X: Transcending Finance

Rhode Island's regulatory authorities have officially granted X (commonly recognized as Twitter) a coveted currency transmitter license, which marks a significant leap forward in the company's strategic expansion into the dynamic realm of financial services.

The issuance of this license is not a mere formality, but rather a mandatory regulatory requirement for companies engaged in a spectrum of financial activities catering to users' needs encompassing the transmission and receipt of funds. This umbrella definition encompasses both the traditional fiat currencies and the burgeoning realm of cryptocurrencies. By obtaining this regulatory green light, X attains the operational capacity to securely store, seamlessly transfer, and even facilitate the seamless exchange of a diverse array of digital currencies.

The auspicious confirmation of X's Rhode Island Currency Transmitter License took place on the auspicious date of August 28, as meticulously documented within the records of the Nationwide Multi-State Licensing System (NMLS). This development holds more significance than meets the eye, as it represents a crucial juncture in Elon Musk's overarching vision of reshaping X into a multifaceted "all-inclusive application." This visionary concept encompasses not only the conventional financial landscape but also boldly extends to encompass the intricacies of cryptocurrency and its integration.

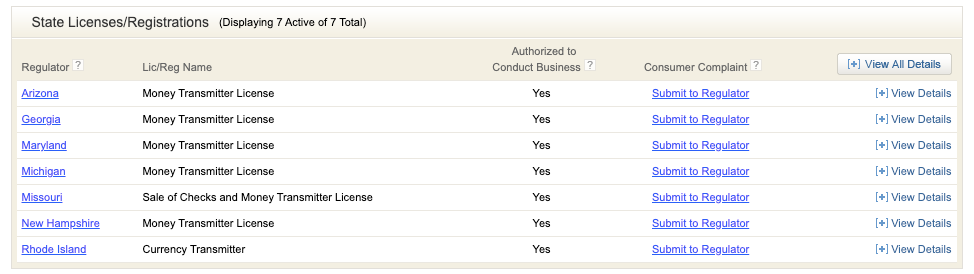

X holds a combined total of seven licenses for money transmission and currency transmission, as confirmed by the NMLS.

X holds a combined total of seven licenses for money transmission and currency transmission, as confirmed by the NMLS.

Amidst the nuanced whispers of insiders, it has been tentatively revealed that the imminent payment feature rollout from X will commence with a primary focus on extending support exclusively to the conventional fiat currencies. Yet, intriguingly, the grapevine suggests that Musk's strategic directives to X's adept developers are far-reaching, emphasizing the structuring of the payment platform as a pliable conduit, primed to seamlessly incorporate the nascent but transformative world of cryptocurrency functionalities as an evolution down the line.

This laudable regulatory approval is the culmination of a patient wait spanning almost a full two months since X achieved similar triumphant licensing victories in the states of Michigan, Missouri, and New Hampshire—a noteworthy feat unanimously cleared on the fifth of July. By adding this latest laurel to its crown, X proudly boasts an impressive tally of licenses in a sum total of seven American states, underscoring its versatile and widespread authorization.

Yet, amidst this celebratory milieu, the precise contours of the financial offerings that are poised to take center stage during X's impending unveiling of its innovative payment features remain tantalizingly obscured. Those privy to the inner workings of the company's strategic compass hint at a prelude marked by fiat currency-based transactions—a blueprint reminiscent of the pioneering path paved by Musk through his co-founding venture, PayPal. However, a key distinction lies in the underlying framework, meticulously designed with a fluid architecture that extends an eager hand of invitation to the eventual amalgamation of advanced cryptocurrency functionalities into its fold, when the time is ripe.

Trending

Press Releases

Deep Dives