Bitcoin Profits Surge: A Deep Dive into Wallet Addresses and Market Dynamics

Bitcoin (BTC) is currently trading at $34,484, which has piqued the interest of many in the crypto space. Despite its price being 50% lower than its all-time highs, it boasts a record number of wallet addresses in profit, as revealed by the latest data from on-chain analytics firm Glassnode.

The $34,000 BTC price level has brought more than 80% of Bitcoin addresses into a state of profitability

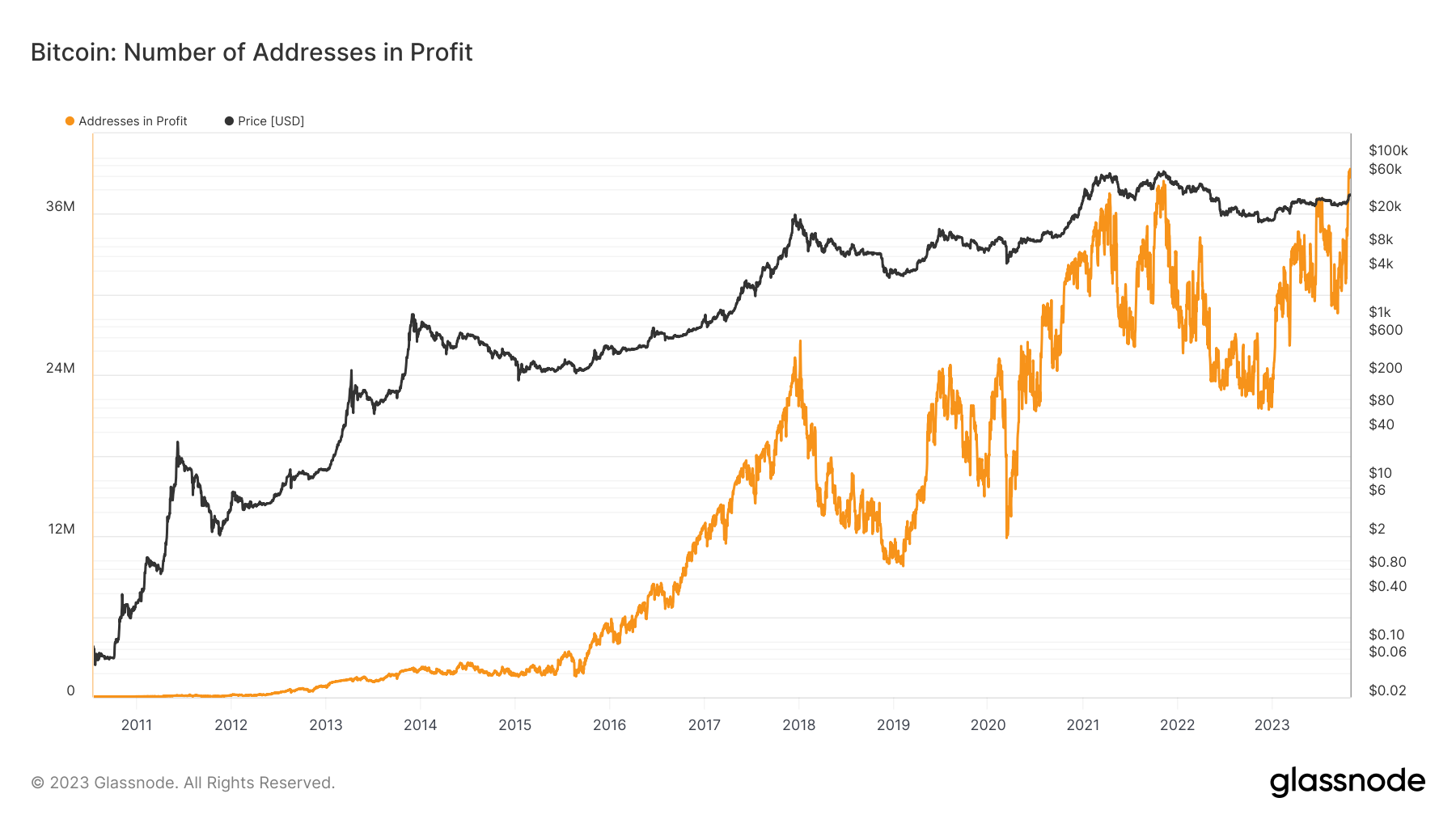

As of October 30, there were a staggering 39.1 million addresses "in the black," marking an all-time high for Bitcoin. This figure surpasses the previous peak of 38.1 million recorded in November 2021 when BTC/USD reached its historical high, resulting in every address with a non-zero balance being profitable. It's an interesting juxtaposition of past and present, showcasing the resiliency of Bitcoin in different market conditions.

