USDR Peg Challenge: A Deep Dive

The stablecoin known as USDR, with its foundation secured in real estate assets, faced a notable divergence from its intended 1:1 peg with the United States dollar. This shift was precipitated by an unforeseen surge in redemption requests, causing a rapid depletion of liquid assets within its treasury, notably including Dai. USDR, an acronym representing its stablecoin status, relies on a dual support system involving a mix of cryptocurrencies and real estate assets.

The predominant avenue for trading USDR is the Pearl decentralized exchange (DEX), a platform thriving within the realm of Polygon, a well-known blockchain network.

An update on $USDR

— Tangible ???????? (@tangibleDAO) October 11, 2023

Over a short period of time, all of the liquid $DAI from the $USDR treasury was redeemed.

This lead to an accelerated drawdown in the market cap.

Combined with the lack of DAI for redemptions, panic selling ensued, causing a depeg.

We’re working on…

Tangible, the entity spearheading this decentralized finance initiative, took to Twitter on October 11 to shed light on the unfolding events. They revealed that within a brief time frame, all liquid DAI assets from USDR's treasury were swiftly redeemed. This, in turn, initiated an accelerated downturn in its market capitalization. When compounded with the scarcity of DAI for fulfilling redemption requests, a consequential loss of peg ensued.

Around 11:30 am UTC, USDR experienced a significant sell-off, causing its value to plummet to a staggering low of $0.5040 per coin. Following this dramatic dip, the coin managed to regain some footing, stabilizing at around $0.53 in subsequent trading.

USDR loses its peg on Pearl DEX. Source: DEXScreener

USDR loses its peg on Pearl DEX. Source: DEXScreener

Despite grappling with an almost 50% reduction in its value, the project's development team remained resolute, assuring their intent to devise "solutions" to address this liquidity hurdle. They emphasized that the root cause was a transient liquidity challenge affecting the smooth process of redemptions.

In their own words, "This is primarily attributed to a liquidity issue. Rest assured, the underlying real estate and digital assets that underpin USDR are still securely held and will be utilized to facilitate redemptions."

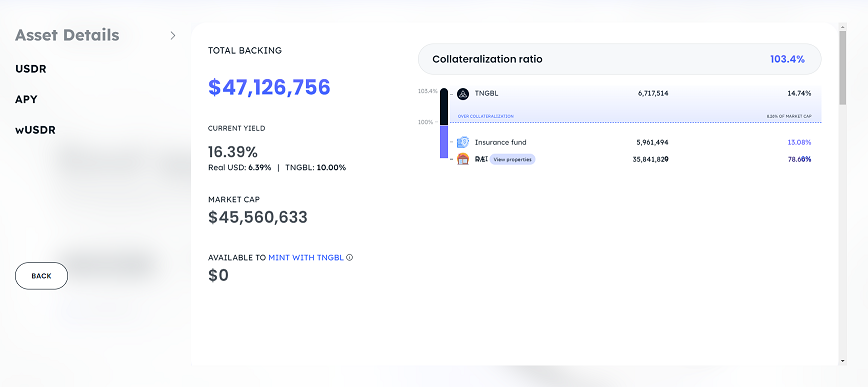

It's worth noting that despite the setback in their treasury, the official website of the application confirmed on October 11 at 9:57 pm UTC that the aggregate worth of their assets still surpassed the entire market capitalization of the coin.

USDR total backing vs. market cap. Source: Tangible

USDR total backing vs. market cap. Source: Tangible

Approximately 14.74% of the collateral backing USDR comprises Tangible (TNGBL) tokens, an integral element within the coin's native ecosystem. The development team affirmed that the remaining 85.26% is firmly backed by tangible real estate properties and a dedicated "insurance fund."

Stablecoins, as a concept, are devised to uphold a consistent value of $1 in the open market. However, in moments of extreme market volatility, these stablecoins occasionally find themselves straying from this intended peg.

As an illustrative example, consider Circle’s USD Coin (USDC), positioned as the sixth-largest cryptocurrency based on market capitalization as of October 11. On March 11, a tumultuous period for the financial sector, this stablecoin witnessed a decline to $0.885 per coin, attributed to financial upheaval within multiple U.S. banks. Nonetheless, commendably, it managed to regain its intended peg by March 14. In stark contrast, Terra’s UST faced a similar loss of peg in May and, regrettably, hasn't made a full recovery; the prevailing value stands at a mere $0.01 per coin as of October 11, based on data gleaned from CoinMarketCap.

Read more about: Slashing Saga: Lido's ETH Staking Woes

Trending

Press Releases

Deep Dives