- Home

- Cryptocurrency

- Bearish Bitcoin: A Deep Dive

Bearish Bitcoin: A Deep Dive

The once-mighty and awe-inspiring surge that propelled Bitcoin to a staggering year-to-date gain of 55.7% has now all but faded into obscurity, as Bitcoin's price has taken a nosedive, shedding a substantial 11.4% of its value over the past 30 days. In the initial stages, Bitcoin's price appeared to soar with unbridled bullish enthusiasm following the landmark Grayscale court victory against the United States Securities and Exchange Commission (SEC). However, much like a mirage in the desert, these gains have evaporated entirely as the September losing streak persists.

The decline in Bitcoin's price has prompted some analysts to draw intriguing parallels between the current BTC market and the reminiscent pre-bull market cycle observed from 2015 to 2017.

Bitcoin's current value according to TradingView data

Bitcoin's current value according to TradingView data

Now, let's venture further into the labyrinth of factors influencing Bitcoin's price today.

Vanishing Liquidity as Investor Sentiment Stagnates

At the commencement of 2023, traders with short positions consistently dominated liquidations within the futures market. The bullish camp found themselves caught off guard on August 17th when a sudden and unexpected flash crash triggered liquidations exceeding a staggering $213.5 million in long positions. This cataclysmic event marked the most substantial single-day liquidation of Bitcoin longs since the infamous Terra Luna collapse back in May 2022.

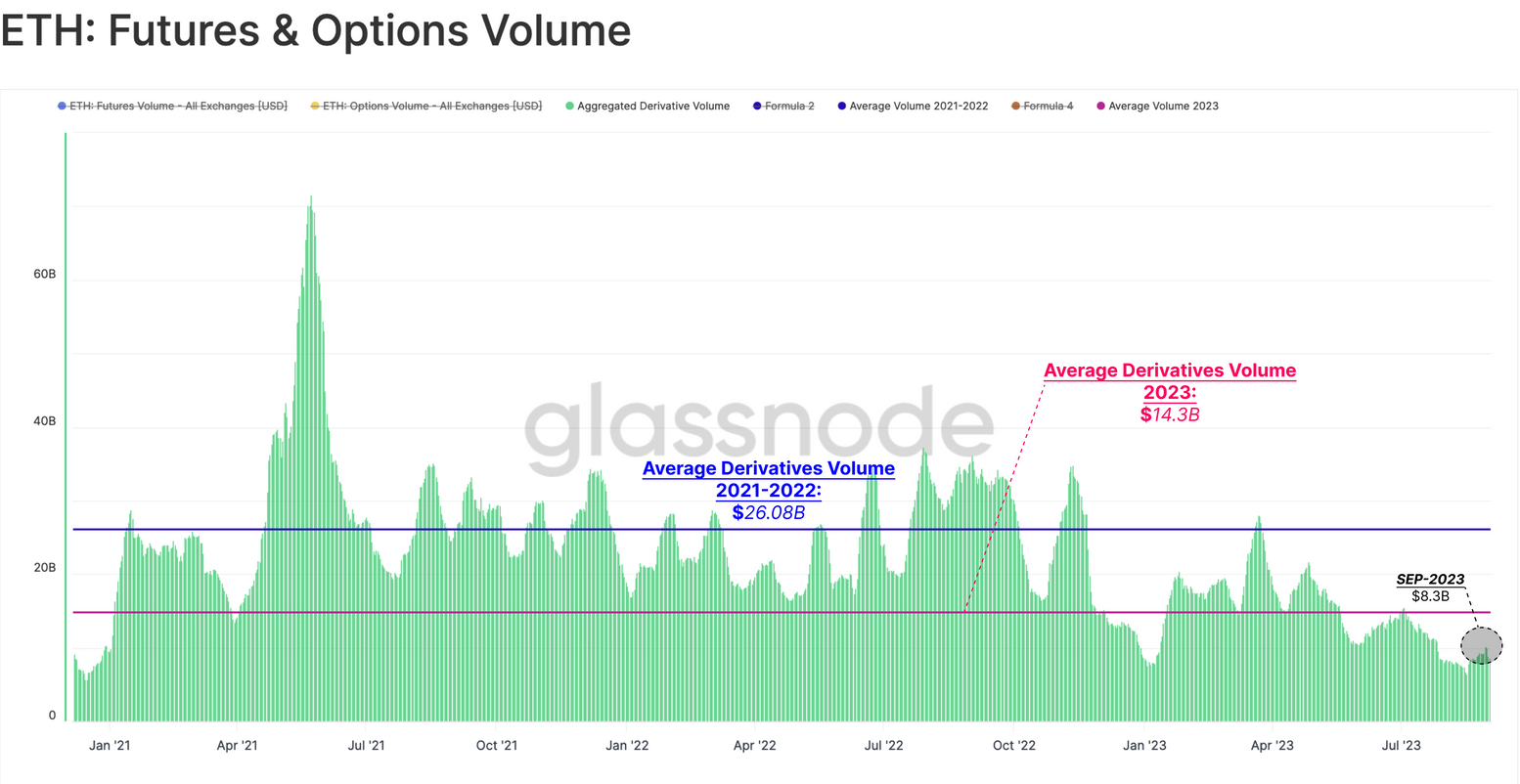

Since the tumultuous flash crash, the market has witnessed an unending exodus of capital from risk-laden assets like Bitcoin and Ether, despite the apparent robustness in volume witnessed at the dawn of 2023 in the derivatives markets. Alas, the risk appetite has been notably dwindling, a stark departure from the exuberant levels seen during the halcyon days of 2021 and 2022, with a daily average hemorrhaging of $6 billion.

