Bitcoin Price Dynamics: Unveiling Alameda's Moves

On a seemingly unremarkable day, precisely on the 11th of October, Caroline Ellison, the former stalwart at the now-defunct Alameda Research, found herself in the judicial spotlight of the United States. In a courtroom setting, she calmly unfolded a revelation—Sam “SBF” Bankman-Fried, the co-founder and CEO extraordinaire of FTX, had dispatched directives her way, urging the sale of Bitcoin (BTC) should its illustrious price perch itself above the lofty $20,000 mark, aiming to gently nudge it down to a perceived sweet spot of $28,508.

The disclosure sent ripples of surprise and intrigue throughout the crypto domain. Yet, it is crucial to discern the discrepancy between devising a strategy to quell BTC's exuberant value and the actual execution thereof.

Regrettably, the specifics regarding the size and precise timing of these trades elude us, shrouded in a veil of mystery. However, it's plausible that this financial maneuvering unfolded between the nebulous months of September and October 2022, a mere heartbeat before the lamentable downfall of Alameda and FTX.

Attempting to ascertain if Alameda was efficacious in its endeavor to smother Bitcoin's value below the prestigious $20,000 mark, as alleged by certain market pundits and trading aficionados, is akin to navigating through an intricate labyrinth—an endeavor that verges on the verge of the impossible. Nonetheless, one can undertake a judicious evaluation of the import of FTX's Bitcoin treasure trove in relation to its peers and the overall trade volume.

Examine the Bitcoin wallet holdings

Embarking on a journey into the realm of Bitcoin wallets, we encounter a realm of information that is both scarce and veiled in opacity. Publicly accessible data only shed light on BTC wallets that once stood as bastions of the exchange's reserves, amounting to a number less than 47,000 BTC by the grace of September 2022, as per the esteemed Glassnode data. It's conceivable that Alameda Research clung to other addresses with a more direct ownership stake, but given the gaping maw of debt that haunted the trading conglomerate, the presence of liquid reserves seems to be but a mirage.

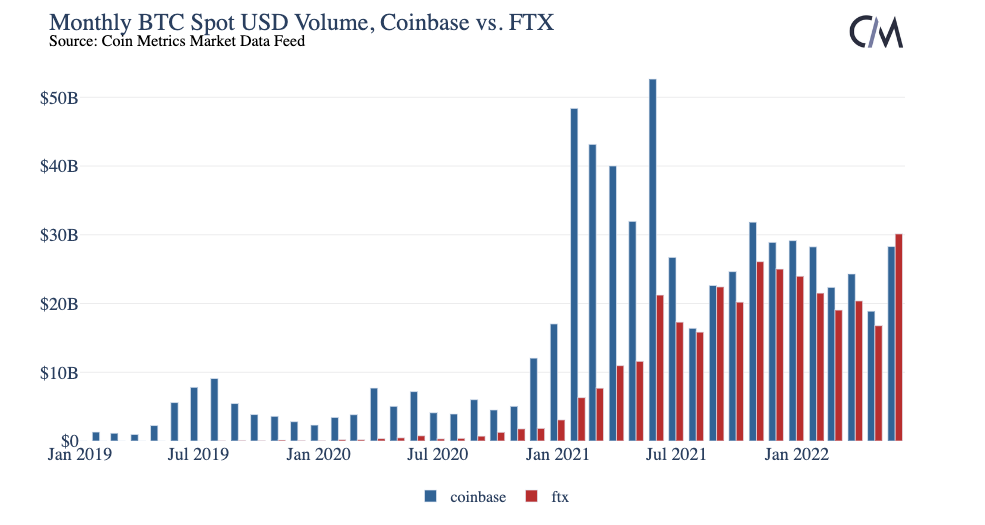

If we dare to envision that the transactions outlined by Ellison were indeed orchestrated on the stage of FTX, a hypothetical order of 4,000 BTC, a treasure trove valued at a princely $80 million in that particular moment, would merely constitute a paltry 8% slice of the exchange's typical daily volume. Furthermore, when we cast our gaze upon the grand tapestry of Bitcoin volume, encompassing the major exchanges, the speculative size of Alameda's order dwindles to the point of inconsequence.

