Bitcoin's Stormy Seas: A Market Analysis

The intricate dance of Bitcoin's price fluctuations hints at a rather delicate and uncertain position for this digital asset. It's like navigating a treacherous river, where each twist and turn presents new challenges. In a recent report from the venerable ARK Invest, we find that short-term Bitcoin investors were seemingly pushed to a proverbial edge in the sweltering month of August. This brings to mind a ship caught in a tempest, forced to make tough decisions as it sails through the volatile seas of the cryptocurrency market. The report reveals a stark reality: the percentage of Bitcoin supply in profit plunged by a substantial 14 percentage points, resembling the ship's mast breaking in the midst of a storm.

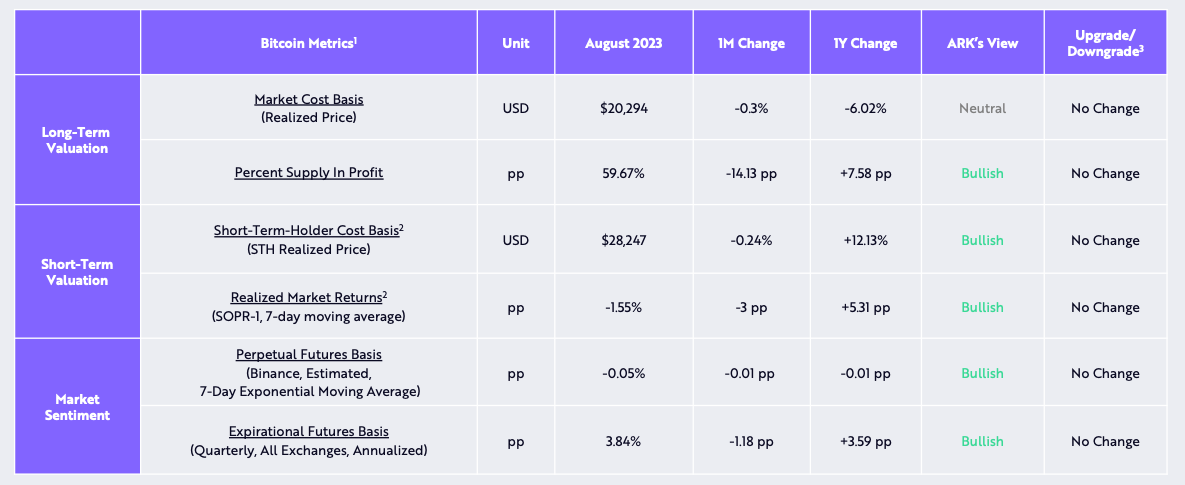

August's Bitcoin Market Sentiment and Monthly Valuation Shifts, Sourced from ARK Invest

August's Bitcoin Market Sentiment and Monthly Valuation Shifts, Sourced from ARK Invest

While seasoned traders often see significant price dips as opportunities, akin to seasoned sailors seizing moments of calm to mend their ship's rigging, the present phase of Bitcoin's journey adds a unique twist. It's as if the ship has entered uncharted waters, for Bitcoin's price has dipped below its 200-week moving average (MA) for the first time since the summer of 2023. This sudden change is akin to a ship's compass spinning wildly, leaving the crew disoriented.

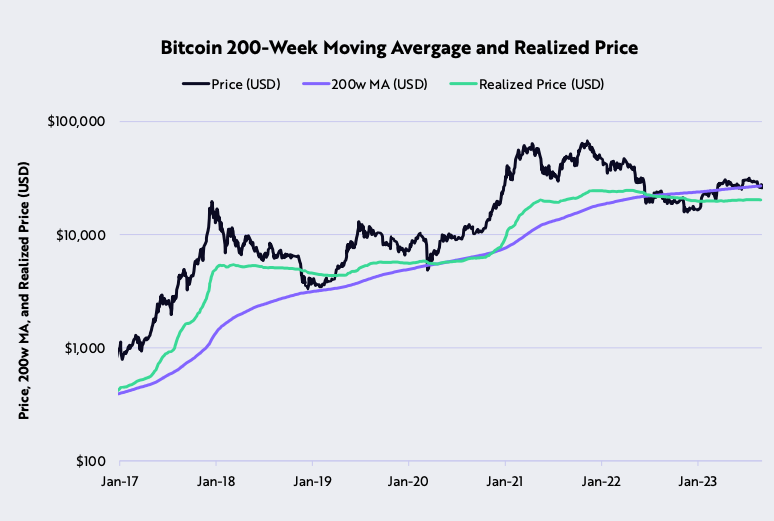

As illustrated in the chart below, the 200-week MA typically serves as a sturdy anchor during major downtrends, akin to a lighthouse guiding a ship safely to shore. Yet, ARK Invest suggests that potential future bearish winds could drive the BTC price to depths as low as $20,300, a destination currently occupied by its realized price. It's as if the ship's crew must brace for an impending storm, unsure of when it will strike.

