Bitcoin in Focus: Recent Trends and Insights

Bitcoin, often abbreviated as BTC, experienced a slight dip in its ticker, settling at a value of $26,882. This price seemed to hover around the critical $26,800 mark for the second day in a row on October 13, creating a sense of anticipation due to impending regulatory decisions in the ongoing battle between United States regulators and the crypto investment behemoth, Grayscale.

BTC/USD 1-hour chart. Source: TradingView

BTC/USD 1-hour chart. Source: TradingView

Bitcoin is positioned amidst significant liquidity boundaries

Amidst the complex landscape of the crypto market, Bitcoin found itself positioned amidst significant liquidity clouds. Data from TradingView confirmed that BTC's price exhibited minimal fluctuations from the previous day, indicating a certain level of stability within a narrow trading corridor.

Seasoned analysts in the Bitcoin market meticulously weighed potential catalysts, with particular attention to the imminent decision by the U.S. Securities and Exchange Commission (SEC) concerning their appeal of a court ruling related to their denial of a Bitcoin spot exchange-traded fund (ETF).

In a snippet of a broader post on X (previously known as Twitter), Michaël van de Poppe, the esteemed founder and CEO of MN Trading, underscored the significance of the day, emphasizing the weight of the SEC Appeal on the Grayscale ruling. He expressed cautious optimism, anticipating a potential upward reversal in Bitcoin's trajectory if the outcome favored the crypto market, strategically positioning himself for a long trade.

BTC/USD annotated chart. Source: Michaël van de Poppe/X

BTC/USD annotated chart. Source: Michaël van de Poppe/X

Amidst a week rife with data releases surpassing market expectations on the inflation front, macro data printing decided to take a breather. This shift in pace triggered contemplation about the potential trajectory of BTC's price. Credible Crypto, a trader and analyst well-regarded in the crypto community, detected a carefully managed decline in Bitcoin's price, hinting at a possible stabilization and subsequent reversal.

BTC/USD annotated chart. Source: Credible Crypto/X In a separate insightful observation, Daan Crypto Trades, an astute trader, highlighted BTC/USD's graceful movement within a specific zone demarcated by two liquidity clouds. This nuance underscored the potential reactions the market might witness as the spot price approached these well-defined boundaries.

BTC/USD annotated chart. Source: Credible Crypto/X In a separate insightful observation, Daan Crypto Trades, an astute trader, highlighted BTC/USD's graceful movement within a specific zone demarcated by two liquidity clouds. This nuance underscored the potential reactions the market might witness as the spot price approached these well-defined boundaries.

#Bitcoin Liquidation Map ????

— Daan Crypto Trades (@DaanCrypto) October 13, 2023

Big zones at $26.5K & $27K. Would expect some sort of ssqueeze to occur at those areas. pic.twitter.com/VW6YYPkMe4

Adding another layer of analysis, Rekt Capital, a trader and analyst known for their strategic insights, set a specific price target of $25,000 for Bitcoin, should attempts by bullish forces to reclaim exponential moving averages (EMAs) falter.

#BTC

— Rekt Capital (@rektcapital) October 12, 2023

Needs to reclaim at least one of these EMAs as support to avoid a drop into the $25k-$26k area$BTC #Crypto #Bitcoin pic.twitter.com/ywRkdM07uw

GBTC regains lost territory

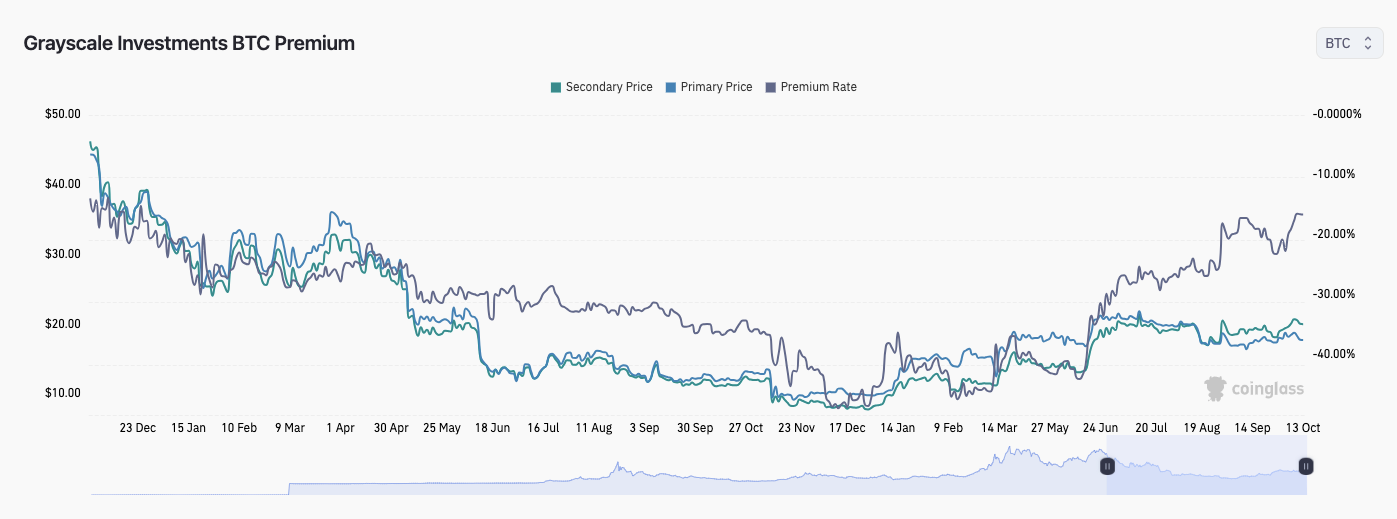

As the appeal deadline loomed on the horizon, the Grayscale Bitcoin Trust (GBTC), a focal point of the ongoing legal proceedings, demonstrated resilience and noteworthy performance. Grayscale, the authoritative entity in this scenario, remained cautiously optimistic, reaffirming their belief that GBTC would eventually transition into a spot ETF. Notably, the Grayscale Bitcoin Trust (GBTC) managed to reduce its discount to net asset value, approaching levels unseen since December 2021. This discounted value, technically referred to as a negative premium, dipped to -16.44% before undergoing further minor adjustments, as reported by the diligent monitoring efforts of CoinGlass.

GBTC premium vs. asset holdings vs. BTC/USD chart (screenshot). Source: CoinGlass

GBTC premium vs. asset holdings vs. BTC/USD chart (screenshot). Source: CoinGlass

Read more about: Potential Russian Involvement in FTX Hack: Insights from Elliptic

Trending

Press Releases

Deep Dives