New Research Reveals Ether Trading at a 27% Discount to Fair Value

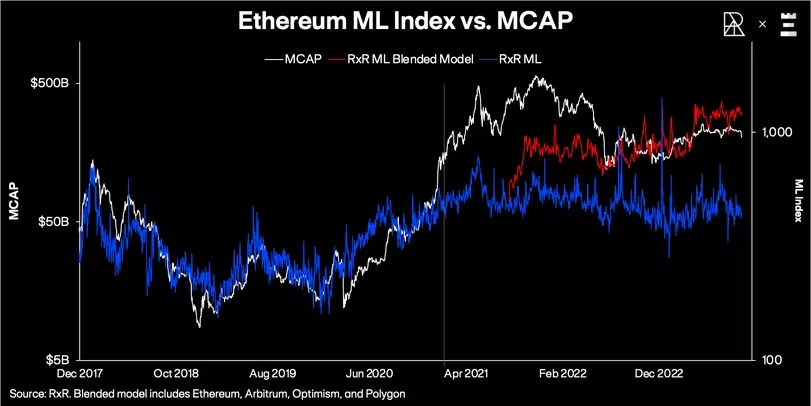

RxR, a research firm, has devised an innovative valuation model centered on the Metcalfe law, which integrates the adoption of layer 2 scaling networks. This model indicates that the appropriate market value for ether should be approximately $275 billion.

According to RxR's assessment, ether, the native token of the Ethereum blockchain, is currently trading at a noteworthy 27% markdown from its calculated fair value. This valuation method takes into account the active user adoption of layer 2 scaling networks, distinguishing it from traditional models that primarily focus on Ethereum's layer 1 user adoption rates.

The fair value estimate by RxR is established through a blended application of the Metcalfe law. This encompasses not only the active user base on the expanding Ethereum scaling networks but also the users on the Ethereum mainnet. In this way, a more comprehensive evaluation of the network's fair value is obtained. Conventional Metcalfe law models often concentrate solely on the mainnet's active user base.

The Metcalfe law establishes a direct correlation between a network's value and the square of its user count. Ether serves as the gateway for users to engage in various activities on the Ethereum blockchain, including transactions, earning interest, participating in network security through staking, and storing non-fungible tokens, among other functions. Consequently, the value of ether is intricately linked to the level of activity on the Ethereum network.

Lewis Harland, an analyst at RXR, emphasized that factoring in the active user base of Ethereum’s scaling networks results in a more accurate representation of Ethereum's network valuation compared to the traditional model. According to this updated model, ether's valuation stands at $275 billion, assuming no further user growth.

Ether's Market Cap Aligns with Blended ML Model" - Lewis Harland, RXR

This assessment implies that ether's market capitalization might be undervalued when compared to RxR's Metcalfe law blended model. The traditional model, which neglects the growing activity on layer 2 networks and off-chain solutions built on top of the mainnet, may not provide a complete picture of ether's true value.

The layer 2 sector has emerged as a particularly dynamic area within the market, with various protocols finding their specialized niches. Notable examples include Coinbase's BASE, which leads in unique addresses and transactions, Arbitrum, which excels in transaction volume, and Optimism, which focuses on its superchain vision.

Over the past two years, the total value locked in layer 2 protocols has witnessed a more than threefold increase, exceeding $9 billion, as reported by data source L2Beat. Harland highlighted the significance of incorporating layer 2 activity in Metcalfe law fair value models, underscoring its impact on the broader crypto market landscape.

Trending

Press Releases

Deep Dives