- Home

- Latest News

- Stanford's Financial Decision: Navigating FTX Waters

Stanford's Financial Decision: Navigating FTX Waters

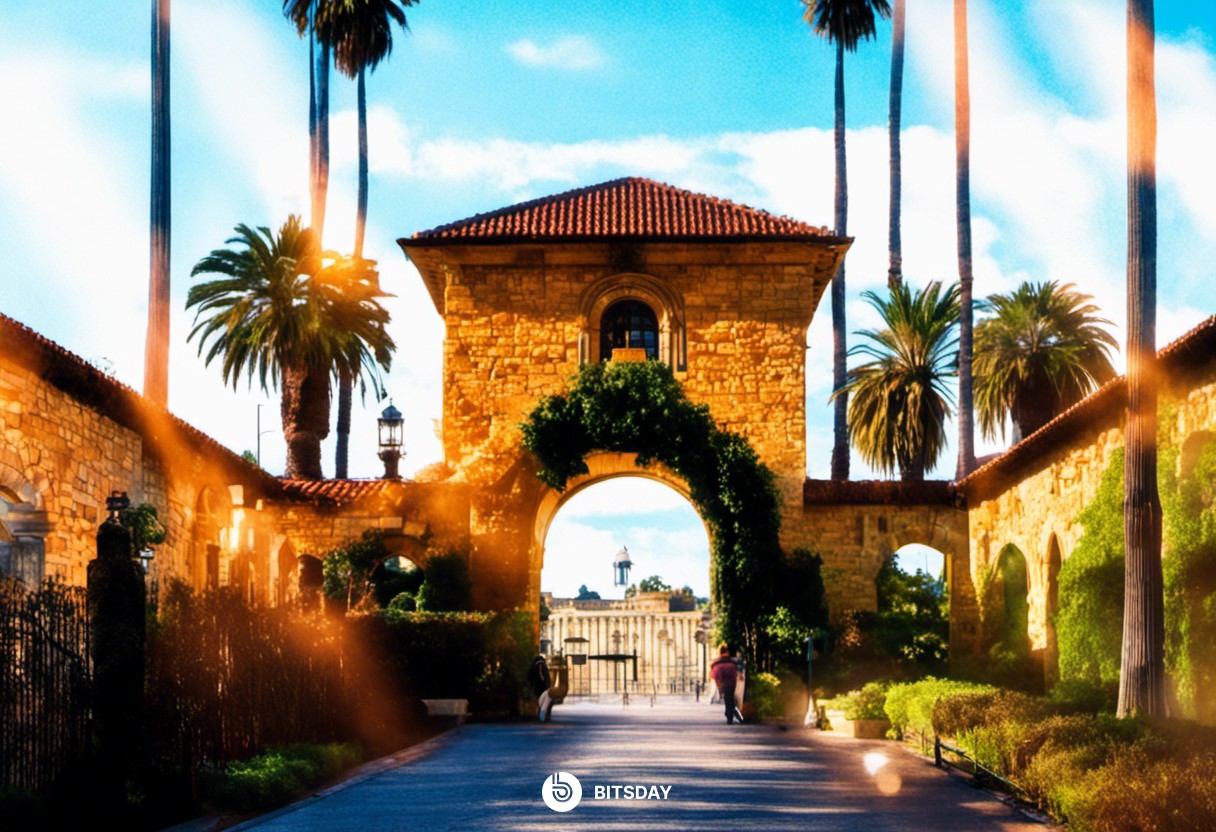

Stanford University, a prominent academic institution situated in the sunny state of California, made a resolute announcement to gracefully return the funds it had previously accepted from the now-defunct cryptocurrency exchange FTX. This decision, as elegantly detailed in a report by the reputable Bloomberg, reflects the university's commitment to ethical financial practices.

In the period stretching from November 2021 to May 2022, FTX-affiliated entities generously bestowed a considerable sum totaling $5.5 million in the form of generous gifts upon Stanford. These financial gestures, akin to gentle waves caressing the shore, arrived at intervals during this timeframe. In a polite and articulate email statement dated September 19, a representative from the esteemed university conveyed their well-considered decision and perspective:

We have been in discussions with attorneys for the FTX debtors to recover these gifts and we will be returning the funds in their entirety.

The communication from Stanford aimed to provide a lucid understanding that the contributions it had gracefully received were intended to bolster pandemic-related prevention and in-depth research efforts. These contributions, akin to a refreshing rain shower during a drought, predominantly hailed from the FTX Foundation and related companies.

It's important to highlight the familial and academic ties that intertwine in this narrative. Both of Sam "SBF" Bankman-Fried's parents, namely Alan Bankman and Barbara Fried, are esteemed legal scholars who have shared their knowledge and wisdom as educators at Stanford Law School, adding an intellectual richness to this intricate story.

Stanford's principled decision to distance itself from the financial assistance tendered by FTX arrives amidst a backdrop of allegations levied against SBF's parents, implicating them in the alleged misappropriation of substantial funds from the cryptocurrency exchange. These accusations, akin to ripples in a tranquil pond, have stirred a legal commotion.

On a significant day, precisely on September 18, creditors of FTX initiated a legal ballet, a carefully choreographed lawsuit against the couple. The lawsuit waltzed into the legal realm, alleging that their involvement with the exchange was like a clandestine tango, allowing them to sway and whirl into wrongful enrichment, both directly and indirectly, by millions of dollars. This intricate dance of legal proceedings was meticulously detailed in court documents, akin to a well-orchestrated musical composition.

The legal filings, akin to the intricate notes in a symphony, asserted that Bankman extended his considerations to Fried, blending their hopes and concerns about his yearly compensation of $200,000, notes that were left unaddressed by SBF or FTX US.

In this legal symphony, there's an interlude that highlights Bankman's expectations, a crescendo of ambition. He envisioned an annual salary of $1 million, a note of aspiration that resonates in the corridors of legal discourse.

Turning the pages of this legal saga to September 19, the plot thickens as SBF's legal ensemble takes center stage, passionately arguing for his early release from custody. This legal drama, reminiscent of a Shakespearean tragedy, aims to provide ample time for rehearsing the upcoming trial, set to unveil its curtains in the month of October.

During the courtroom drama, one of the learned judges, akin to a discerning theater critic, was noted to remark that SBF's legal arguments, akin to dialogues in a play, regarding his First Amendment rights "hold no ground." This critical analysis emerged due to documented attempts, akin to plot twists, where SBF allegedly sought to intimidate witnesses, including the former CEO of Alameda Research, Caroline Ellison. The courtroom drama continues to unfold, with each act revealing new dimensions to this riveting narrative.

Read more about: Stability Persists: Bitcoin and Ether Face Bearish Outlook from Analysts

Trending

Press Releases

Deep Dives