Crypto Chronicles

Bitcoin (BTC) is like the enigmatic wanderer of the financial landscape, with its ticker swooping down to $25,890 like a graceful swan taking a leisurely dive. It tantalizingly teased the boundaries of its well-established range in the first half of last week, but the bull brigade struggled to maintain their lofty positions. Alas, Bitcoin found itself once again nestled within its familiar range, cozying up to the $26,000 level like an old friend.

The recent price action has painted a picture of uncertainty on the weekly chart, with two successive Doji candlestick patterns emerging like cryptic hieroglyphics. These patterns seem to be whispering secrets about the impending directional move, leaving traders and enthusiasts alike in suspense.

Forecasting the trajectory of this crypto behemoth is akin to reading tea leaves. Yet, in this hazy crystal ball, there's a glimmer of hope that the downside risks might be contained in the near term. Why, you ask? Well, there's talk in the air, a buzz that the United States Securities and Exchange Commission (SEC) might eventually nod approvingly at one or more pending applications for a spot Bitcoin exchange-traded fund (ETF). The former commission chair, Jay Clayton, even sounded quite bullish in a recent interview, boldly stating that "an approval is inevitable."

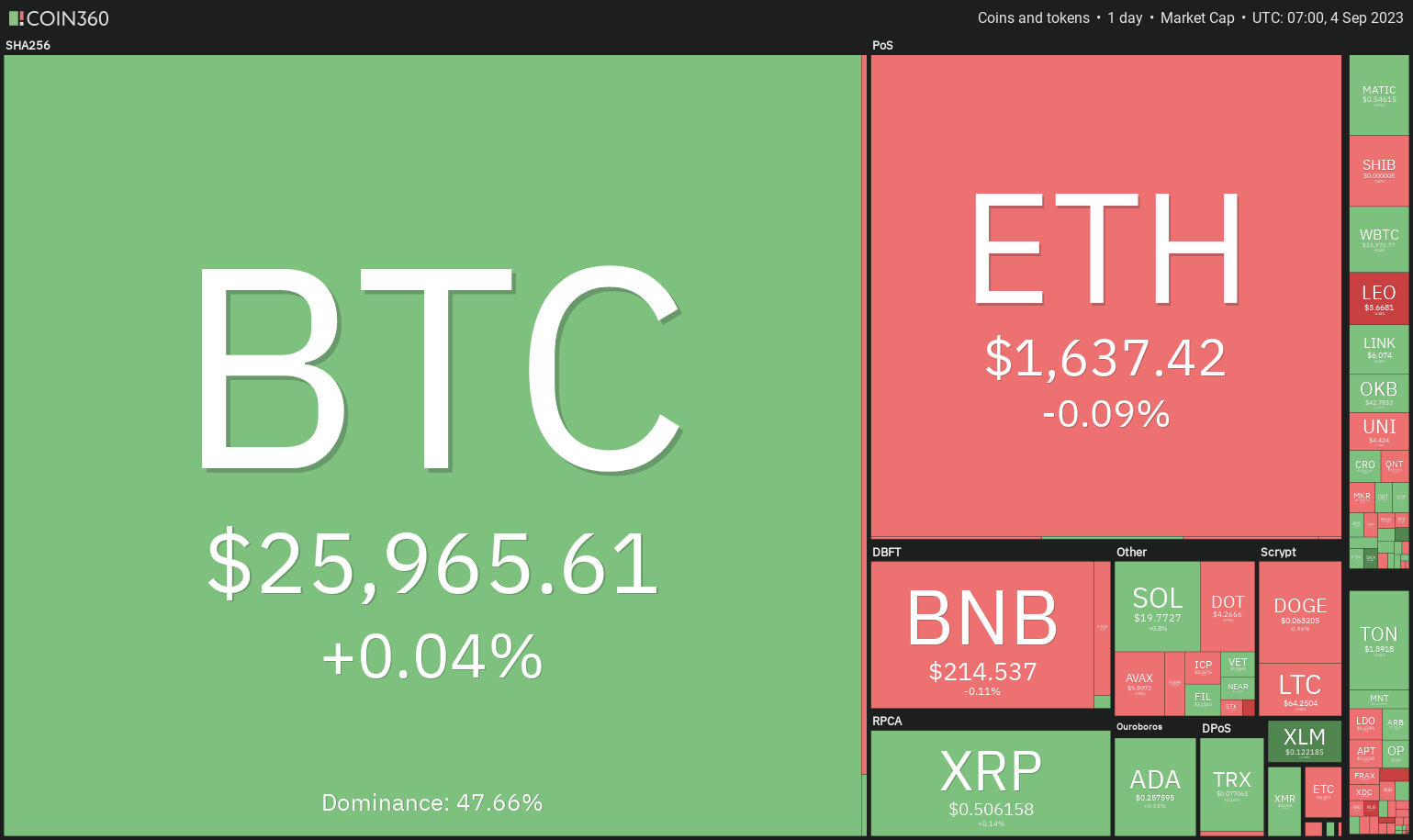

Crypto market data daily view. Source: Coin360

Crypto market data daily view. Source: Coin360

But, in the short term, pinpointing the catalyst that could break Bitcoin free from its shackles is akin to hunting for a needle in a digital haystack. The fog of uncertainty about Bitcoin's next course of action has cast a shadow over most of the major altcoins.

Yet, amidst this mist, a few altcoins are flexing their muscles, displaying flickers of strength in the short run. Let's now embark on a journey through the charts of the top five cryptocurrencies that might potentially ignite a rally should they manage to overcome their respective overhead resistance levels.

Analysis of Bitcoin's Price

Now, turning our gaze to the Bitcoin price analysis, the BTC vessel has sailed back into the $24,800 to $26,833 harbor. However, there's a silver lining: the bull sailors are still buying the dips, as evidenced by the long tail on the Sep. 1 candlestick.

