Altcoin Rally: XRP, LINK, DOGE Surge While Bitcoin Stabilizes at $35K

- Stable BTC Amidst Altcoin Surge: Large-Caps Gain 5%-10%

- Decreasing Bitcoin Dominance Reflects Shift to Riskier Assets, Analysts Note

- ByteTree Analysts Anticipate Possible Altcoin Season, Adjust Portfolio Emphasis

In the midst of a recent surge in performance, there's a growing buzz surrounding the onset of "altcoin season." Unlike Bitcoin (BTC), which maintained a stable position around $35,000, alternative cryptocurrencies, commonly referred to as altcoins, saw impressive gains ranging from 5% to 10% on Monday. This shift indicates that investors are becoming more inclined towards riskier tokens.

Ripple's XRP experienced a remarkable spike of nearly 10% throughout the day, solidifying its position as the fourth-largest cryptocurrency by market capitalization, overtaking Binance's BNB. This surge was propelled by significant approvals for the company to operate and provide services in both Georgia and Dubai.

Other major digital assets also joined the upward trend. Native tokens for layer 1 networks like Cardano (ADA) and Avalanche (AVAX), as well as popular meme token Dogecoin (DOGE), the token associated with the Chainlink oracle network (LINK), and UniSwap's decentralized exchange token (UNI) all saw gains of 5% to 6% in the past 24 hours.

Blur's token (BLUR), from the non-fungible token (NFT) marketplace, saw an extraordinary 32% increase in its value today, doubling in price over the course of just one month. This surge comes in anticipation of the platform's plan to distribute 300 million tokens in an upcoming airdrop scheduled for November 20.

Meanwhile, Bitcoin maintained a tight trading range on either side of $35,000, and Ethereum (ETH) showed little change in its value.

Rising Altcoins: Bitcoin Dominance Declines, Hinting at Altcoin Season

While the outperformance of altcoins has only been sustained for a short period, it may signal a continued shift of profits from Bitcoin's impressive 30% rally in October towards lower-cap digital assets.

Bitcoin's dominance in the market capitalization has dipped from 54.3% in late October to 52.5% on Monday, according to TradingView data. This decline, after five consecutive weeks of increase, indicates a heightened interest in altcoins among investors, reflecting a potentially riskier market sentiment.

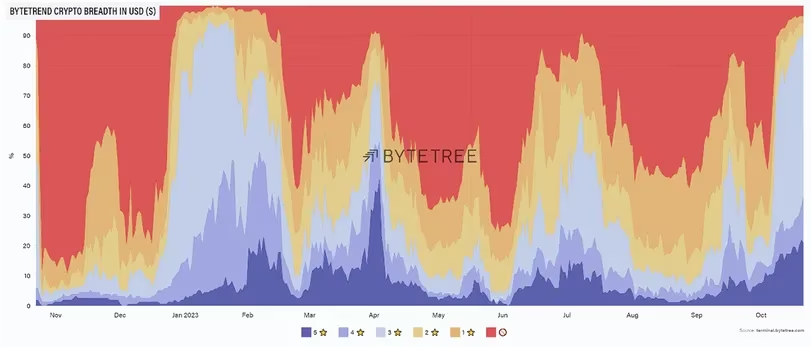

Leading investment advisory firm ByteTree hinted at the early stages of an "alt season," suggesting an extended period where the broader altcoin market outperforms Bitcoin's price. This is attributed to the improved market breadth of the crypto rally and the anticipated conclusion of the Federal Reserve's rate hiking cycle, creating a more favorable environment for riskier assets.

Enhanced Market Breadth: ByteTree's Assessment of the Crypto Rally

Enhanced Market Breadth: ByteTree's Assessment of the Crypto Rally

ByteTree analysts expressed a significant shift in their investment strategy, adding layer 1 protocol NEAR's token (NEAR), Bitcoin-based smart contract platform Stacks (STX), LINK, and XRP to their model portfolio by reducing the weight of BTC.

Despite the rally in BTC extending to altcoins, data from Blockchaincenter suggests that it has not yet reached the breadth required for a full-fledged altcoin season. Approximately 57% of the top 50 digital assets have outperformed BTC over the past 30 days, and 33% over the past 90 days, falling short of the 75% threshold needed to officially declare an altcoin season.

Read More: CryptoClimb: The Ascension of Digital Assets

Trending

Press Releases

Deep Dives