While Bitcoin's current spot price remains significantly lower than those record levels, the total number of non-zero addresses has now grown to 48.3 million. This surge in address numbers signifies the growing interest and participation of a diverse set of investors in the cryptocurrency market, each with their own expectations and strategies.

Bitcoin addresses in profit chart. Source: Glassnode

Bitcoin addresses in profit chart. Source: Glassnode

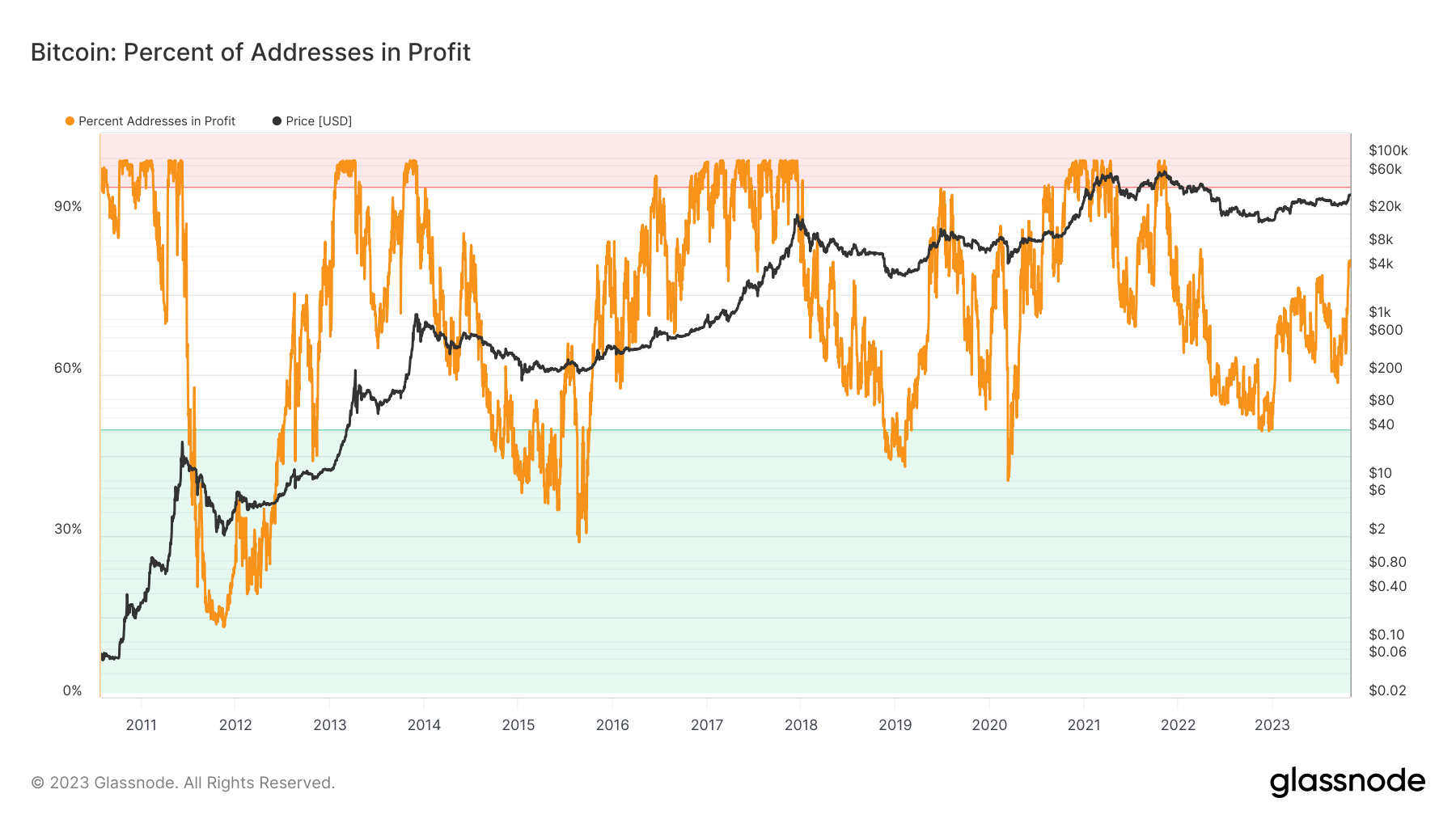

In terms of percentages, addresses in profit have reached an 18-month high of 81.1%, demonstrating a notable increase from 60% in just the past two months. This dynamic underscores the ever-evolving nature of the crypto market, where investor sentiment and participation can change rapidly.