BTC/USDT daily chart. Source: TradingView

BTC/USDT daily chart. Source: TradingView

The bearish winds might have the advantage with downsloping moving averages, but the slowly recovering relative strength index (RSI) suggests that their grip might be loosening. The first sign of a comeback for the bulls would be a triumphant break and close above the $26,833 range. If that celestial event occurs, the BTC/USDT pair could set sail for a voyage to retest the Aug. 29 intraday high of $28,142.

But, should the bears wish to seize control of the ship, they shall have to navigate the treacherous waters and keep the price firmly below $24,800. This will be a herculean task, for the bulls shall defend this level with unwavering determination. Nonetheless, if the bears do prevail, the pair could plunge into the abyss of $20,000, with only a minor support at $24,000 serving as a flimsy lifebuoy, offering little salvation.

BTC/USDT 4-hour chart. Source: TradingView

BTC/USDT 4-hour chart. Source: TradingView

In the recent skirmish, the bears made a valiant effort to pull the price beneath the immediate support at $25,300, yet the brave bulls stood their ground, resisting the onslaught. The buyers shall now endeavor to fortify their position by propelling the price above the 20-exponential moving average. Success here would signal the commencement of a resolute recovery.

However, the path ahead is not without its trials. The 50-day simple moving average may stand as a formidable barricade, but it is a barrier that is expected to yield. Beyond that lies the prospect of rallying toward the distant shores of the overhead resistance at $26,833.

The sellers, however, harbor their own designs. They shall strive to drag the price below $25,300 and challenge the sacred support at $24,800.

Analysis of Toncoin's Price

Now, as we shift our focus to Toncoin's price analysis, we find ourselves in a market filled with intrigue. Toncoin (TON), our cryptic protagonist, rides the waves of an uptrend, yet the bears lurk on the horizon, attempting to halt its triumphant ascent near the ethereal realm of the overhead resistance at $2.07.

