Bitcoin Revival: ETF Anticipation and Supply Shifts

Bitcoin BTC

The price of Bitcoin has undergone a brief descent, landing at approximately $29,804. However, today, the crypto world witnessed a remarkable resurgence as Bitcoin soared past the $30,200 mark, reaching a high not seen in the last two months. The source of this newfound optimism lies in the recent revelation from the United States Securities and Exchange Commission, which, with an air of dramatic magnanimity, announced the complete abandonment of all charges against Ripple's high-profile leadership, including the illustrious CEO, Brad Garlinghouse. In response, the cryptocurrency community erupted in jubilation, reveling in Ripple's legal triumph.

Nevertheless, while Bitcoin's ongoing flirtation with the $30,000 threshold may face occasional turbulence, a palpable surge of bullish momentum has been noted, possibly stemming from institutional investors' recent adjustments to numerous spot Bitcoin exchange-traded fund (ETF) applications and the buoyant hopes of retail investors regarding the impending Bitcoin supply halving.

Bitcoin price. Source: TradingView

Bitcoin price. Source: TradingView

Investment from institutional players enhances market confidence in Bitcoin

The increased institutional interest in Bitcoin has become a beacon of optimism, shining through the clouds of prevailing macroeconomic challenges. In mid-October, a wave of amendments to spot Bitcoin ETFs lent their collective weight to Bitcoin's price, lifting it above $30,000, a milestone unseen for a full two months.

The spark that ignited this frenzy was the U.S. Court of Appeals Circuit Judge Neomi Rao's ruling in favor of Grayscale Investments on August 29, a turning point in its battle against the SEC concerning the Grayscale Bitcoin Trust. This ruling catalyzed a veritable stampede of major institutions filing for ETFs. It wasn't long before Grayscale secured another victory, as the SEC, perhaps fatigued from previous skirmishes, chose not to contest the decision. In the wake of this pivotal moment, Grayscale swiftly submitted an application for a brand-new spot Bitcoin ETF on October 19.

Remarkably, the SEC has remained steadfast in its denial of a spot Bitcoin ETF, despite a plethora of applications, including those from industry titans such as BlackRock, Fidelity, ARK Invest, and 21Shares, which, incredibly, has beseeched the SEC for approval on three separate occasions.

The Bitcoin halving story resurfaces

The approaching Bitcoin halving event, scheduled for April 2024, continues to be a subject of animated debate within the analyst community. The question on everyone's mind is whether this upcoming event will, once again, unfurl a bullish tapestry for Bitcoin, as historical patterns seem to suggest.

According to the research conducted by Capriole Investments:

Over the course of Bitcoin's cyclical history spanning 14 years, all of its returns, and then some, have materialized within the 12-18 months following each Halving. In fact, investing in the 4-6 months leading up to a Halving has historically yielded even more impressive 12-month returns.

There is a growing belief that the approval of a Bitcoin ETF could play a pivotal role in addressing liquidity concerns, potentially generating an influx of demand to the tune of $600 billion, as indicated by various reports. One particularly noteworthy report from Capriole Investments posits that the approval of a gold ETF led to a remarkable 350% return and a significant market resurgence.

Gold performance. Source: TradingView

Gold performance. Source: TradingView

CryptoQuant, ever the optimist, envisions the approval of an ETF as the catalyst for a staggering $1 trillion boost in market capitalization.

The Next Wave of #Bitcoin Institutional Adoption:

— CryptoQuant.com (@cryptoquant_com) October 16, 2023

The Launch of Spot ETFs

- SPOT ETFS AS THE NEW WAY OF INSTITUTIONAL ADOPTION.

- IMPLICATIONS OF ETF APPROVALS FOR BITCOIN MARKET CAPITALIZATION.

Prepared by Our Head of Research, @jjcmoreno.

Link????https://t.co/dKyd5GJJdT pic.twitter.com/ECEWMpkf0g

The quantity of Bitcoin held on exchanges continues to decline

In a curious parallel, the supply of Bitcoin on exchanges has been gradually dwindling alongside these price gains. Since its peak in September, exchanges have witnessed an exodus of over 70,000 BTC.

BTC balance on exchanges. Source: Coinglass

BTC balance on exchanges. Source: Coinglass

This trend is perceived as an encouraging signal by the market, as traders typically withdraw their BTC from exchanges when their intention is to embrace long-term self-custody. Interestingly, on October 19, long-term Bitcoin holders astonishingly claimed a 76% share of all BTC ownership, marking a historic high.

As Bitcoin continues its exodus from exchanges, any associated liquidations have the potential to exert a considerable influence on its price. In the last 24 hours alone, we've witnessed the liquidation of more than $30.1 million worth of BTC shorts, with an additional $18.2 million in shorts liquidated within a mere 12-hour window.

Bitcoin liquidation data. Source: Coinglass

Bitcoin liquidation data. Source: Coinglass

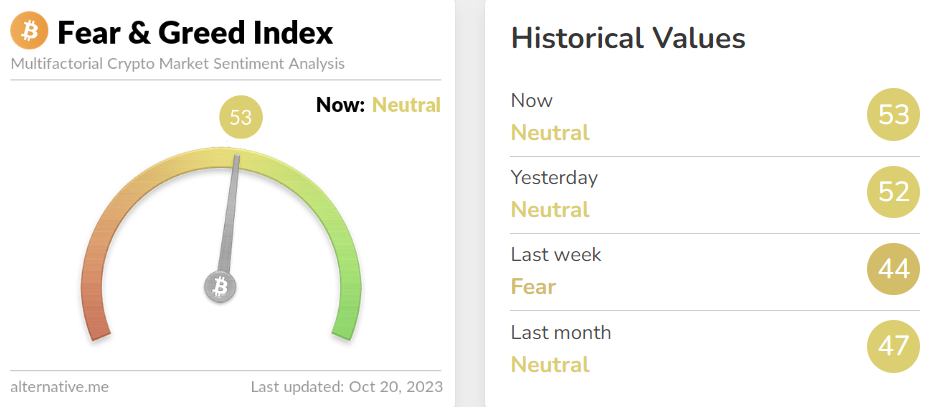

The current show of bullish momentum in Bitcoin's price is undeniably bolstering market sentiment, a fact attested to by the Bitcoin Fear & Greed Index, which, like a weather vane, has shifted from fear to a neutral stance, gaining nine points in the span of just one week.

Bitcoin Fear & Greed Index. Source: Alternative.me

Bitcoin Fear & Greed Index. Source: Alternative.me

You might also like: eETH Unleashed: Ether.Fi Introduces Liquid Staking Token with EigenLayer Restaking Capability

Trending

Press Releases

Deep Dives