ARK's GBTC Maneuver Amid ETF Speculation

ARK Investment firm, under the seasoned and Bitcoin-enthusiastic leadership of Cathie Wood, recently made a notable and strategic move by divesting a significant number of 100,739 shares of Grayscale Bitcoin Trust (GBTC) from their ARK Next Generation Internet ETF (ARKW). This intriguing transaction, with a valuation of $2.5 million, took place on the auspicious date of October 23, amidst a buoyant market characterized by heightened expectations surrounding the potential launch of a spot Bitcoin exchange-traded fund (ETF).

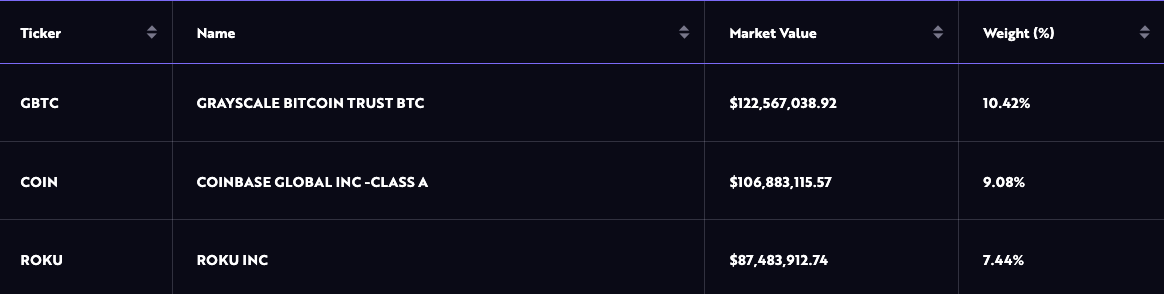

This sale of GBTC shares by ARK is noteworthy not only for its financial implications but also due to its timing. Remarkably, it marks their first reported GBTC transaction since the distant month of November 2022 when they took the initiative to add 450,272 GBTC shares, totaling a sum of $4.5 million, to the ARKW portfolio. In the current context, this divestment amounts to approximately 2% of the total GBTC holdings nestled within ARKW's diversified portfolio, which stood at a noteworthy $122.6 million as of the mentioned date. Of particular significance is the fact that GBTC stands as the crowning jewel in ARKW's asset collection, representing a substantial 10.4% of the fund's exposure, with Coinbase and Roku shares following with 9% and 7.4% weightings, respectively.

The ARK Next Generation Internet ETF’s top three holdings by weight. Source: ARK

The ARK Next Generation Internet ETF’s top three holdings by weight. Source: ARK

Seeking to unravel the motives behind this intriguing maneuver, some have posited the theory that ARK might be adeptly positioning itself in anticipation of a pivotal decision to be made by the United States Securities and Exchange Commission (SEC) regarding the approval of their groundbreaking Bitcoin-based ETF. It is worth noting that Grayscale, the parent company of GBTC, submitted a fresh registration statement for a Bitcoin ETF to the SEC on the notable date of October 19, a few days subsequent to ARK's strategic amendment of their own spot Bitcoin ETF filing on October 11. These timeline synchronicities invite contemplation about ARK's strategic foresight and adaptability.

Furthermore, a prevailing theory among astute online traders suggests that, should ARK's aspirations for a spot Bitcoin ETF come to fruition, this ETF might find itself prominently situated as the flagship holding within ARKW, which could, in turn, spur the rational divestment of GBTC.

Awesome thx! Huge for $ARKW @DilksJay

— J-Rod (@80_JRod) October 14, 2023

In addition to the riveting GBTC divestment, ARK concurrently embarked on the disposal of 32,158 shares of Coinbase (COIN) from the ARKW portfolio, along with 10,455 COIN shares from their ARK Fintech Innovation fund, resulting in a cumulative cash flow of $3.4 million. Noteworthy is the strategic decision by ARK to continue accumulating Robinhood (HOOD) shares, thus, manifesting a robust stance by adding 32,158 HOOD shares to ARKW on October 23, amounting to a sum of $300,000.

As of the time of this comprehensive report, ARK remains elusive in its response to requests for comments on these intriguing financial maneuvers.

Read more about: Bitcoin ATM Count Hits Lowest Mark Since 2021 Globally

Trending

Press Releases

Deep Dives