Bitcoin % addresses in profit chart. Source: Glassnode

Bitcoin % addresses in profit chart. Source: Glassnode

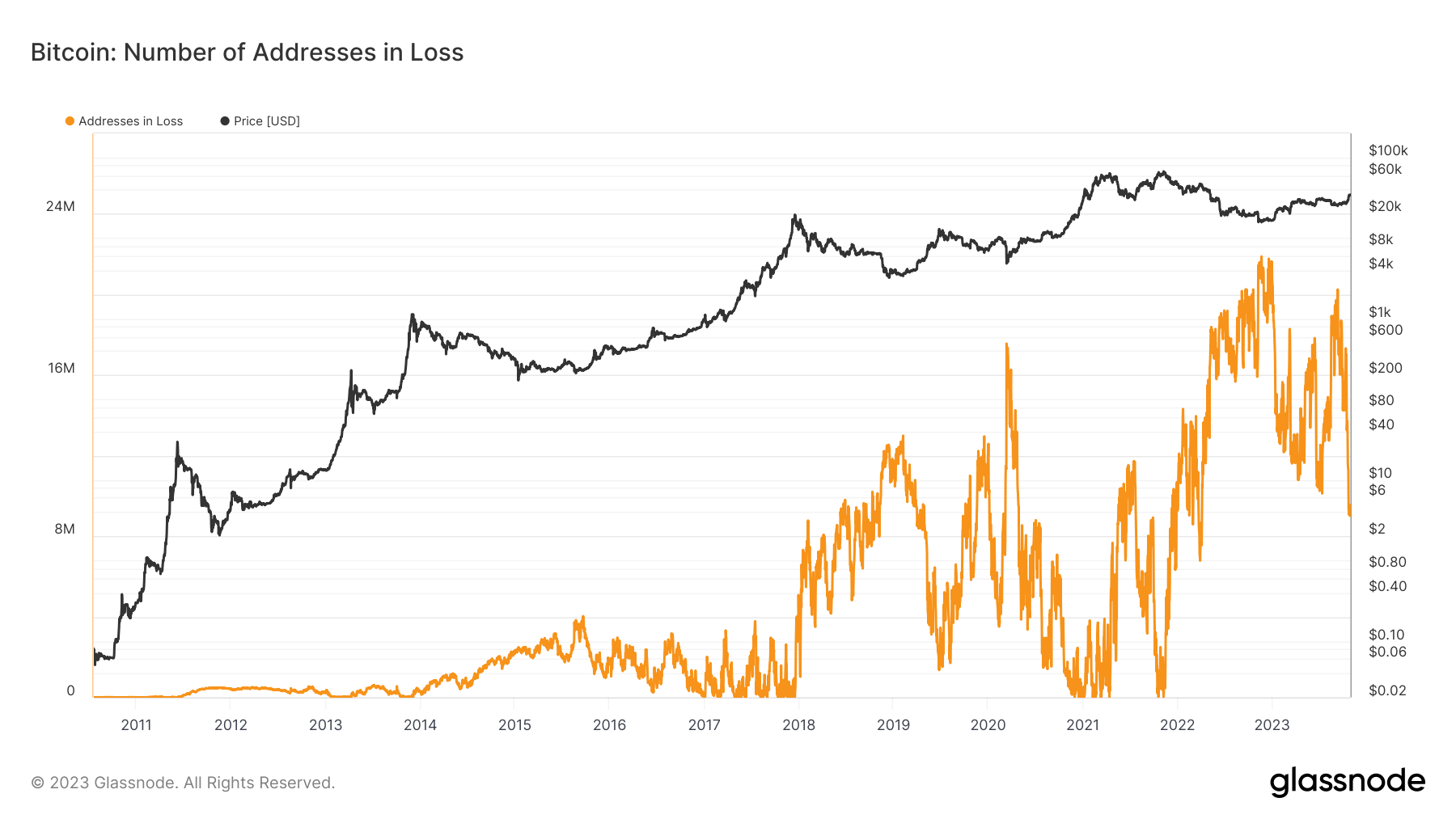

In contrast, there are currently just over 9 million addresses experiencing losses, a significant drop from the over 20 million recorded in December 2022 following the FTX meltdown. This contrast highlights the market's ability to recover and adapt to adverse events, offering valuable insights into its resilience.