The volume of derivative contracts related to Ether as reported by Glassnode.

The volume of derivative contracts related to Ether as reported by Glassnode.

In parallel with the diminution in Ether derivatives volume, Bitcoin bulls appear to be displaying dwindling interest, and the diminishing open interest is sowing seeds of doubt, causing some analysts to consider the sobering prospect of $22,000 as the next plausible threshold for Bitcoin's price.

Despite the diminishing Bitcoin derivatives volume, more than $8.76 million worth of long positions met their untimely demise within a mere 24-hour time span, while open options have tilted decidedly in favor of short positions, providing a compelling tableau of bearish dominance.

Data regarding Bitcoin's liquidation events, sourced from CoinGlass

Data regarding Bitcoin's liquidation events, sourced from CoinGlass

The unforgiving liquidation of BTC longs in the absence of commensurate buying pressure stemming from trading volume has undeniably cast a shadow over Bitcoin's price. Moreover, Bitcoin's trading volume has descended to its lowest ebb since the distant echoes of early 2021, and BTC Ordinals volume has plummeted by an astonishing 98% or more.

The perpetual dearth of liquidity and the echoing emptiness of trading volume have collectively conspired to drive the Fear & Greed Index, that venerated barometer of investor sentiment, into a protracted descent over the course of the past 30 days, transmuting it from a state of neutral detachment into the chilly embrace of outright fear.

The Fear & Greed Index, obtained from Alternative as its source

The Fear & Greed Index, obtained from Alternative as its source

All Eyes on Bitcoin ETFs

The prevailing haze of short-term uncertainty shrouding the crypto market seems to have scarcely ruffled the feathers of institutional investors, who steadfastly maintain their unwavering long-term gaze. In the face of an increasingly hostile regulatory landscape within the United States, the heavyweights of the financial world are unrelenting in their pursuit of Bitcoin financial instruments, potentially igniting the flickering flames of a bullish rally. Presently, no fewer than nine prominent investment behemoths have applications for exchange-traded funds (ETFs) awaiting the judgment of the SEC.

Yet, in a twist of fate, even as these financial titans clamor for action, Bitwise has officially withdrawn its applications for Bitcoin and Ether ETFs. The SEC, seemingly unfazed, appears poised to maintain its status quo of persistent delay in rendering decisions regarding the approval of Bitcoin ETFs, including the eagerly anticipated application from BlackRock, which may not see the light of day until the distant horizon of 2024. This ongoing protraction in decision-making could continue to exert its gravitational pull on investor sentiment and orchestrate its subtle dance within the intricate tapestry of price movements across the sprawling crypto market.

While the whispers of conspiracy suggest that BlackRock may be clandestinely suppressing the Bitcoin price in anticipation of its eventual ETF debut, such notions remain shrouded in conjecture. After all, a precipitous tumble in BTC's value would hardly serve the interests of this financial juggernaut.

Notwithstanding the current tempestuous descent of Bitcoin's price, Pantera Capital steadfastly clings to its belief that BTC possesses the potential to scale the staggering heights of $148,000 by the time July 2025 graces our calendars.

Will Short-Term Turbulence Pave the Way for Long-Term Prosperity in the Crypto Realm?

The price of Bitcoin remains inextricably intertwined with the ebbs and flows of macroeconomic events, and it is eminently plausible that further regulatory maneuvers and interest rate hikes will continue to exert their gravitational pull on the trajectory of BTC's price. Even as the sands shift beneath our feet, with China bestowing the mantle of legal property upon virtual assets on the auspicious date of September 1st and the OKX exchange gingerly navigating the final stages of securing a coveted Hong Kong virtual asset service provider license, Bitcoin's price appears unmoved by these seismic shifts.

The solemn pronouncements of Federal Reserve Chairman Jerome Powell, delivered with gravitas on August 25th in the idyllic setting of Jackson Hole, Wyoming, offer insight into the Federal Reserve's unwavering commitment to the pursuit of aggressive interest rate policies, an unyielding resolve to quell the fires of inflation, regardless of the temporal scope required to achieve such lofty aims.

In the annals of time, market participants continue to harbor steadfast expectations of a renaissance in the price of Bitcoin, driven in no small part by the growing embrace of BTC by financial institutions, which may ultimately transform the turbulent currents of today into the tranquil seas of tomorrow.

Trending

Press Releases

Deep Dives