Survey Finds 'Long Big Tech' Still Dominates Crowded Trades, According to BofA Fund Managers

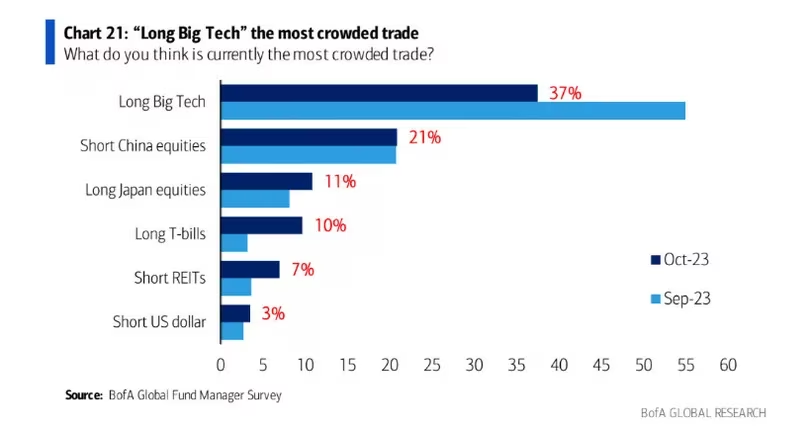

The prevalence of the "long big tech" trade, where investors hold bullish positions in technology companies with substantial market capitalization, is causing concerns in financial markets. Bank of America's (BofA) October survey of 295 fund managers, collectively overseeing $736 billion in assets, revealed that this trade is currently considered the most crowded. The survey, conducted from October 6 to 12, reflects a market preference for this trade, often leading to complacency about its profit-generating potential.

Crowded trades, while popular, can become vulnerable to a loss of investor confidence, resulting in substantial unwinding of positions and market turbulence. In this context, the excessive popularity of the long-big-tech trade could trigger disruptions.

This situation may have an adverse impact on the cryptocurrency market, particularly on Ether (ETH), which is often likened to a technology stock. Bitcoin (BTC), on the other hand, is commonly referred to as digital gold.

According to Noelle Acheson, the author of the widely-read Crypto Is Macro Now newsletter, "the most crowded trade" usually implies that a category, in this case, Big Tech, is potentially overvalued and at risk of a significant correction. The consequences of such an event may not bode well for the crypto market.

The allure of the "long big tech" trade is potentially indicative of overvaluation in technology stocks, suggesting a possibility of a sharp correction in the near future. This situation highlights the interconnectedness of traditional financial markets and the crypto space, as sentiment shifts in one area can reverberate in the other. The top crowded trade is "long big tech" at 37%, and it's followed by "shorting China equities." (BofA Global Research, Crypto is Macro Now)

The top crowded trade is "long big tech" at 37%, and it's followed by "shorting China equities." (BofA Global Research, Crypto is Macro Now)

Read more: Blockchain ETF Boost: BlackRock's Key Move

Trending

Press Releases

Deep Dives