Bitcoin ETF Boost: Price Projections

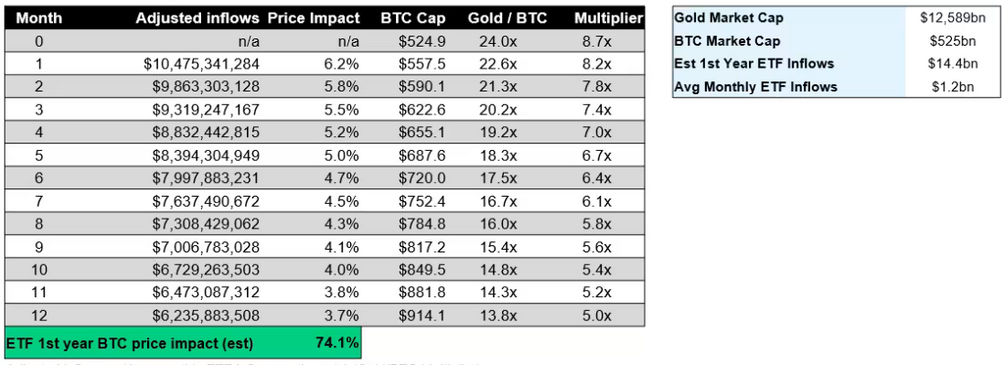

According to the insights provided by Galaxy Digital, a well-known crypto investment firm, Bitcoin's current price stands at $34,206 per BTC. Their analysis suggests that this value is poised to witness a substantial surge of 74.1% in the first year following the eagerly anticipated launch of spot Bitcoin exchange-traded funds (ETFs) in the United States. This intriguing estimation, outlined by their research associate Charles Yu in a detailed blog post dated October 24, is underpinned by a meticulous examination of the potential impact of fund inflows into Bitcoin ETF products. As a reference point, Yu employs the performance of gold ETFs, drawing parallels to gauge the expected dynamics.

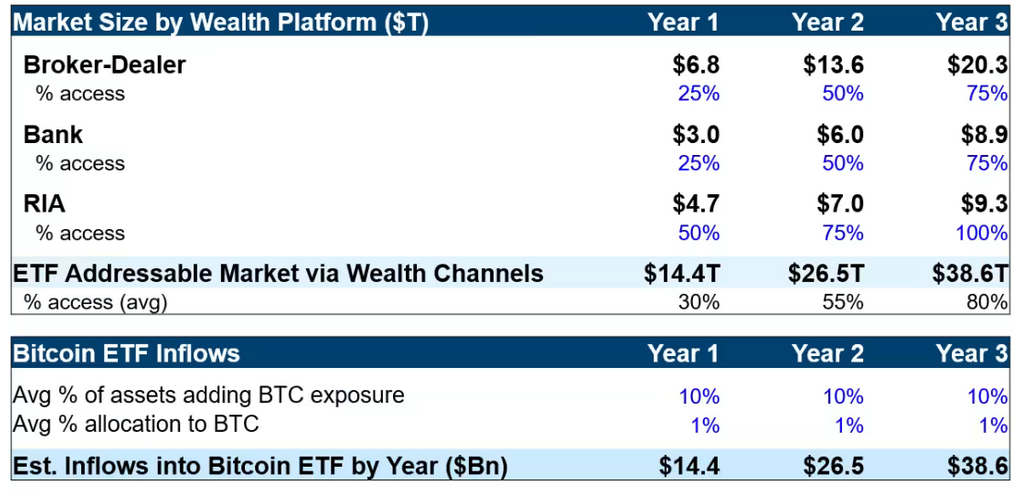

Yu's forward-looking vision envisions that the total addressable market for Bitcoin ETFs will attain a staggering scale of $14.4 trillion within the inaugural year of their introduction. This suggests a significant influx of capital into this emerging asset class.

In the immediate aftermath of the ETF launch, Yu anticipates an initial price boost of 6.2% during the first month, followed by a gradual decrease in the rate of ascent. This momentum is projected to stabilize at a still-impressive 3.7% monthly increase by the end of the first year.

Spot Bitcoin ETF estimated one-year inflows by month and Bitcoin price impact. Source: Galaxy Digital Research

Spot Bitcoin ETF estimated one-year inflows by month and Bitcoin price impact. Source: Galaxy Digital Research

It's noteworthy that Yu's analysis, based on Bitcoin price data from September 30, implies that this predicted price surge would elevate Bitcoin to a remarkable new high of $59,200, representing a noteworthy upswing from its prevailing valuation.

Markus Thielen, who holds the position of head of research at Matrixport, a well-regarded digital asset financial services firm, aligns with a similar outlook in a post dating back to October 19. His estimation posits that if BlackRock's application for a spot Bitcoin ETF secures regulatory approval, Bitcoin could potentially attain a price range spanning from $42,000 to $56,000.

Yu's forward-looking projections also encompass the growth trajectory of the addressable market size for U.S. Bitcoin ETFs. He envisions this size expanding to a substantial $26.5 trillion in the second year following the launch and further escalating to an impressive $39.6 trillion at the conclusion of the third year.

Spot Bitcoin ETF market sizing and inflow estimates over the first three years. Source: Galaxy Digital Research

Spot Bitcoin ETF market sizing and inflow estimates over the first three years. Source: Galaxy Digital Research

However, Yu prudently acknowledges the potential impact of any unforeseen delays or, in a less favorable scenario, denials in the approval of spot Bitcoin ETFs, which could influence the trajectory of his price predictions. Nevertheless, he maintains that his estimates are intentionally conservative and intentionally do not factor in the "second-order effects" that may emerge from the regulatory approval of these ETFs.

Peering into the future, Yu anticipates that global markets will follow the United States in embracing and introducing similar Bitcoin ETF offerings to cater to a broader and more diverse spectrum of investors. With all these factors in play, 2024 shapes up to be a pivotal year for Bitcoin, with considerable excitement stemming from anticipated ETF inflows, the impending April 2024 Bitcoin halving event, and the intriguing possibility that interest rates may have already reached their zenith or are poised to do so in the near term. These multifaceted dynamics collectively contribute to a promising outlook for the cryptocurrency market in the coming years.

Trending

Press Releases

Deep Dives