Cryptocurrency ETF Listing Saga

Amidst the continuous chatter and speculations that seem to have permeated the digital realms of social media, we find ourselves pondering the current status of ARK Invest's Bitcoin exchange-traded fund (ETF), proudly bearing the BTC ticker symbol, which appears to be noticeably absent from the Depository Trust and Clearing Corporation's (DTCC) official website.

This captivating development, which unfolded on the eventful day of October 25th, saw an array of distinguished figures within the ever-vibrant cryptocurrency community on Twitter, including prominent personalities such as Mike Alfred, Bitcoin News, Simply Bitcoin, Crypto News Alerts, and a host of others, taking to their social media accounts to share a flurry of tweets and screenshots, making bold assertions about the joint spot Bitcoin ETF by ARK Invest and 21 Shares being granted a coveted spot on the DTCC's esteemed website. In an intriguing twist, these screenshots appeared to feature ticker symbols that, rather curiously, were associated with futures products rather than the much-anticipated spot Bitcoin ETF.

BREAKING:

— Mike Alfred (@mikealfred) October 25, 2023

CATHIE WOODS’ ARK SPOT BITCOIN ETF IS NOW LISTED ON THE DTCC WEBSITE WITH TICKER AND CUSIP

As a piece of the puzzle worth examining, the most recent amendment to Ark's spot Bitcoin ETF filing, diligently dated October 11th, shed light on the plan to actively trade under the evocative ticker symbol "ARKB."

Furthermore, a meticulous inspection of the DTCC's online domain as of October 25th reveals a rather puzzling scenario - the dedicated section intended to provide a comprehensive list of current ETF listings appears, perplexingly, devoid of any mention of the ARKB ticker symbol.

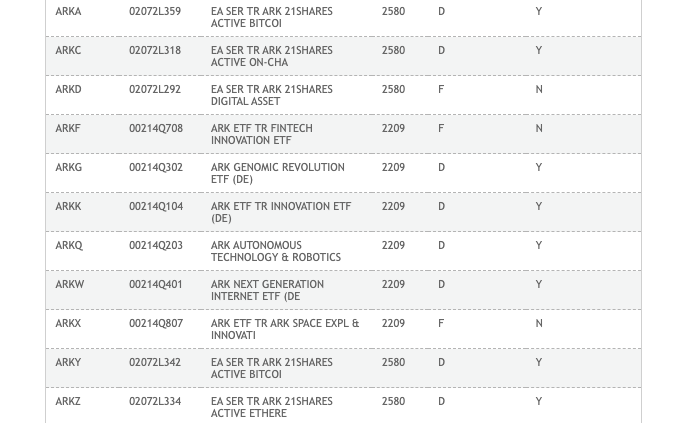

The current list of ARK ETF products on the DTCC ETF list. Source: DTCC

The current list of ARK ETF products on the DTCC ETF list. Source: DTCC

Intriguingly, the enigmatic ticker symbol "ARKA" leads us down the path of the ARK 21Shares Active Bitcoin Futures ETF. According to the official records, this particular ETF is still awaiting the coveted approval, positioned to offer investors an opportunity to dabble in the intricacies of Bitcoin futures contracts.

For the sake of presenting the full tableau, let's not forget the curious tickers ARKY and ARKZ, which respectively correspond to the ARK 21Shares Active Ethereum Futures ETF and the ARK 21Shares Active Bitcoin Ethereum Strategy ETF. These products, it should be duly noted, are currently residing in the realm of proposals, awaiting the discerning gaze of the United States Securities and Exchange Commission.

Turning the spotlight toward yet another intriguing facet of this narrative, it appears that the excitement generated by iShares' listing was not devoid of its fair share of flair. The cryptocurrency market witnessed an exhilarating surge following the revelation of BlackRock's iShares spot Bitcoin ETF (IBTC) being welcomed into the folds of the DTCC's esteemed website. Yet, an individual purporting to speak for the DTCC recently let it slip that IBTC had, in fact, earned its place on the website back in August.

This revelation invites us to a closer examination of the typical procedural dance surrounding securities, where adding these financial instruments to the NSCC security eligibility file is akin to laying the groundwork for the forthcoming debut of a new ETF in the market. It's imperative to stress that such an inclusion, as clarified by the spokesperson, does not carry the weight of indicating the outcome of ongoing regulatory or approval processes.

Curiously, and perhaps not without a touch of synchronicity, traders bore witness to BlackRock's spot ETF listing on the DTCC website coinciding with an impressive one-day rally in Bitcoin's market value, resulting in a remarkable 14% surge that momentarily propelled its value beyond the elusive $35,000 threshold for the first time in nearly two years. Concurrently, just as the initial ripples of rumors surrounding ARK's potential listing began to make waves, Bloomberg's esteemed senior ETF analyst, Eric Balchunas, shared his insights on ARK Invest's latest move, highlighting that the company had submitted a fourth amendment to its spot Bitcoin ETF application. It appears that the changes proposed in this amendment were predominantly of a cosmetic nature, adding an additional layer of intrigue to the unfolding narrative.

ARK just filed amendment #4 to their 19b-4, looks like it is to incorporate changes made to their S-1 (which again were to address SEC qs). I guess just want to make both docs be in tune (first issuer to do so). I don't see anything else to read into here but cc @SGJohnsson pic.twitter.com/NE4Gy3spgN

— Eric Balchunas (@EricBalchunas) October 24, 2023

Read more about: Blockchain ETF Boost: BlackRock's Key Move

Trending

Press Releases

Deep Dives