- Home

- Latest News

- Terra's Crypto Surge: A 300% Rally Sparks Bitcoin-Centric Resurgence, Igniting Speculative Frenzy with Binance Perpetuals Listing

Terra's Crypto Surge: A 300% Rally Sparks Bitcoin-Centric Resurgence, Igniting Speculative Frenzy with Binance Perpetuals Listing

USTC and LUNC tokens, remnants from the downfall of the Terra ecosystem, are experiencing a resurgence as a dedicated group of community members strives to rejuvenate their value. TerraClassicUSD (USTC) witnessed an extraordinary 300% surge in just one week, driven by the prospect of a bitcoin-backed revival and the inclusion of a Binance perpetual contract, sparking heightened speculation.

The Terra ecosystem, once a dominant force that crumbled in May, is anchored by USTC and LUNC. The current week has witnessed a remarkable surge in TerraClassicUSD (USTC) and its counterpart Terra luna classic (LUNC), both emerging from the ruins of the fractured Terra blockchain. This surge was ignited by the introduction of a Binance perpetuals contract and the revelation of a bitcoin-focused revitalization plan, accompanied by an airdrop initiative.

LUNC experienced a notable 60% increase over the week, with an additional nearly 20% surge in the past 24 hours. Conversely, USTC saw its value nearly quadruple. Despite this surge, USTC's price remains at $0.05, significantly lower than its original peg of $1.

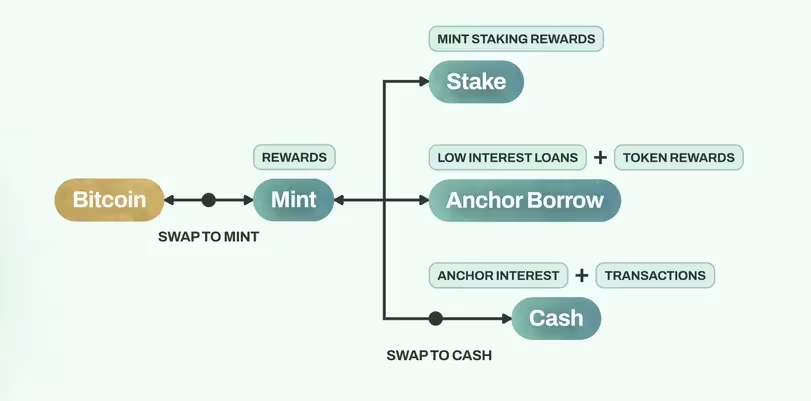

Despite facing regulatory hurdles, Binance played a crucial role in these recent developments. The exchange introduced perpetual contracts for USTC, offering leverage of up to 50x. The anticipation of a USTC revival, with bitcoin as its anchor, further fueled the market rally. Mint Cash, a bitcoin-centric payment project, proposed an alternative to Terra's failed stablecoin, aiming to secure it with BTC for token minting.

Mint Cash Unveils Groundbreaking Stablecoin Proposal: Revolutionizing Crypto Stability

Mint Cash Unveils Groundbreaking Stablecoin Proposal: Revolutionizing Crypto Stability

The development team also disclosed plans for an airdrop benefiting USTC and LUNC holders, intensifying speculative activity. USTC experienced an explosive surge in trading volume, peaking at times above $1 billion in 24-hour activity, a significant contrast to the sub-$10 million average earlier in the month, according to CoinGecko data.

$ust & anchor making a return, this time backed by bitcoin

— IAN (@cryptoian) November 25, 2023

will be interesting to see the stablecoin experiment continue

airdropped planned for pre-crash $luna & $ust holders and also new $ustc holders via some sort of lockdrop

could be a decent play for $ustc here just in… https://t.co/7BWe8MXkoq

Terra's Legacy: Unveiling the Resilient Remnants of a Crypto Empire

LUNC and USTC stand as remnants of the sibling tokens that once supported the colossal yet failed Terra ecosystem. Developed by Terraform Labs and overseen by co-founder Do Kwon, who faced arrest earlier this year, USTC functioned as an algorithmic stablecoin, while LUNC, previously known as LUNA, maintained the stablecoin's $1 peg. The unsustainable design resulted in a hyperinflationary collapse in May, leading to the demise of the entire multibillion-dollar Terra ecosystem.

In February, the U.S. Securities and Exchange Commission (SEC) charged Terraform Labs and Kwon with orchestrating a "multi-billion dollar crypto asset securities fraud." Kwon's arrest in March, involving forged passports in Montenegro, received court approval for extradition to the U.S. or South Korea.

Following the collapse, developers introduced a new version of the Terra blockchain, introducing a fresh native token called LUNA. The old blockchain underwent a rebranding as Terra Classic, with tokens now named LUNC and USTC. Despite the obstacles, a dedicated group of developers remains committed to revitalizing the Terra Classic ecosystem. Community decisions, such as ceasing the creation of new USTC tokens and implementing token burning strategies, underscore their commitment to stabilizing the hyperinflated supply.

Read More: ARK's Financial Maneuvers: Navigating Crypto Currents

Trending

Press Releases

Deep Dives