US Stablecoin Oversight Report

In a recent report released by blockchain research firm Chainalysis, there are concerning indications that the United States government's regulatory control over the stablecoin market may be slowly slipping away. This report, published on October 23, brings to light an interesting and evolving trend where stablecoin transactions are increasingly being conducted through entities that do not possess the necessary licenses within the United States.

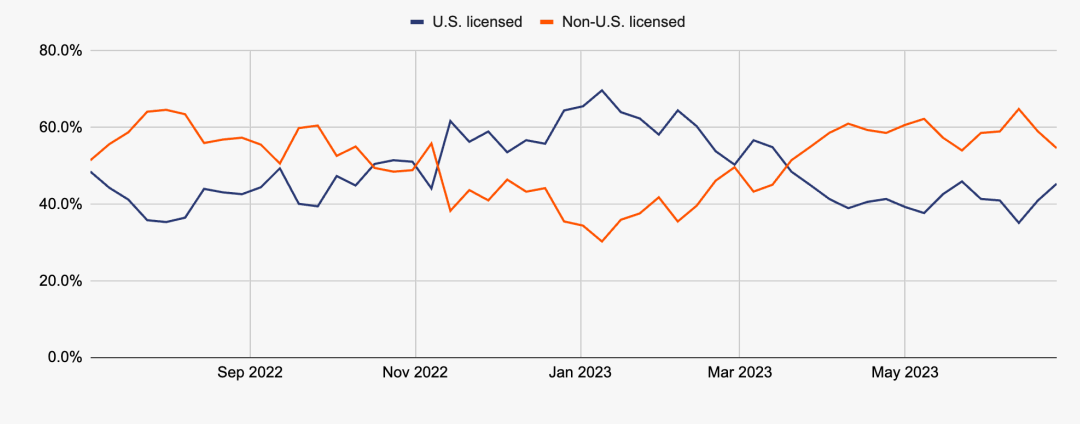

Chainalysis' extensive findings reveal a noteworthy shift in the destination of stablecoin inflows among the top 50 cryptocurrency services. Starting from the spring of 2023, a significant majority of these inflows have been relocating from U.S.-licensed services to non-U.S.-licensed entities. By the time June 2023 rolled around, approximately 55% of stablecoin inflows to these top 50 services were redirected to exchanges operating outside the United States, as thoughtfully outlined in the report.

Share of stablecoin inflows to U.S.-licensed vs. non-U.S.-licensed exchanges between July 2022 and June 2023. Source: Chainalysis

Share of stablecoin inflows to U.S.-licensed vs. non-U.S.-licensed exchanges between July 2022 and June 2023. Source: Chainalysis

The study suggests a nuanced perspective: that the U.S. government's ability to effectively oversee the stablecoin market has been diminishing over time. This phenomenon is accompanied by the observation that American consumers might be inadvertently missing out on valuable opportunities to engage with regulated stablecoins. What's intriguing is that, despite the initial and vital role played by U.S. entities in legitimizing and catalyzing the stablecoin market, more cryptocurrency users are now shifting their focus towards stablecoin-related activities with foreign-based trading platforms and issuers. This gradual transformation in the cryptocurrency landscape is happening while U.S. lawmakers grapple with the complexities of enacting stablecoin regulations. Congress continues to deliberate on relevant bills, such as the Clarity for Payment Stablecoins Act and the Responsible Financial Innovation Act, contributing to this evolving narrative.

It's worth noting that, despite the decline in licensed stablecoin activity within the United States, North America has notably risen as the preeminent global cryptocurrency market. According to the report, an estimated $1.2 trillion worth of transactions took place in this region between July 2022 and June 2023. Impressively, North America accounted for 24.4% of the global transaction volume during this period, surpassing the regions of Central, Northern, and Western Europe, which collectively received an estimated $1 trillion, as thoughtfully illuminated by Chainalysis.

Read more: Bitcoin Surges Above $30,000 on ETF Optimism, Fueling Bullish Sentiment

Trending

Press Releases

Deep Dives