Strategic Crypto Maneuvers Amid Market Swings

A substantial holder of Ethereum (ETH), known in the crypto world as a "whale," recently made a shrewd move that diverged significantly from the norm. This crypto aficionado, owning a considerable amount of Ether, decided to execute a strategic maneuver just days prior to a tumultuous market downturn, skillfully sidestepping a potential loss of up to $5 million.

This tactical play did not go unnoticed, catching the discerning eye of Lookonchain, a platform specializing in blockchain analysis. On the 18th of August, this astute whale deposited a whopping 22,341 ETH onto the Binance exchange, only to swiftly withdraw an impressive $41 million in Tether (USDT), which had a fixed value of $1.00 per unit at that time.

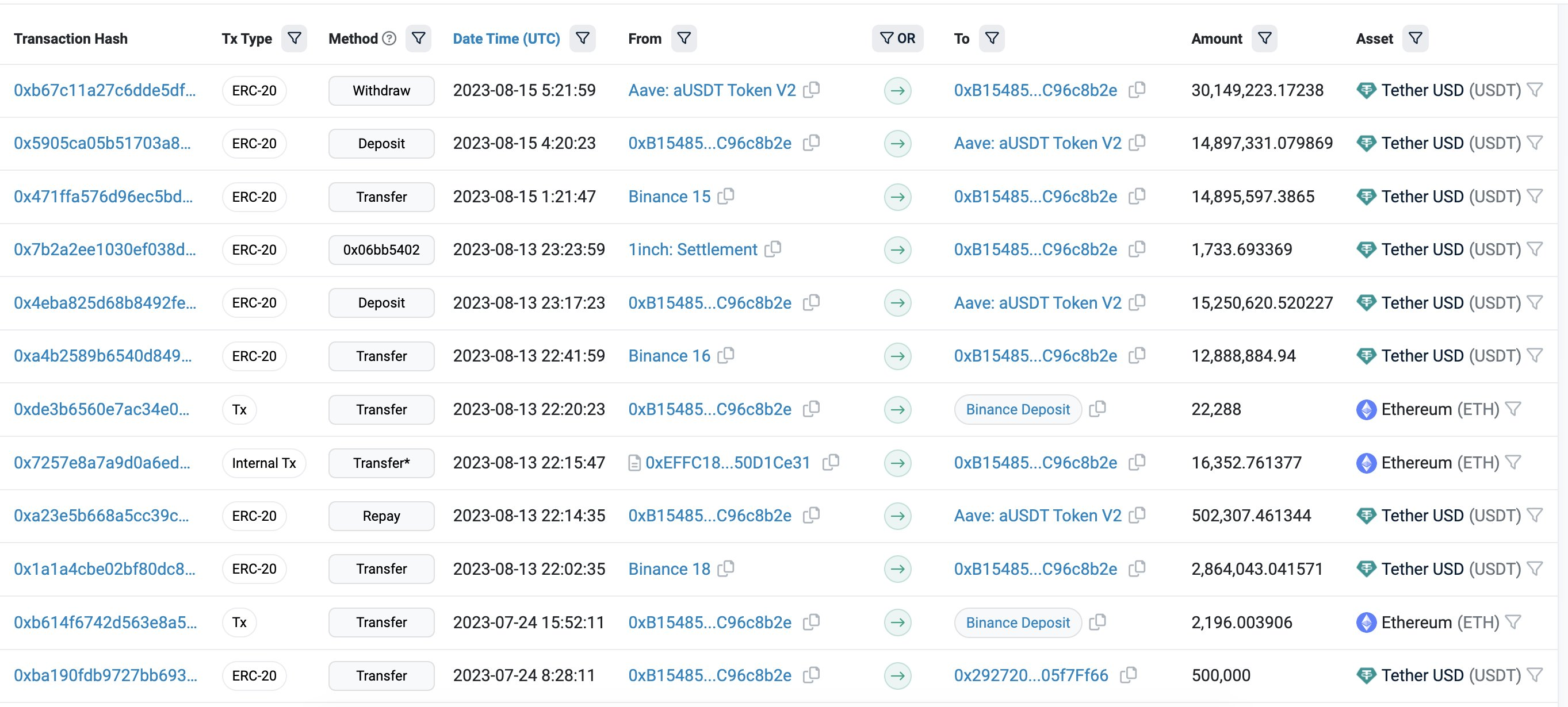

The sequence of transactions conducted by this player can be traced back, revealing a sequence of actions that undoubtedly set the stage for their financial prowess. (Image Source: Etherscan)

The sequence of transactions conducted by this player can be traced back, revealing a sequence of actions that undoubtedly set the stage for their financial prowess. (Image Source: Etherscan)

While the whale did incur a depreciation of approximately $1.7 million in overall asset value, the trader's prescient maneuver ensured the avoidance of potential losses that could have easily snowballed to exceed the $5 million mark. This strategic decision proved even more valuable given the market's subsequent turmoil. On that fateful August 18th, the cryptocurrency market witnessed a substantial decline of 6%, causing the collective market capitalization to dwindle to $1.1 trillion - a threshold not observed for at least two months.

Ether, positioned as the second-largest cryptocurrency by market capitalization, underwent a notable price correction, plunging from its preceding value of approximately $1,820 per token on August 17th to a diminished $1,597 on the subsequent day. Parallelly, Bitcoin (BTC), a dominant player comprising half of the cryptocurrency landscape, exhibited a similar decline. Bitcoin's price, initially at around $28,400, experienced a dip to $25,649 within the same timeframe. However, Bitcoin staged a rapid recovery, rebounding to a level surpassing $26,000 in a matter of hours.

These intriguing market dynamics followed in the wake of a report unveiled by prominent mainstream media outlet, The Wall Street Journal. The report spotlighted that SpaceX, the aerospace technology venture led by Elon Musk, had made a significant markdown of $373 million attributed to Bitcoin holdings held from 2021 to 2022. Curiously, the details surrounding the status of these holdings remained somewhat enigmatic, with uncertainty lingering as to whether the entire cache was liquidated or not.

Amidst this backdrop, a wave of bewilderment swept through the cryptocurrency community. Divergent interpretations emerged from various media sources, some asserting that the entirety of the holdings had been offloaded, while others found themselves unable to verify the extent of the sale based on the verbiage employed within the report. Within the realm of the social media platform X (formerly known as Twitter), certain users directed pointed remarks toward Musk, insinuating that his disposition mirrored the concept of "paper hands," a colloquial expression describing an inability to retain cryptocurrencies over the long haul.

Trending

Press Releases

Deep Dives