- Home

- Latest News

- FTX Bankruptcy Holdings: $150 Million in SOL and ETH Amid Sam Bankman-Fried's Ongoing Trial

FTX Bankruptcy Holdings: $150 Million in SOL and ETH Amid Sam Bankman-Fried's Ongoing Trial

Based on data from the blockchain, it seems that addresses associated with the insolvent crypto exchange, under the control of a group of creditors, have ventured into token staking with the aim of generating yields.

The FTX bankruptcy estate seemingly staked substantial quantities of both ether (ETH) and solana's SOL over the weekend, as indicated by blockchain addresses linked to the crypto exchange.

The information on the blockchain indicates that more than 5.5 million SOL, valued at approximately $122 million at current market prices, along with slightly over 24,000 ETH, valued at around $30 million, have been staked through separate transactions.

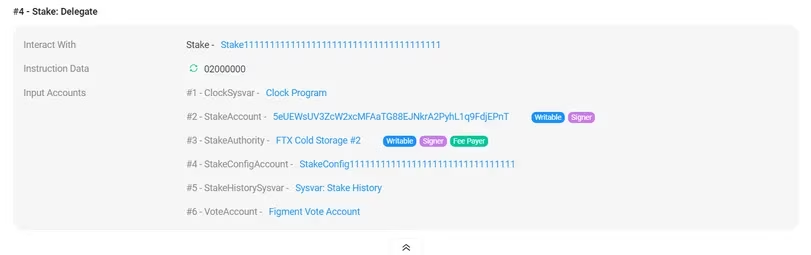

SolScan displays a transaction on the Solana blockchain wherein SOL tokens from an FTX wallet address are staked to Figment.

SolScan displays a transaction on the Solana blockchain wherein SOL tokens from an FTX wallet address are staked to Figment.

Staking entails locking up one's cryptocurrency holdings on a blockchain to contribute to network operations, in return for rewards in tokens. This strategic maneuver holds the potential to yield significant returns for the estate in the years to come, as rewards accumulate from the staked positions.

Onlookers on the social app X, relying on on-chain data, have suggested that the SOL tokens were staked on Figment, where they stand to generate an annualized return of 6.79% on the holdings — potentially resulting in over $8 million in compounded SOL tokens.

Ethereum transactions indicate that the ether was staked directly on the network, with a current annualized return of 3.4% — amounting to approximately $1 million in ETH tokens.

It's noteworthy that FTX was an early investor in Solana and routinely receives a substantial volume of unlocked SOL tokens according to a pre-established vesting schedule. As of September 2023, the exchange held over $1.16 billion worth of these tokens, as disclosed in a court filing.

The exchange experienced a collapse after Bitsday revealed details about its financial state last year. The newly appointed CEO, John J. Ray III, has voiced criticisms about the company's financial controls, while founder Sam Bankman-Fried is presently undergoing a trial.

Read more: Bitcoin Surges to Almost $28K as Optimism Builds for ETF Approval

Trending

Press Releases

Deep Dives