- Home

- Latest News

- Sui Foundation Disputes Supply Manipulation Report as 'Materially Inaccurate

Sui Foundation Disputes Supply Manipulation Report as 'Materially Inaccurate

In a recent twist of events, the SUI token, which is native to a blockchain platform pioneered by former Meta (META) employees, encountered a substantial downturn, plummeting by nearly 9% within a single day. This sudden drop was precipitated by concerns raised in a report regarding potential supply manipulation via staking. Lee Bok-Hyeon, the director of the South Korean Financial Supervisory Service, announced an intention to initiate an inquiry into whether the Sui team had engaged in manipulative practices concerning the token's supply. This article delves into the complexities of these allegations and the subsequent reactions from the Sui Foundation.

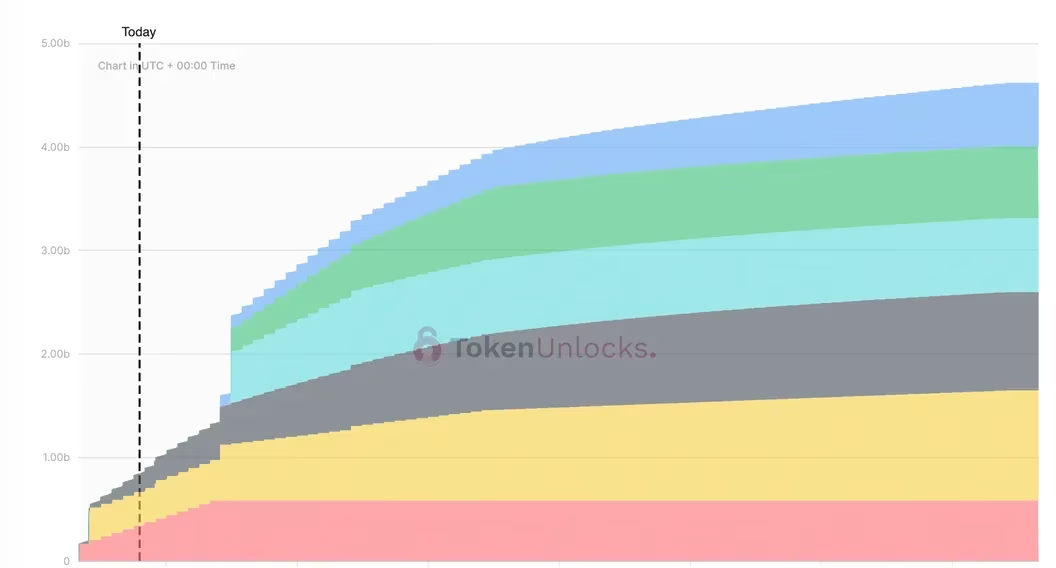

Token unlocks (Data by Token.Unlock)

Token unlocks (Data by Token.Unlock)

Lee Bok-Hyeon's declaration to meticulously examine SUI's operations, particularly to establish whether the team intentionally inflated the supply through staking or engaged in unfair disclosure, sent shockwaves through the cryptocurrency community. This move underscores the escalating regulatory interest in ensuring transparency and integrity within the cryptocurrency space.

Swiftly responding to the accusations, the Sui Foundation vehemently refuted any misconduct. A spokesperson stressed that the Foundation has never partaken in the sale of SUI tokens subsequent to the initial Community Access Program (CAP) distributions. Furthermore, they affirmed their dedication to collaborating with DAXA and its member exchanges, emphasizing a commitment to complete compliance and openness. The circulating supply schedule, accessible via public API endpoints and the Sui Foundation's official website, was also reaffirmed to be precise.

The Sui Foundation clarified earlier allegations in June, asserting that they had not engaged in the sale of staking rewards or any other tokens derived from locked and non-circulating staked SUI on Binance or any other platform. This statement was issued in response to assertions made by decentralized finance (DeFi) researcher DefiSquared, who accused deliberate misrepresentation of emission rates and charged the project with "dumping tokens on Binance."

At present, SUI is trading in close proximity to an all-time low of $0.3796. This signifies a notable drop of approximately 78% from its debut in May, according to data sourced from CoinMarketCap. The recent events undeniably have made a significant impact on the token's market performance.

As per data gleaned from token.unlocks, a substantial $336 million worth of tokens have been unlocked since the token's inception. Among these, $72 million has been earmarked for stake subsidies, $129 million allocated towards the community reserve, and $139 million disseminated through the community access program. Notably, Series A and Series B investors are slated to gain access to their tokens in May 2024, with tokens valued at $290 million scheduled for unlocking.

The recent happenings surrounding the SUI token stand as a testament to the evolving regulatory framework and the criticality of transparency in the cryptocurrency ecosystem. As the investigation unfolds and market dynamics continue to evolve, the crypto community watches with great interest for further updates on this intriguing saga.

Read more: SEC Argues Against Coinbase's Bid to Dismiss Lawsuit

Trending

Press Releases

Deep Dives