Bitcoin Ballet: Whales' Encore and Market Symphony

In the ever-fluctuating landscape of Bitcoin, where the ticker BTC recently experienced a downturn to $36,545, the atmosphere is thick with a sense of familiarity for analysts amidst a surge in order book activity.

BTC/USD 4-hour chart. Source: TradingView

BTC/USD 4-hour chart. Source: TradingView

It's like déjà vu, a recurring theme that adds an intriguing layer to the unfolding narrative. The complex maneuvers of whales within the Bitcoin domain hint at a tale reminiscent of Q1 2023.

Whale maneuvers evoke memories of Bitcoin's Q1 2023

According to the latest data from TradingView, the price dynamics of BTC displayed a noteworthy surge, peaking at $37,770 just the day before. At the current moment, Bitcoin is meandering around $37,400, maintaining a range that echoes patterns observed earlier in the month. Yet, beneath the surface, Material Indicators, an on-chain monitoring resource, detected a resonance with the market conditions of Q1 this year—a pivotal period marking Bitcoin's resilient bounce-back from post-FTX lows.

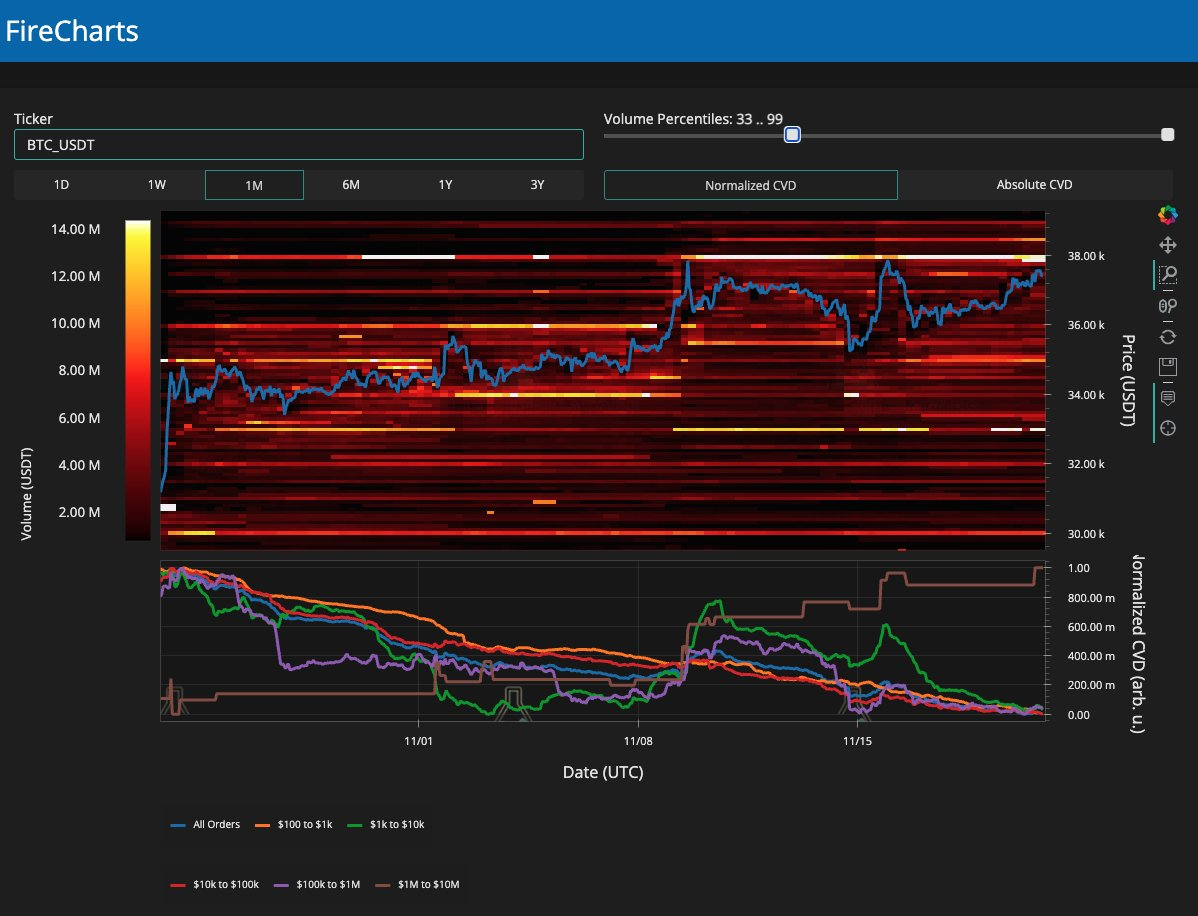

Unveiling the drama of the order book, Material Indicators pointed towards the possible influence of a significant liquidity provider, playfully dubbed the "Notorious B.I.D." in the past. The recurring bid support at $33,000, happening "7 times in the last 30 days," adds an intriguing layer to the unfolding narrative, a familiar strategic play that seems to have been orchestrated before.

BTC/USDT liquidity data. Source: Material Indicators/X

BTC/USDT liquidity data. Source: Material Indicators/X

Delving into the speculation, Keith Alan, co-founder of Material Indicators, pondered whether the entities orchestrating these buy orders possess a level of sophistication beyond the realm of high-volume speculation. A snapshot of BTC/USDT liquidity further revealed sellers strategically positioned at and just below $38,000, creating a dynamic interplay within the market. Interestingly, the largest order class among whales, ranging from $1 million to $10 million, emerged as the lone active cohort, with others uniformly reducing their exposure throughout the week.

The bid wall at $33k disappeared AGAIN and Brown MegaWhales bought resistance at the local top AGAIN.

— Keith Alan (@KAProductions) November 20, 2023

If you think MegaWhales have an issue with timing, re-read the thread I shared from @MI_Algos.

No telling how long they keep this game going. Of course, I have my theory about… pic.twitter.com/sEZuvSgWIs

A rapid decline may ensue after reaching the $40,000 mark

Peering into the crystal ball of possibilities, Michaël van de Poppe, the CEO of trading firm Eight, kept the option of Bitcoin reaching $40,000 on the table. His anticipation of a potential breakout, followed by a swift downturn, resonates with the age-old wisdom of "keep on buying the dips." However, analyst Matthew Hyland introduced a note of caution into the mix.

BTC/USD annotated chart. Michaël van de Poppe/X

BTC/USD annotated chart. Michaël van de Poppe/X

He highlighted the looming risk of a bearish divergence between the relative strength index (RSI) and price if the latter fails to surpass the current 18-month highs just below $38,000.

As the digital ink dries on this narrative, the bullish momentum appears elusive, leaving the outcome hanging in the delicate balance of the crypto cosmos.

#Bitcoin still all going to plan

— Matthew Hyland (@MatthewHyland_) November 21, 2023

Price and RSI are moving up

Both will need to put in higher highs to prevent any opportunity at bearish divergence

Will continue to update this situation: https://t.co/yNCi1fBuz2 pic.twitter.com/1XxPhiDd28

You might also like: CryptoCurrents: Navigating Profits in Bitcoin's Sea of Opportunities

Trending

Press Releases

Deep Dives