TON/USDT daily chart. Source: TradingView

TON/USDT daily chart. Source: TradingView

The moving averages, like ancient runes, have turned in favor of the buyers, hinting at their dominance. Yet, the RSI, that mystical gauge, whispers of overbought levels, implying that a minor correction or consolidation might be on the horizon.

Should the valiant bulls hold their ground from this vantage point, the potential for a rally above $2.07 grows stronger. The TON/USDT pair may ascend to $2.40, like a phoenix soaring from its ashes.

However, let us not forget the possibility of a darker narrative. A deeper correction may beckon, pulling the price toward the 20-day EMA ($1.61). A resilient bounce from this threshold shall signal that the sentiment remains bullish, and traders continue to buy during moments of fleeting despair. Yet, beware, for the story could take a darker turn if the 20-day EMA support crumbles.

TON/USDT 4-hour chart. Source: TradingView

TON/USDT 4-hour chart. Source: TradingView

On the 4-hour chart, we observe the bulls diligently purchasing the pullbacks to the 20-EMA, like knights protecting their castle. Their mission is clear: to breach the formidable walls at $1.98, signaling the resurgence of their noble cause. Yet, the tenacious bears may not yield easily.

The sellers, ever vigilant, shall endeavor to pull the price beneath the 20-EMA. If they succeed, the pair may embark on a deeper pullback toward the 50-SMA. Here, a clash of titans may unfold. Should the bull knights vanquish the foes and clear this roadblock, it shall signify the triumphant return of the bulls to the saddle.

Analysis of Chainlink's Price

As for Chainlink's (LINK) price analysis, it leads us into a realm of enduring mystery. LINK, the enigmatic wanderer, has been ensnared within the confines of a vast range, bordered by $5.50 and $9.50, for countless moons. Bears, with cunning, managed to breach the support of this sacred range on June 10, but their grip proved ephemeral, unable to sustain the price at lower altitudes.

LINK/USDT daily chart. Source: TradingView

LINK/USDT daily chart. Source: TradingView

On August 17, the LINK/USDT pair ventured dangerously close to the support of the range, a precipice over which many feared it would tumble. Yet, the bulls, like guardian spirits, intervened, as evidenced by the long tail on that fateful day's candlestick. The noble buyers now strive to ignite a renaissance, but their path is fraught with peril, for resistance looms near the 20-day EMA ($6.23), a crucial juncture in their quest.

Should these brave souls succeed in surmounting the 20-day EMA, the pair could embark on its epic odyssey toward the 50-day SMA ($6.94). A minor skirmish may occur at $6.40, but history suggests that it shall be but a fleeting obstacle.

However, let us not disregard the ominous possibility of a swift descent, should the price veer sharply downward from the 20-day EMA. Such a turn of events would signal that the sentiment remains tainted, and traders are opportunistic, capitalizing on any rallies to offload their burdens. This could lead to a perilous journey down to $5

LINK/USDT 4-hour chart. Source: TradingView

LINK/USDT 4-hour chart. Source: TradingView

On the 4-hour chart, it appears that the moving averages have somewhat stabilized, and the RSI is just hovering slightly above the midpoint, indicating a potential easing of the selling pressure, if you will. Buyers will need to muster some extra effort to nudge the price past the $6.40 mark, thus setting the stage for a promising upswing. The pair might even embark on an exciting journey, initially aiming for $6.87, with the possibility of further advancing to a lofty $7.07.

However, let's ponder an alternative scenario for a moment; should the price experience a downturn from the $6.40 level, it would serve as a clear signal that the bears are actively participating in the market, engaging in selling activities during these periodic rallies. This might keep the pair comfortably nestled within the range of $5.50 to $6.40 for a while longer, providing some liquidity for those looking to dip their toes in these waters.

Analysis of the Maker Price

Now, turning our gaze to the Maker price analysis, we find Maker (MKR) taking a dip, with its tickers settling down at $1,122. The price has sought refuge around the $1,000 mark, but alas, the resilient bulls are facing quite the challenge from the steadfast bears, creating a rather tumultuous sea along the downtrend line.

