

However, let it be known that should the price indeed descend to the perilous depths of $23,000, the conviction of buyers will be rigorously tested. A breach below this threshold would set their sights on the fabled levels of $21,451 and $19,549, harking back to the annals of 2022.

Bitcoin's levels of support and resistance, sourced from Jarvis Labs

Trending

Press Releases

Deep Dives