ARK's Economic Insights: Navigating 2023

The year 2023 has been quite a rollercoaster ride for investor sentiment, with twists and turns aplenty. Despite the surprising resilience of equities markets, a recent report from the well-known ARK Invest has put forward a rather cautionary perspective on what the rest of 2023 might have in store from an economic standpoint.

ARK Invest, a prominent player in the financial landscape with assets under management amounting to a substantial $13.9 billion, is led by the ever-passionate Cathie Wood, a staunch advocate for cryptocurrencies. In an interesting collaborative effort with the European asset management firm 21Shares, ARK Investment ventured into the world of Bitcoin exchange-traded funds (ETFs) back in June 2021. Fast forward to the present, and their most recent request for a spot BTC ETF is currently sitting in the queue, awaiting review by the United States Securities and Exchange Commission, having been filed in May 2023.

Optimistic in the long run but cautious in the short term?

While ARK maintains an overall bullish stance on Bitcoin, underpinned by their deep-dive research highlighting the transformative potential of fusing Bitcoin with artificial intelligence to revolutionize corporate operations by enhancing productivity and cost-efficiency, they also acknowledge that the current macroeconomic backdrop doesn't lend itself to a straightforward path for a Bitcoin bull run.

In their newsletter, ARK outlines a plethora of factors contributing to their somewhat guarded outlook on cryptocurrencies. These factors include the ebb and flow of interest rates, the vagaries of GDP forecasts, the twists and turns of unemployment statistics, and the ever-watching eye on inflation. Notably, they highlight the Federal Reserve's shift towards a more restrictive monetary policy, a development not seen since the aftermath of the 2008 financial crisis, as indicated by the elusive "natural rate of interest."

The natural interest rate as defined by the Federal Reserve, sourced from ARK Investment

The natural interest rate as defined by the Federal Reserve, sourced from ARK Investment

Now, let's take a moment to understand the "natural rate of interest." It's a somewhat theoretical concept representing an interest rate at which the economy neither expands nor contracts. ARK explains that when this elusive rate exceeds the real federal funds policy rate, it puts a certain level of strain on lending and borrowing rates, adding an extra layer of complexity to the financial landscape.

ARK anticipates that inflation will continue to slow down, pushing the real federal funds policy rate higher and creating a widening chasm above the natural rate of interest. As a result, the report takes on a somewhat pessimistic tone when considering the broader macroeconomic picture, largely hinging on this particular indicator.

Furthermore, the analysts at ARK delve deeper into the divergence between real GDP (the measure of production) and GDI (the measure of income). According to the report, these two metrics should ideally move in lockstep since income earned should equate to the value of goods and services produced. However, recent data suggests a concerning discrepancy, with real GDP outpacing real GDI by approximately 3%. This indicates that downward revisions in production data may be on the horizon.

U.S. employment data is another key area of focus for ARK, with their analysts noting that the government has been consistently revising these figures downward for the past six months.

Revisions to U.S. nonfarm payrolls, as cited by ARK Investment

Revisions to U.S. nonfarm payrolls, as cited by ARK Investment

The graph above illustrates a labor market that appears weaker than initially reported. It's worth noting that the last time we saw six consecutive months of downward revisions was back in 2007, just prior to the onset of the Great Financial Crisis, which adds an extra layer of concern.

Typically, 'stagflation' has a negative impact on assets associated with higher risk tolerance

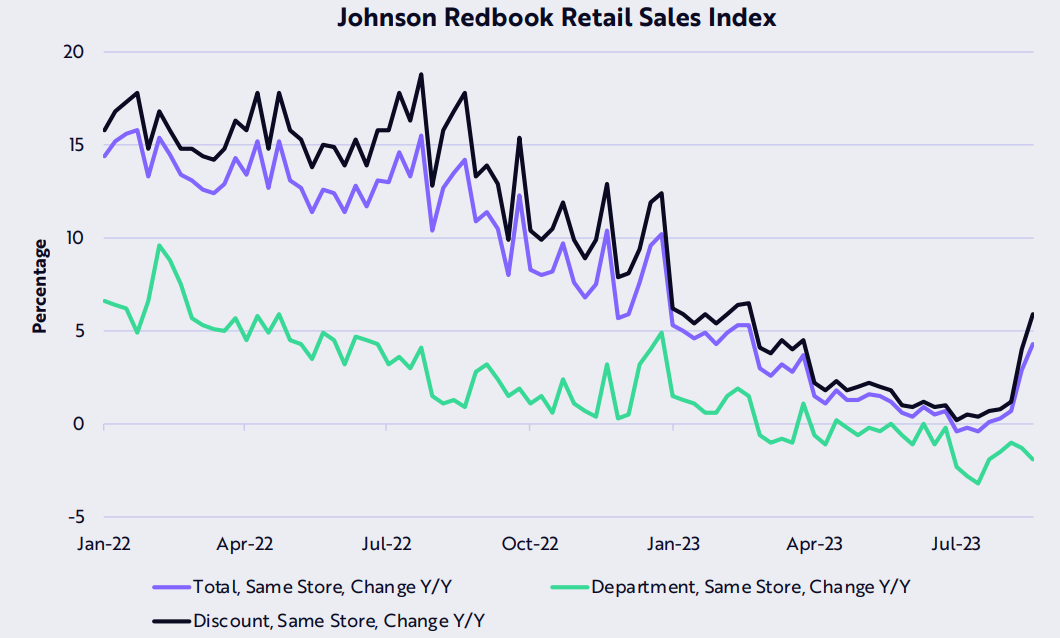

Now, let's keep our eyes on another potentially bearish development known as "stagflation." The report points out a reversal in the year-long trend of price discounts driven by increased consumer spending. Referring to the Johnson Redbook Index, which covers over 80% of the "official" retail sales data compiled by the U.S. Department of Commerce, we see a notable rebound in total same-store sales for the first time in 12 months, suggesting that inflation might be applying upward pressure.

The Johnson Redbook index for retail sales, as referenced by ARK Investment

The Johnson Redbook index for retail sales, as referenced by ARK Investment

Taken together, these various metrics and indicators paint a picture of ongoing macroeconomic uncertainty that could potentially persist in the months ahead. However, they do not offer a definitive answer regarding how cryptocurrency investors might react if this trend confirms lower economic growth and higher inflation—typically considered an unfavorable scenario for risk-on assets.

Trending

Press Releases

Deep Dives