MKR/USDT daily chart. Source: TradingView

MKR/USDT daily chart. Source: TradingView

Recent days have witnessed the bulls valiantly breaching the downtrend line on multiple occasions, but alas, their attempts have been short-lived, akin to waves crashing against a rocky shore. However, it's worth noting that buyers haven't retreated too far, signifying that traders are not hastily abandoning their positions, perhaps navigating these waters with caution.

Should the price make an impressive turnaround and manage to close above the downtrend line, it would send a signal that the buyers are back in the game, ready to sail into calmer waters. The surge of positive momentum could be unleashed once the price surmounts the $1,227 mark, guiding the pair towards the promising shores of $1,370.

Nevertheless, if the price finds itself adrift below the 20-day EMA ($1,106), it would suggest that the bears have seized the helm. In such a scenario, the pair might find itself navigating towards the robust support level at $980, a destination not for the faint of heart.

MKR/USDT 4-hour chart. Source: TradingView

MKR/USDT 4-hour chart. Source: TradingView

Switching our charts to the 4-hour timeframe, we observe that the bulls did manage to momentarily breach the downtrend line. However, the prevailing theme suggests that the bears are far from conceding defeat and continue to engage in selling during these brief rallies, akin to the unpredictable currents in these financial waters.

The price has now descended to the 50-SMA, marking a pivotal moment on this trading voyage. If the price charts a course upwards from this juncture, the bullish sailors will once again embark on their quest to conquer the obstacles at $1,186 and $1,227, potentially steering the ship towards the prosperous shores of $1,280.

Conversely, should the price find itself caught in the doldrums below the 50-SMA, it might signal the opening of floodgates, potentially leading the ship towards treacherous waters, with a potential destination lurking at $1,040, and the grim possibility of a further descent to $980.

Analysis of Tezos Price

Now, let's shift our attention to the Tezos price analysis. Tezos (XTZ), with its tickers down at $0.70, has become the arena for a fierce battle between the bullish and bearish forces, right around the formidable support level of $0.70. The inability of the bears to sink the price below this level implies a resilient wave of buying interest in these lower depths of the market.

XTZ/USDT daily chart. Source: TradingView

XTZ/USDT daily chart. Source: TradingView

While the downtrending moving averages might cast a shadow favoring the bears, the rising RSI provides a glimmer of hope, suggesting a potential reduction in bearish momentum. A close above the 20-day EMA ($0.71) would be akin to raising the sails, the first sign of strength that could set the course for a rally towards the elusive downtrend line.

However, this journey won't be without its challenges. The downtrend line looms on the horizon, serving as a formidable hurdle that the bullish crew must navigate. If they succeed in breaching it, the XTZ/USDT pair may embark on a new voyage towards $0.94, and further still, to the prosperous shores of $1.04. But, as with any voyage, there are risks, and the waters could turn treacherous if the price slips and remains submerged below $0.66.

XTZ/USDT 4-hour chart. Source: TradingView

XTZ/USDT 4-hour chart. Source: TradingView

Upon examining the 4-hour chart, we find the price ensnared in a consolidation zone, a sort of no man's land, between the $0.70 and $0.66 marks. The crisscrossing moving averages and the RSI hovering around the midpoint indicate a delicate equilibrium between the forces of supply and demand, akin to finding the perfect balance while navigating these financial waters.

If the price charts a course above the $0.70 level, it might tip the scales in favor of the bullish crew, potentially guiding the ship towards the lofty resistance at $0.74. However, should the bears gain the upper hand and manage to steer the ship below $0.68, it could result in a perilous retest of the support level at $0.66. A breach of this support might signal the beginning of the next leg of the downtrend, steering the ship towards the ominous depths of $0.61.

Trending

Press Releases

Deep Dives

Русский

Русский