Resilient Asset Managers Forge Ahead: Overcoming Market Blues and Regulatory Challenges in Crypto Investments

Roughly 50% of the 60 surveyed professionals from asset management firms and hedge funds based in the U.S. and Europe have confirmed their active involvement in the management of digital assets. A recent report, titled "Digital Assets: Managers Fuel Data Infrastructure Needs," co-published by Coalition Greenwich (a subsidiary of India's credit rating company, Crisil) and Amberdata (a crypto data provider), reveals that the uncertain regulatory landscape and the downturn in the cryptocurrency markets have not dampened the enthusiasm of asset managers for digital assets.

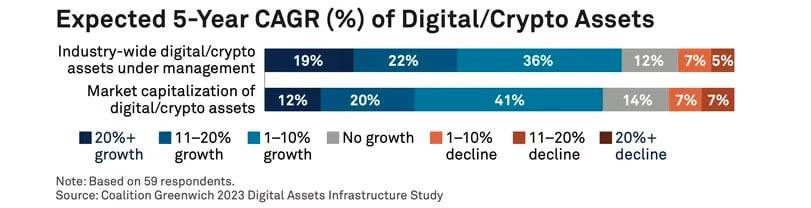

According to the survey conducted between May and June, a significant portion of these managers anticipates substantial growth in the digital assets industry over the next half-decade in terms of assets under management. More than 40% of respondents project a compound annual growth rate of no less than 11%, with nearly 20% foreseeing a growth rate of 20% or higher. Certain asset managers are anticipating a five-year Compound Annual Growth Rate (CAGR) exceeding 20%, as reported by Coalition Greenwich and Amberdata.

Certain asset managers are anticipating a five-year Compound Annual Growth Rate (CAGR) exceeding 20%, as reported by Coalition Greenwich and Amberdata.

Around 25% of the surveyed firms have already formulated a dedicated strategy for handling digital assets, and an additional 13% are planning to introduce one within the next two years. In general, asset managers display a positive outlook on the growth potential within the digital assets sector, particularly in terms of commercial prospects such as exchange-traded funds (ETFs) and tokenized securities. Summary of the findings by Coalition Greenwich, Amberdata

Summary of the findings by Coalition Greenwich, Amberdata

Despite enforcement actions by the U.S. Securities and Exchange Commission (SEC) against major crypto exchanges like Binance and Coinbase, asset managers maintain confidence in the U.S. as a crypto-friendly destination. They expect that American regulators will eventually establish a well-considered regulatory framework for the industry.

It is worth noting that a substantial number of managers also anticipate the growth of centralized exchanges in the coming five years, which may come as a surprise. Since the collapse of Sam Bankman-Fried's crypto exchange FTX in November of the previous year, investors have shown an increasing preference for directly holding their coins, opting to keep them away from centralized exchanges.

The report further highlights that the industry is still in a phase of evolution, and managers are particularly bullish about the most evident applications, such as crypto portfolios, investment products, and the tokenization of financial instruments.

Trending

Press Releases

Deep Dives