Volatility Strikes: $256M Lost in Liquidations Amid Crypto Price Swings

The recent volatility in cryptocurrency prices has led to significant setbacks for traders. Coinglass data reveals that liquidations have resulted in losses of approximately $256 million in the past 48 hours. The head of research at FalconX, a company specializing in institutional exchange, noted that the diminishing open interest is likely to mitigate the effects of these liquidations on spot prices.

The initial wave of liquidations was triggered on Monday by concerns about FTX potentially divesting its crypto assets. This caused Bitcoin's value (BTC) to drop from the $26,000 range to below $25,000, a level not seen since mid-June. Ether (ETH) also hit a six-month low, and other major cryptocurrencies saw declines ranging from 5% to 10%.

Coinglass reports that this price shift led to $167 million in liquidations that day, with 90% of them being leveraged long positions. This marked the most significant single-day leverage flush-out since the turbulent activity on August 17, when Bitcoin rapidly fell from around $29,000 to below $25,000 within hours.

After Monday's sell-off, traders turned to short positions expecting further declines. However, an unexpected short squeeze on Monday night propelled digital asset prices upwards. Bitcoin saw a gain of over 4%, surging back above $26,000 by early Tuesday. This surge resulted in the elimination of another $89 million worth of leveraged positions, primarily shorts this time.

Major liquidation events often serve as indicators of potential price reversals, as the rapid price swings force derivatives traders to reassess their bets. Liquidations occur when an exchange closes a leveraged position due to the trader's partial or complete loss of initial margin, as they fail to add sufficient funds to maintain the position.

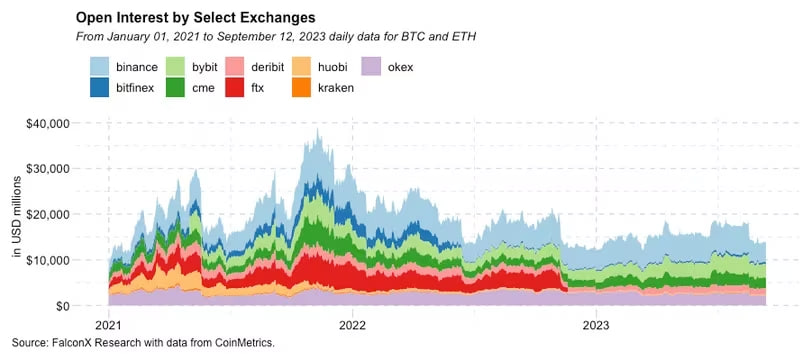

David Lawant, the head of research at FalconX, pointed out that open interest, representing the total amount of open options and futures contracts, has significantly decreased after previous major liquidation events. The open interest for BTC and ETH derivatives on major exchanges has dropped by approximately 38% from this year's peak and is now approaching the levels observed in March, according to the report. Bitcoin and Ethereum Open Interest

Bitcoin and Ethereum Open Interest

"The significant open interest washout over the past six months suggests that liquidations should have a less pronounced impact on spot price action," Lawant remarked.

Trending

Press Releases

Deep Dives