Stablecoin Renaissance: Surge of Fresh Capital into Crypto Markets Ends 18-Month Downturn

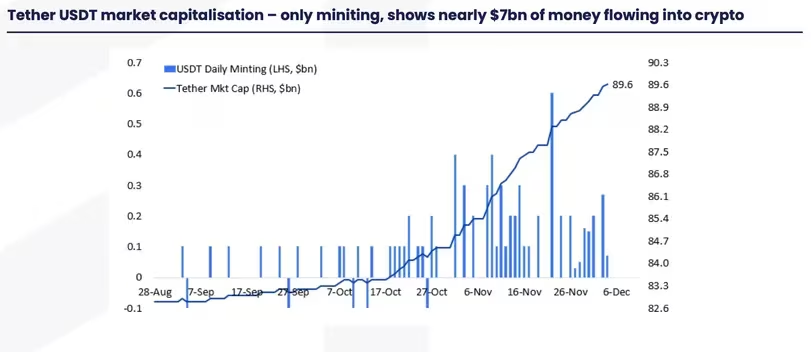

Tether's USDT has seen a remarkable upswing, contributing $7 billion to its market capitalization since September, according to insights from Matrixport. This substantial uptick signifies a notable surge in capital inflow into the cryptocurrency market. Noteworthy is the recent expansion of the stablecoin market, breaking a hiatus dating back to May 2022, with Tether's USDT emerging as the primary beneficiary, reaching an unprecedented peak supply of almost $90 billion.

This reversal in market dynamics acts as a promising signal of improved liquidity within the crypto space, credited to the increasing capital entering the ecosystem, as highlighted by analysts. The renewed interest in cryptocurrencies is evidenced by the growth of the stablecoin market, marking the conclusion of an 18-month downtrend. Tether's USDT, achieving an all-time high market capitalization of $89 billion, takes a leading role in this resurgence.

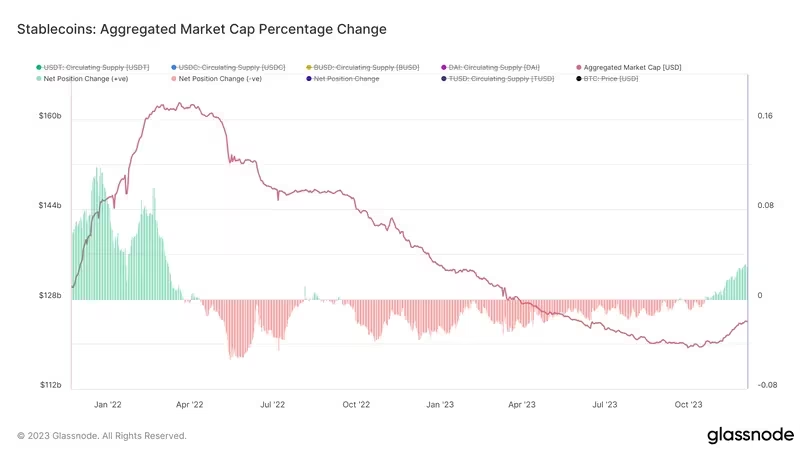

According to data from Glassnode, the collective market capitalization of the most significant stablecoins has surged by nearly $5 billion in the past month alone, reaching a cumulative value of $124 billion. This substantial expansion represents a noteworthy departure from the protracted downturn that began in May 2022, aligning with the onset of the challenging crypto winter.

Revitalizing Trends: After 18-Month Slump, Stablecoin Market Cap Experiences Resurgence, According to Glassnode

Revitalizing Trends: After 18-Month Slump, Stablecoin Market Cap Experiences Resurgence, According to Glassnode

Stablecoins, serving as digitized equivalents of traditional currencies, play a pivotal role in facilitating transactions within the crypto ecosystem. Operating as a crucial bridge between fiat currencies and blockchain-based digital asset markets, stablecoins offer liquidity for trading and lending to market participants. Consequently, the reversal in the size of the stablecoin market is considered a positive indicator for the overall health of the recent crypto rally.

Record-Breaking Surge: Tether Supply Reaches Unprecedented Heights

Tanay Ved, an analyst at Coin Metrics, interprets this upward trajectory as a leading sign of enhanced on-chain liquidity, indicating an environment where more capital is ready for deployment. The surge is predominantly driven by Tether (USDT), the largest stablecoin in terms of market capitalization, widely utilized on centralized exchanges and for transactions in the developing world. Its supply has experienced a noteworthy uptick of $7 billion since September, with a substantial surge observed since mid-October.

Surging Demand: Tether USDT Minting on the Rise Since Mid-October, Highlighting Growing Interest, as Reported by Matrixport

Surging Demand: Tether USDT Minting on the Rise Since Mid-October, Highlighting Growing Interest, as Reported by Matrixport

Despite the consistent growth in USDT's market capitalization throughout 2023, nearing $90 billion, CoinGecko data suggests that this growth was somewhat counterbalanced by the contraction of competitors like USDC and BUSD until recently. Noelle Acheson, an analyst and author of the Crypto Is Macro Now newsletter, interprets the upward trend as a positive signal for crypto assets, indicative of growing investor interest. However, she acknowledges that the total stablecoin market capitalization remains below levels observed earlier this year, emphasizing that it is still early to assess the overall market outlook.

Read More: SOL Dynamics: Charting Resistance and Support

Trending

Press Releases

Deep Dives