Coinbase vs. FTX monthly spot Bitcoin volume, USD. Source: CoinMetrics

Coinbase vs. FTX monthly spot Bitcoin volume, USD. Source: CoinMetrics

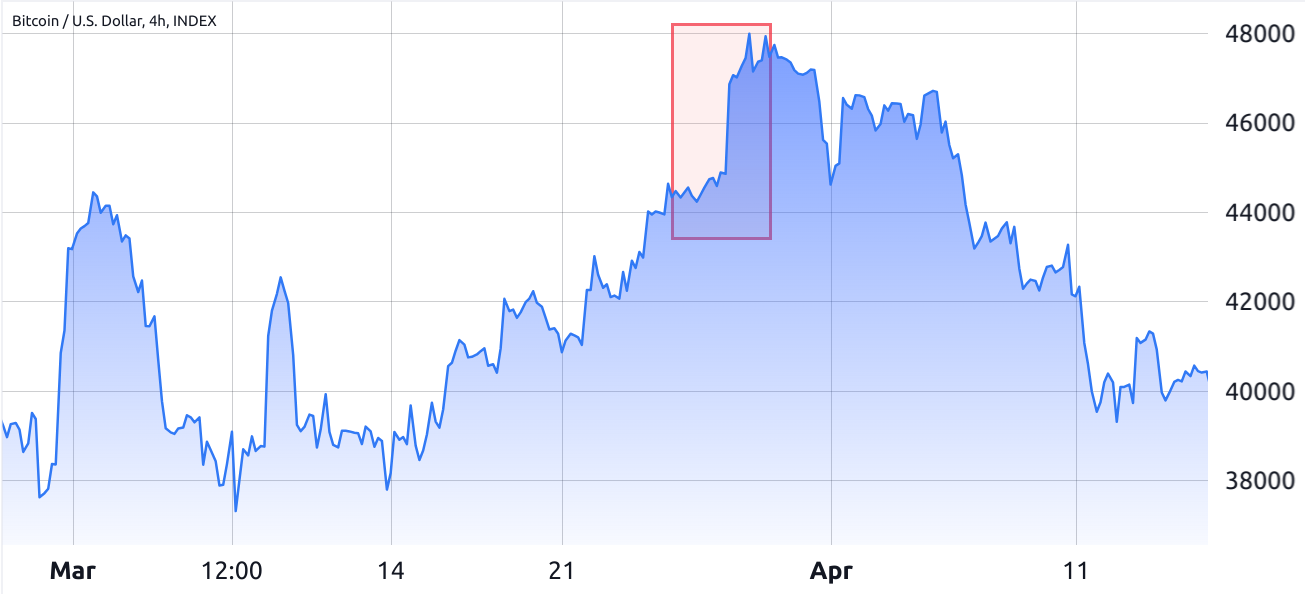

For comparative purposes, in the annals of April 2022, the saga of MicroStrategy unfurled—4,167 BTC found a new abode under the company's banner, at an average price of $45,714, summing up to a grand total of $190 million. This particular saga likely unfolded in the twilight moments of March, as Bitcoin's price experienced a 6% uptick, transitioning from $44,580 to a more resplendent $47,270.

Bitcoin price index (USD), March–April 2022. Source: TradingView

Bitcoin price index (USD), March–April 2022. Source: TradingView

Yet, when we broaden our vista to encompass the larger tableau, we find Bitcoin amiably trading at around $39,500 in the fortnight preceding MicroStrategy's momentous activity, only to reprise the same price a few weeks hence. There is scant reason to entertain the notion that a singular entity could deftly manipulate the market's tempo for a stretch longer than the span of a week. Whether it's Tesla parting ways with a fortune of $936 million worth of Bitcoin or Alameda embarking on the path of liquidating FTX clients' deposits—this truth holds.

In a bid to set the stage with context, it's prudent to illuminate that Binance luxuriated in the possession of 623,000 BTC within its august reserves by the grace of August 2022, whilst Coinbase boasted an impressive tally of nearly 690,000 BTC. These two bastions of exchange prowess, when united in their might, lorded over the Bitcoin realm with a combined treasure, eclipsing that of FTX by a staggering factor of 28. This glaring fact underscores the somewhat limited impact of SBF and Caroline’s venture, particularly in terms of wielding the coveted firepower that could sway markets on a grand scale.

In essence, there might indeed have existed fleeting moments where Alameda maneuvered the levers of influence with some success, effecting a gentle descent of Bitcoin's price below the esteemed threshold of $20,000. Yet, when we unfurl the tapestry of their reserves and carefully study the intricate dance of similarly sized orders, the event's magnitude seems to fade into insignificance—especially when viewed through the lens of a timeframe stretching beyond a single month.

You might also like: Crypto Liquidity Optimization at Coinbase: Trading Pairs Update

Trending

Press Releases

Deep Dives