SEC Deadlines, Grayscale Victory, and Binance Moves: A Crypto Update

In the approaching days ahead, the U.S. Securities and Exchange Commission finds itself at a pivotal juncture, as it readies to navigate through a series of impending deadlines. These deadlines hold significant weight as they mark the initial milestones in the evaluation process for seven distinct Bitcoin exchange-traded funds (ETFs). This scenario unfolds against the backdrop of Grayscale Investments' recent legal triumph over the SEC and Binance's strategic decision to remove one of Venezuela's leading banks from its peer-to-peer trading platform as an accepted payment avenue.

Ticking Clock for SEC's Verdict on 7 Bitcoin ETFs

The corridors of the U.S. Securities and Exchange Commission are abuzz with activity as it races against time over the course of the next six days. These days are no ordinary days, for they represent the imminent deadlines that will shape the fate of seven proposed spot Bitcoin exchange-traded funds (ETFs). This unfolding drama comes hot on the heels of the SEC's recent courtroom setback courtesy of Grayscale Investments.

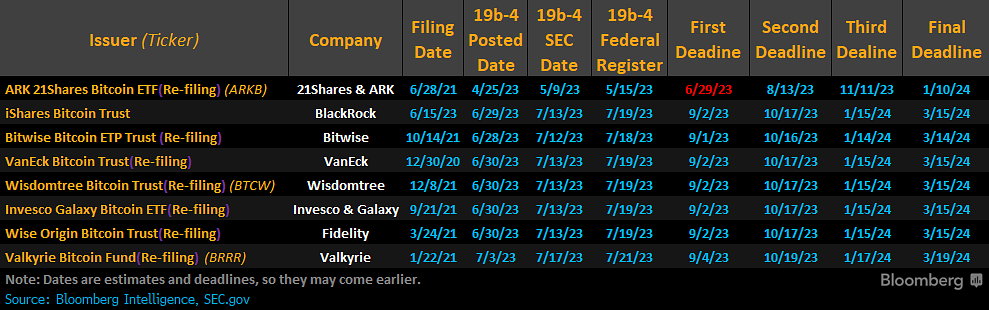

The SEC's inaugural deadline, scheduled for September 1, serves as the moment when the Commission's decision regarding the destiny of Bitwise's ETF proposal is expected to emerge. Swiftly thereafter, on September 2, the financial world will be holding its collective breath as the SEC unveils its judgments on ETF proposals brought forth by industry titans like BlackRock, VanEck, Fidelity, Invesco, and Wisdomtree.

Concurrently, Valkyrie stands on the threshold of receiving its initial feedback from the SEC on September 4.

The initial due dates for the recent batch of Bitcoin spot ETF applications are approaching within the upcoming days, as reported by Bloomberg.

The initial due dates for the recent batch of Bitcoin spot ETF applications are approaching within the upcoming days, as reported by Bloomberg.

Steering the conversation, ETF analyst James Seyffart, in an insightful interview with Bloomberg on August 29, acknowledged that Grayscale's legal victory unquestionably tilts the scales in favor of a positive outcome for the incoming wave of ETF aspirants. However, Seyffart also highlighted a nuance—namely, the SEC retains the prerogative to elongate its decision-making process. This prerogative is anchored in the existence of two additional rounds of deliberation for each fund, prior to the regulatory body being compelled to render its final verdict on the 240th day post-filing.

For those entities awaiting their turn in the SEC's spotlight, the journey of uncertainty culminates in a unified date: the middle of March in the subsequent year.

Grayscale's Inroads in the Bitcoin ETF Pursuit

In a legal saga that's been closely monitored, the scales of justice have tilted in favor of Grayscale in its legal showdown with the U.S. Securities and Exchange Commission. This victory is a significant milestone in the crypto asset management firm's ongoing crusade to usher in a new era with the introduction of a Bitcoin exchange-traded fund (ETF).

On the pivotal date of August 29, the U.S. District of Columbia Court of Appeals delivered a verdict echoing in favor of Grayscale. The central tenet of the ruling is that the SEC's prior rejection of Grayscale's endeavor to convert its GBTC fund into a Bitcoin ETF was, in fact, unfounded. The SEC's rationale had hinged on its assertion that Grayscale's proposal inadequately addressed the imperative of thwarting fraudulent and manipulative practices in the crypto space.

???? JUST IN ????

— Sonnenshein (@Sonnenshein) August 29, 2023

The D.C. Circuit ruled in favor of @Grayscale in our lawsuit challenging the SEC's decision to deny $GBTC's conversion to an ETF!

Thank you to everyone who has been on this journey with us, especially our investors. We are grateful for your support and…

Judge Neomi Rao, in her assessment, pointedly noted the SEC's deficiency in providing a coherent rationale for its decision to decline Grayscale's application.

However, it's imperative to underline that this courtroom victory does not translate to an immediate green light for Grayscale's Bitcoin ETF aspirations. Yet, the echoes of this legal triumph have the potential to reverberate significantly within the SEC's chambers of consideration, influencing the direction of thought surrounding pending Bitcoin ETF applications, including those laid forth by industry heavyweights like BlackRock, Fidelity, and WisdomTree.

Binance's Strategic Revisions: Banco de Venezuela's Omission from P2P Payments

The epicenter of the cryptocurrency realm, Binance, has orchestrated a strategic alteration by eliminating Banco de Venezuela as an eligible payment avenue on its peer-to-peer trading service. This strategic maneuver mirrors a similar course taken vis-à-vis sanctioned Russian banks in the preceding week. Notably, this move can be discerned as Binance's endeavor to harmonize with the contours of international financial sanctions.

Insights gleaned from the Venezuelan user base provide a glimpse into the shifting landscape. Banco de Venezuela has conspicuously vanished from the array of payment options within Binance's peer-to-peer trading realm. This vanishing act follows a pattern set in motion by the ejection of Russian banks from this space. The crux of this strategic action lies embedded within the folds of The Wall Street Journal's investigative report, published on August 24. The report cast a spotlight on Binance's alleged involvement in skirting international financial sanctions.

Within Venezuela, Banco de Venezuela has enjoyed a substantial presence within the financial tapestry, historically holding its ground as the third-largest player with an impressive market share surpassing 11%. Its history is intertwined with a 2009 sale to the state, a transaction that saw Grupo Santander, a private holding entity, relinquishing ownership for a sum of around $1 billion. The roots of sanctions trace back to 2018 and 2019 when the U.S. Treasury Department imposed punitive measures on Venezuelan governmental officials and entities linked to them, as a response to the clampdown on protests in 2014 and 2017.

Of note, various private Venezuelan banks like Banesco, Banplus, and BBVA Provincial retain their status as viable options on Binance's peer-to-peer platform.

The landscape of cryptocurrency payments experienced a seismic tremor with revelations from The Wall Street Journal. This investigative piece illuminated the inclusion of sanctioned banks within cryptocurrency peer-to-peer payment platforms, with Tinkoff Bank and Sberbank featuring on Binance. Curiously, on the very same day, these banking options vanished from the platform, even though vestiges of these options persisted through color codes reflective of their respective brands. Confirming the inevitable, journalists verified the complete erasure of sanctioned banks from the list on August 25, citing inputs from a Binance spokesperson.

Keeping with this wave of actions, two other prominent cryptocurrency exchanges, OKX and Bybit, followed Binance's cue and excluded sanctioned Russian banks from their roster of payment alternatives on August 28.

Trending

Press Releases

Deep Dives