Bitcoin's 200-Week Moving Average and Actual Price Trends, Sourced from ARK Invest

Bitcoin's 200-Week Moving Average and Actual Price Trends, Sourced from ARK Invest

Despite the rather gloomy short-term outlook that looms over the crypto market like a dark cloud, a more optimistic perspective on Bitcoin's descent below the 200-week MA reveals a silver lining. It's like finding treasure amidst the wreckage of a sunken ship. These dips below both realized prices and long-term moving averages have historically signaled cyclical buying opportunities. Much like explorers who stumbled upon hidden riches in the past, investors who seized these chances in 2019, 2020, and early 2022 found themselves basking in substantial profits within the following six months, a bit like discovering a chest of gold doubloons.

The astute analyst Ben Lilly recently drew parallels to a similar phenomenon within the Bitcoin dominance metric, painting a picture of Bitcoin once again taking the helm of the crypto ship. Picture this: Bitcoin as the captain, steering the ship through tumultuous seas. According to Lilly:

Dominance of Bitcoin in Market Capitalization, Sourced from TradingView

Dominance of Bitcoin in Market Capitalization, Sourced from TradingView

"In terms of price action, at this moment, I see a striking resemblance to the events of 2019. This has me anticipating a trend in Bitcoin over the next few weeks and possibly months. It revolves around Bitcoin dominance (BTC.D), a metric akin to the ship's position as the flagship of the crypto armada, based on its market capitalization. In the chart below, we can observe that the rally in 2019 set sail in 2018 when we witnessed a promising double bottom (highlighted in red), followed by a robust uptrend until Q1 2019. Subsequently, we navigated through a period of uncertainty for a few months (indicated by the first red arrow) before experiencing a monumental course correction on April Fools' Day (highlighted by the first green arrow)."

Comparing the sentiment of market participants from 2018-2019 to the present market sentiment is akin to comparing the ship's crew during a calm and prosperous voyage to their demeanor in the midst of a raging storm. Lilly suggests that the current price action resembles the pre-reversal period in 2019 when "we were in a winter, everybody's spirits were low, and interest in Bitcoin or crypto seemed to have frozen over, much like the ship's deck during a polar expedition."

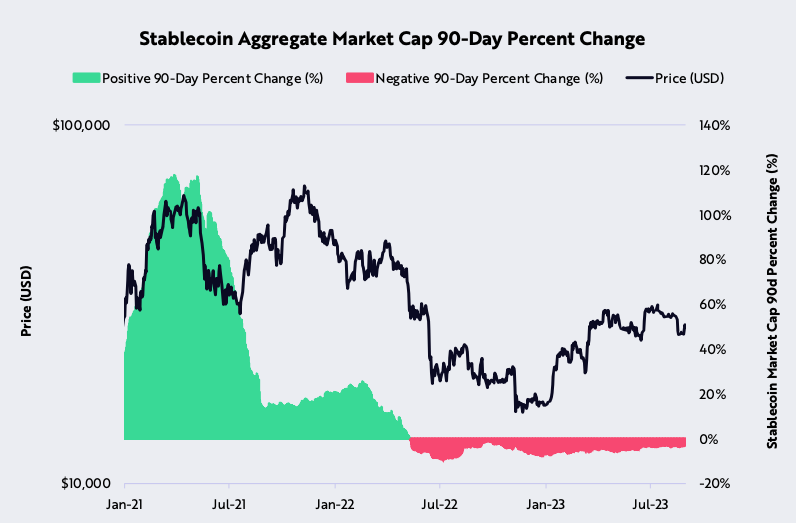

Furthermore, data on stablecoin market capitalization reveals a sea change in investor sentiment. According to ARK Invest, the decline in the 90-day supply of aggregate stablecoins from a substantial $162 billion back in March 2022 to a relatively modest $120 billion today mirrors a dwindling reservoir of market liquidity, reminiscent of a shrinking river in a dry season. Investors' confidence in engaging with Bitcoin and altcoins appears to have waned, akin to sailors hesitant to set sail in uncertain waters.

Percentage Change in the 90-Day Aggregate Market Capitalization of Stablecoins, Sourced from ARK Invest

Percentage Change in the 90-Day Aggregate Market Capitalization of Stablecoins, Sourced from ARK Invest

Certainly, the notion of spot Bitcoin exchange-traded funds (ETFs) is a beacon of hope on the horizon, much like a distant lighthouse guiding ships to safety. Yet, until one such ETF receives the much-anticipated approval or the narrative of the upcoming Bitcoin halving takes precedence over the "ETF approval triggering a bull market narrative," the prevailing market dynamics described above are destined to persist, much like a ship steadily navigating its course through unpredictable waters.

Trending

Press Releases

Deep Dives