Steady Signals: Bitcoin and Ether Options Order Books Amid Escalating Risks

Recent market data reveals an intriguing trend in the bitcoin and ether options markets, indicating a prevailing preference for selling. This inclination, marked by a bid-ask ratio consistently below one, suggests a proclivity for volatility selling. In this article, we delve into the factors contributing to this phenomenon and its potential implications for cryptocurrency traders.

The bid-ask ratio, a key metric in options trading, has shown a consistent bias towards asks in both bitcoin and ether options. This reflects a predisposition towards selling, implying an anticipation of prolonged periods of subdued market volatility. This strategic approach aims to capitalize on phases of reduced price fluctuations, emphasizing an expectation for a market characterized by relative stability.

Despite escalating tensions in the Middle East and the potential for increased global economic risks, cryptocurrency traders remain remarkably composed. This sentiment is vividly reflected in the order flow within the bitcoin (BTC) and ether (ETH) options market. The prevailing bias towards selling options underscores a confidence in navigating a market environment marked by lower volatility.

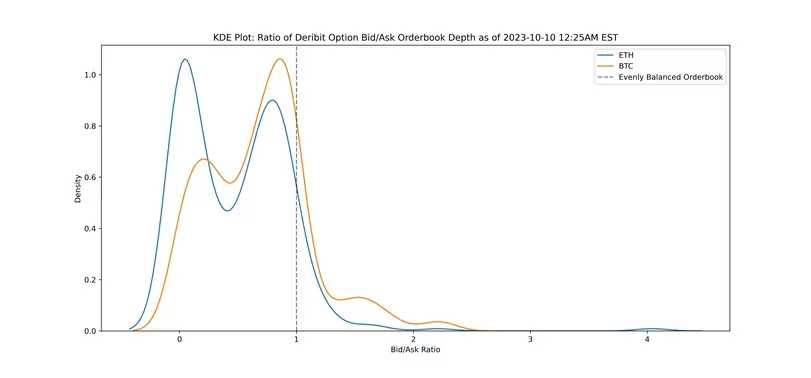

Renowned crypto quant researcher, Samneet Chepal, highlights this observed trend, noting that Deribit's option order books consistently favor selling volatility. The bid/ask ratio, consistently leaning below one, signifies a strong inclination towards selling, contrasting with a ratio above one, which suggests a preference for buying.

Options, as derivative contracts, confer the right to buy or sell an underlying asset at a predetermined price in the future. Calls provide the right to buy, while puts grant the right to sell. The ask price denotes the seller's willingness to sell, while the bid price reflects the buyer's readiness to purchase.

As the largest crypto options exchange globally, Deribit commands significant open interest and trading volumes, overseeing over 85% of the global activity in bitcoin and ether options. This prominence underscores the influence of Deribit on shaping market dynamics.

Historically, geopolitical events, central bank actions, and economic data releases have driven traders towards options buying. This strategy stems from the belief that such events can lead to substantial market fluctuations.

Despite the turbulent global landscape, both bitcoin and ether have demonstrated a period of relative stability. Bitcoin, with its leading market capitalization, has maintained a narrow range of $27,000 to $28,500 this month, while ether has oscillated within a two-month range of $1,550 to $1,750.

The ratios are skewed below 1, indicating a preference for selling volatility, as noted by Samneet Chepal.

The ratios are skewed below 1, indicating a preference for selling volatility, as noted by Samneet Chepal.

Examining the bid-ask order book depth ratio in early Asian hours on Deribit, a ratio below 1 indicates a preference for sell trades. This aligns with the ongoing reduction in implied volatility (IV) for both bitcoin and ether since the start of the year. IV, a reflection of investors' price fluctuation expectations, is directly influenced by options demand.

The prevailing selling bias in the bitcoin and ether options markets unveils a strategic approach adopted by traders to navigate a market environment marked by reduced volatility. Understanding this trend provides valuable insights for market participants seeking to make informed decisions in an ever-evolving cryptocurrency landscape.

Read more: Anticipating a Near $5 Billion Expiry: Bitcoin and Ether Options in Focus

Trending

Press Releases

Deep Dives