Bitcoin addresses in loss chart. Source: Glassnode

Bitcoin addresses in loss chart. Source: Glassnode

Long-term holders observe only "minimal" instances of profit-taking

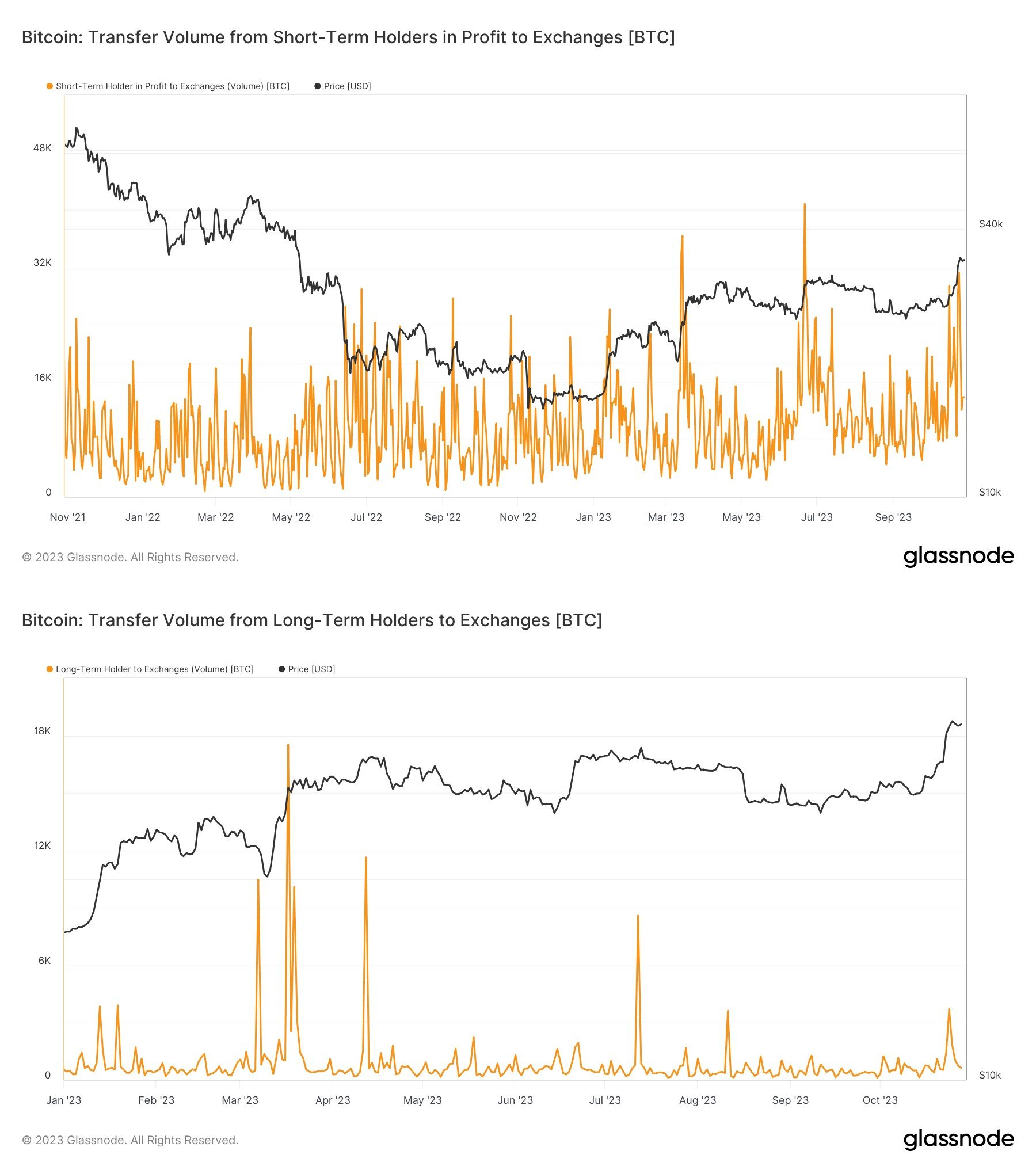

Furthermore, recent price action in the past week has seen Bitcoin surpass multiple resistance levels, resulting in both long-term (LTH) and short-term (STH) holders returning to profitability. This has prompted profit-taking activities, particularly among more speculative hodlers, as the market exceeded the $34,000 mark. It's an intriguing development that reflects the complex interplay of various factors influencing the crypto market.

James Van Straten, a research and data analyst at crypto insights firm CryptoSlate, pointed out the different mindset among these cohorts. He noted, "Bitcoin has displayed remarkable resilience above $34k for the past five days while witnessing some of the most significant profit-taking in the past two years among STHs." On the other hand, "LTHs have remained relatively stable, with this year's sixth-largest profit-taking, which is minimal in the grand scheme of things." This observation underscores the diverse strategies and perspectives within the crypto community.

Accompanying charts from Glassnode tracked the inflows to exchanges from LTHs and in-profit STH entities, providing valuable data to understand the market's movements and the motivations of different investor groups.

Bitcoin exchange inflows composite chart. Source: James Van Straten/X

Bitcoin exchange inflows composite chart. Source: James Van Straten/X

You might also like: Crypto and M2: Charting a New Frontier in Financial Dynamics

Trending

Press Releases

Deep Dives